MSA.Legend

Reading: “Market-Security Analysis & Research Inc.” 2023.

Author: MSA

Contents

Pop Quiz

Alice the actuary is looking to break into the insurance market of a new country, Everworld. What would be the most appropriate method to determine the risk adjustment for this new book of business?

Study Tips

This is an addendum to the MSA.Ratios paper that adds a few modifications to some of the ratios for IFRS17. I would spend some time memorizing them as I do expect that they will be tested.

Estimated study time: 5 hours (not including subsequent review time)

BattleTable

No past exam questions are available for this reading.

reference part (a) part (b) part (c) part (d)

P&C Insurance Key Performance Indicators (KPIs) Under IFRS 17

In Plain English!

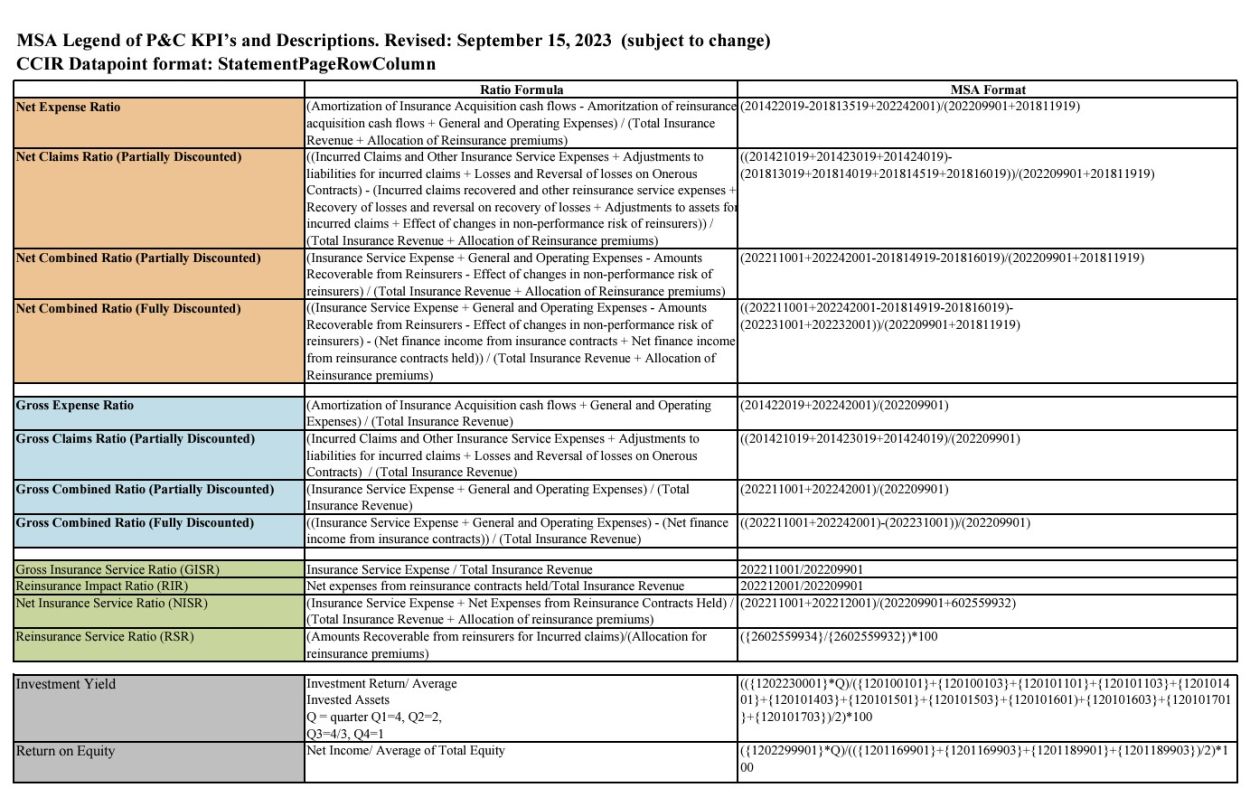

This article really focuses on detailed explanations of some of the newer KPIs under IFRS17. We'll try to dive deeper into what exactly each of these categories represent in an intuitive manner. Here is the table attached

Before we go into the next section, I will clarify what the MSA numbers mean: the number 201422019 means this is:

- Page 20.14

- Row 220

- Column 019

in the P&C annual return

| Warning! It's gonna be long so bear with me 😟 |

Net Ratio Metrics

Net Expense Ratio

Key Concept: Measures the proportion of premium revenue spent on operating the insurance business after reinsurance

Formula: Operating Expenses (after reinsurance) ÷ Premium Revenue

Components Include:

- Acquisition costs (adjusted for reinsurance)

- Ongoing operational expenses

💡 Interpretation: Lower ratio = Greater operational efficiency

Company spends less on expenses relative to premiums earned

Net Claims Ratio (Partially Discounted)

Key Concept: Measures claims paid to policyholders AFTER accounting for reinsurance recoveries

Formula: Net Claims Paid ÷ Premium Revenue (after reinsurance recoveries)

💡 Interpretation: Lower ratio = More profitable underwriting

- Company pays out less in claims relative to premiums collected

- Rising ratio may indicate: deteriorating underwriting standards, inadequate pricing, or unfavorable claims experience

📚 EXAM TIP: "Partially Discounted" Explanation: So partially here means that not all discounting components are considered. Excludes "Net finance income from insurance contracts" and "Net finance income from reinsurance contracts held" - these represent discount unwinding over time and changes in discount rates which are not included which is why its called "partially discounted". Confusing I know and I don't think you'll be tested in this level of detail.

