CIA.IFRS17-LRC

Reading: IFRS 17 – Actuarial Considerations Related to Liability for Remaining Coverage in P&C Insurance Contracts (53 pages)

Authour: Canadian Institute of Actuaries

BA Quick-Summary: IFRS17 Liability for Remaining Coverage

|

Contents

- 1 Pop Quiz

- 2 Study Tips

- 3 BattleTable

- 4 In Plain English!

- 4.1 Section 1: Introduction

- 4.2 Section 2: Definitions

- 4.3 Section 3: Level of aggregation and financial statement presentation

- 4.4 Section 4: LRC under the GMA – Insurance contracts issued

- 4.4.1 Section 4.1: Definitions

- 4.4.2 Section 4.2: Allocations

- 4.4.3 Section 4.3: Estimates of Future Cash Flows

- 4.4.4 Section 4.4: Effect of Discounting

- 4.4.5 Section 4.5: Risk Adjustment

- 4.4.6 Section 4.6: Contractual Service Margin

- 4.4.7 Section 4.7: Coverage Units

- 4.4.8 Section 4.8: Loss Component

- 4.5 Section 5: LRC under PAA – Insurance contracts issued

- 4.6 Section 6: Considerations for Reinsurance Contracts Issued and Held

- 4.7 Section 7: Illustrative Example - Loss Component Calculation

- 4.8 Section 8: MCT Considerations

- 5 POP QUIZ ANSWERS

Pop Quiz

Study Tips

| Click for a long forum thread on the inconsistency in signs in FCF formulas. |

This is a very long wiki article but the good news is that the material duplicates much of what's already covered in the other IFRS 17 readings. For that reason, this will be a pretty good review.

These are the sections you'll have to spend the most time on:

- Section 4: LRC under the GMA – Insurance contracts issued

- Section 5: LRC under PAA – Insurance contracts issued

There are also 2 types of calculation problems you need to learn in these subsections: (Randomized Excel practice problems are available.)

Note: If you look at the source text, you'll see that it often refers to Appendices of a document called "IFRS 17". That document is not the document discussed in the wiki article CIA.IFRS17, and the document referred to as "IFRS 17" is not on the syllabus. All you should have to know is what's specifically discussed in the actual source text.

Fun Fact:

|

- shout-out #1: LL slayed it first! 😄 Way to go!!!

- shout-out #2: LLFDC The beast is dead! 😆 We are all free!

You guys found it so fast!

|

- honourable mention #1: Francis slayed it! 🤪

- honourable mention #2: the superactuary 🧐

The Easter egg was: FIREWORKS!

|

Estimated study time: several days (not including subsequent review time)

BattleTable

No past exam questions are available for this reading.

reference part (a) part (b) part (c) part (d)

In Plain English!

Section 1: Introduction

| Click for a long forum thread on the inconsistency in signs in FCF formulas. |

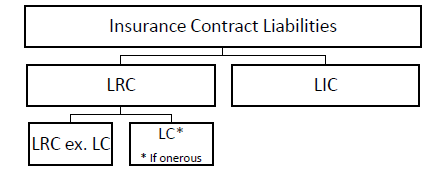

Recall that LIC and LRC stand for Liability for Incurred Claims and Liability for Remaining Coverage. Recall also that LIC refers to the "normal" claims liabilities for insured events that have already occurred. This wiki article focuses on LRC, which is the IFRS 17 version of Canadian premium liabilities discussed in CIA.PrLiabs. Simple definitions of LIC & LRC were covered in the wiki article CIA.IFRS17 and you can click the links for quick review. Here we cover a more detailed definition of LRC that you should definitely memorize. But first, the source reading has a convenient diagram that shows the components insurance contract liabilities:

The abbreviation "LC" in the diagram stands for Loss Component and you can click the link to see this and other basic definitions from a previous article. The key fact about LC is that it pertains to onerous contracts and is dealt with separately from the "regular" part of LRC. Click for further background information on onerous contracts.

| Question: how does IFRS 17 define LRC (Liabilities for Remaining Coverage) |

- LRC (Liabilities for Remaining Coverage) is an entity's obligation to:

- (a) investigate & pay valid claims under existing insurance contracts for insured events that have not yet occurred

- (b) pay amounts under existing insurance contracts that are not included in (a) and that relate to:

- (i) insurance contract services not yet provided

- (ii) any investment components or other amounts that are not related to the provision of insurance contract services and that have not been transferred to the liability for incurred claims

| That definition is wordy and Ian-the-Intern is having trouble making sense of it so let's break it down for him. |

- → The key word seems to be "not". It appears 5 times in the definition!

- → Part (a) is the main part of the definition and says that LRC is basically the same thing as the CIA premium liabilities you've already studied.

- (obligations for events that have not yet occurred)

- → Part (b) is much longer than part (a) but it just describes secondary obligations not covered under part (a).