Net Combined Ratio (Partially Discounted)

Key Concept: Aggregates expense and claims components for a comprehensive underwriting profitability view

Formula: (Net Claims + Net Expenses) ÷ Premium Revenue

💡 Critical Interpretation:

- Below 100% = Underwriting Profit (before investment income)

- Above 100% = Underwriting Loss

🎯 This is ONE OF THE MOST IMPORTANT METRICS for assessing fundamental profitability of insurer operations

Net Combined Ratio (Fully Discounted)

Key Difference: Fully accounts for time value of money by incorporating finance income components

💡 Advantage: More economically accurate picture of profitability by adjusting for discounting effects on both claims and premium sides

📚 EXAM TIP: Provides more comprehensive view of economic performance by factoring in all relevant financial aspects, including discount rate impacts.

Gross Ratio Metrics

Gross Expense Ratio

Key Concept: Measures operational efficiency BEFORE considering reinsurance arrangements

Formula: (Acquisition + Operating Expenses) ÷ Gross Premium Revenue

💡 Purpose:

- Reflects proportion of premium revenue consumed by acquisition and operating expenses

- Assesses insurer's cost structure in relation to premium base

- Lower ratio = More efficient operations and potentially higher margins

Gross Claims Ratio (Partially Discounted)

Key Concept: Shows relationship between claims incurred and premium revenue BEFORE reinsurance effects

Formula: Gross Claims Incurred ÷ Gross Premium Revenue

💡 Interpretation:

- Reflects fundamental quality of insurer's risk selection and pricing

- Identifies underlying trends in claims experience

- Can expose problematic underwriting that reinsurance arrangements might mask

Gross Combined Ratio (Partially Discounted)

Key Concept: Combines gross claims and expenses relative to gross premiums - BEFORE reinsurance effects

Formula: (Gross Claims + Gross Expenses) ÷ Gross Premium Revenue

💡 Critical Interpretation:

- Below 100% = Gross underwriting profit

- Above 100% = Reliance on investment income OR reinsurance arrangements for overall profitability

Gross Combined Ratio (Fully Discounted)

Key Difference: Incorporates time value of money through finance income adjustments

💡 Advantage:

- More economically accurate view of gross underwriting performance

- Better captures economic reality by accounting for discounting impact on long-tail business

Service Ratio Metrics

Gross Insurance Service Ratio (GISR)

Key Concept: Focuses specifically on insurance service expenses relative to premium revenue

Formula: Insurance Service Expenses ÷ Premium Revenue

💡 Purpose:

- Isolates the pure insurance service component of the business

- Lower ratio = More efficient service delivery or favorable claims experience

Reinsurance Impact Ratio (RIR)

Key Concept: Measures the net cost (or benefit) of reinsurance arrangements

Formula: Net Cost of Reinsurance ÷ Gross Premium Revenue

💡 Interpretation:

- Positive ratio = Net cost of reinsurance

- Negative ratio = Reinsurance contributing positively to overall results

Net Insurance Service Ratio (NISR)

Key Concept: Combines insurance service expense with reinsurance effects for comprehensive view after reinsurance

Formula: (Insurance Service Expenses + Reinsurance Effects) ÷ Premium Revenue

💡 Purpose: Assesses how effectively the insurer manages both:

- Direct insurance services

- Reinsurance arrangements

and helps optimize net performance

Reinsurance Service Ratio (RSR)

Key Concept: Shows relationship between reinsurance recoveries and reinsurance premiums - essentially the "claims ratio" on reinsurance

Formula: Reinsurance Recoveries ÷ Reinsurance Premiums

💡 Interpretation:

- Higher ratio = Better recovery value from reinsurance programs

- May suggest either:

- Favorable reinsurance terms, OR

- Higher-than-expected claims subject to reinsurance recovery

Investment and Profitability Metrics

Investment Yield

Key Concept: Measures return generated by insurer's investment portfolio, annualized based on reporting period (Q)

Formula: Investment Returns ÷ Average Invested Assets × (Annualization Factor)

📚 EXAM TIP: This metric is particularly important for insurers - investment returns often contribute significantly to overall profitability, especially when underwriting margins are thin.

Return on Equity (ROE)

Key Concept: Measures profitability relative to shareholders' equity - indicates how efficiently capital is used to generate profits

Formula: Net Income ÷ Average Shareholders' Equity

💡 Interpretation:

- Higher ROE = Better financial performance and more efficient capital use

- Closely watched by investors and analysts as key indicator of:

- Overall profitability

- Capital efficiency

🎯 ROE is a KEY INDICATOR for assessing overall profitability and capital efficiency

Key Distinctions Summary

| Ratio Type | Key Feature | Primary Use |

|---|---|---|

| Gross Ratios | Before reinsurance effects | Assess underlying performance and cost structure |

| Net Ratios | After reinsurance effects | Measure final operational results |

| Service Ratios | Focus on service components | Isolate specific operational aspects |

| Investment/ROE | Capital efficiency | Assess overall profitability and returns |

📚 STUDY TIP: Remember the distinction between gross (before reinsurance) and net (after reinsurance) ratios - this is fundamental to understanding the insurer's performance.

POP QUIZ ANSWERS

Margin method, given that she does not have any data. She could also use the cost of capital method if enough due diligence was done on the expansion with capital allocated for the project.