- (i) refers to obligations for services other than investigating and paying claims (no examples are provided)

- (ii) refers to other amounts that may be due policyholders such as an investment component, which is mentioned in the wiki article CIA.IFRS17 in Section 4: Separation of Contract Components.

| Memory trick: To memorize the LRC definition, first notice that it's defined as an obligation. Then pay attention to the different places where the word not appears. |

Section 2: Definitions

The definitions provided in this section of the source text are either obvious or are covered in other IFRS readings. The only term I'm going to mention here is contract boundary, which was discussed briefly in a previous article. In that article, the contract boundary was described as the term of the contract, and any cash flows relevant to the insurance policy that occur during the policy term are included in the measurement of the liability. It's a simple concept that's described in a complicated way. Here's the definition as given in the source text, but I don't think I would bother memorizing it:

- Contract boundary: The contract boundary distinguishes future cash flows to be considered in the measurement of the insurance contract from other future cash flows. Per IFRS 17.34, “Cash flows are within the boundary of an insurance contract if they arise from substantive rights and obligations that exist during the reporting period in which the entity can compel the policyholder to pay the premiums or in which the entity has a substantive obligation to provide the policyholder with insurance contract services …”

| If you were asked to define contract boundary on the exam, I think this would be a pretty good way to answer it: |

- The contract boundary defines the cash flows that should be included when measuring the insurance liability arising from a contract.

- → the relevant cash flows are triggered by the contract during the term of the contract (Ex: 1 year)

- → the cash flows include premiums paid by the policyholder & payments from the insurer to the policyholder in accordance with the contract

Section 3: Level of aggregation and financial statement presentation

The concept of Level of Aggregation was already discussed in CIA.IFRS17-1 so you can click on the link to review that. The most basic fact you need to know is:

- all the policies owned by the insurer are subdivided into portfolios (Ex: portfolios could correspond to provinces)

- portfolios are further subdivided into groups

So portfolios would generally contain multiple groups of policies.

Anyway, the only extra bits of information provided here are the concepts of asset position and liability position. It's pretty simple:

- For a portfolio of contracts, if the expected cash inflows are greater than the expected cash outflows, then the portfolio is in an asset position.

- For a portfolio of contracts, if the expected cash inflows are less than the expected cash outflows, then the portfolio is in an liability position.

Section 4: LRC under the GMA – Insurance contracts issued

There are lots (and lots and lots and lots) of details coming up in sections 4 and 5 below. I would like to tell you not to panic, but sometimes pressing the panic button is the best course of action.

This is what you should look like right now: 😲

If you don't look like that then you just don't understand the gravity of the situation! It's going to be tough going but Alice has a some advice for you:

The BIG picture: - There are 2 ways to calculate LRC or Liability for Remaining Coverage. (This is the IFRS 17 version of premium liabilities covered in CIA.PrLiabs)

- The first method is called GMA or General Measurement Approach and is the harder method.

- The second method is called PAA or Premium Allocation Approach and is the easier method.

The presentation of these 2 methods is organized as follows:

- Section 4 goes in to great detail about GMA and section 5 goes into great detail about PAA.

- The source text does not have a complete example of the GMA method.

- The source text does have an example of the PAA method and Alice thinks that could be a likely exam question.

If you find yourself getting lost in the details, just remember the big picture: These sections are explaining how to calculate LRC using these 2 different methods.

Section 4.1: Definitions

The measurement of insurance contract liabilities under the General Measurement Approach was discussed earlier. It applies to both LIC & LRC (Liability for Incurred Claims & Liability for Remaining Coverage) and we referred to the 3 components of this measurement approach as building blocks. Here, we're concerned primarily with the LRC component (although it seems the LIC component is measured the same way.)

Because the measurement of liabilities is so important, let's take a moment to review. Unfortunately, the presentation of this concept is slightly different from the presentation in CIA.IFRS17 at the link in the previous paragraph. The following definition for LRC under the standard GMA approach is taken from the current reading and is a little clearer:

LRC = FCF + CSM

- where...

- FCF (Fulfilment Cash Flows) is the sum of:

- estimates of future cash flows

- an adjustment to reflect the time value of money and financial risk (to the extent financial risk is not reflected in the estimates of cash flows)

- a risk adjustment for non-financial risk

- CSM (Contractual Service Margin) represents unearned profit from a group of insurance contracts

- FCF (Fulfilment Cash Flows) is the sum of:

If you refer back to a prior reading that discusses building blocks of measurement under IFRS 17, you'll see that the first and second bullet points under FCF above represent building block 1 and the third bullet point (risk adjustment for non-financial risk) represents building block 2. The CSM is building block 3.

Here is the part that Ian-the-Intern finds confusing:

Possible point of confusion: - In CIA practice, financial risk is explicitly reflected in the MfAD and PfAD for financial risk. We first calculate the PV at the "best-estimate" interest rate and then again at a different (lower) interest to reflect the uncertainty in future rates (resulting in a higher PV.) The difference between these dollar-value estimates is the risk margin (PfAD) for financial risk.

- In IFRS, it isn't as clear. Financial risk may be partly reflected in the estimates of cash flows but also partly in the PV calculation for the cash flows. The actual risk margin for financial risk may not be explicitly available.

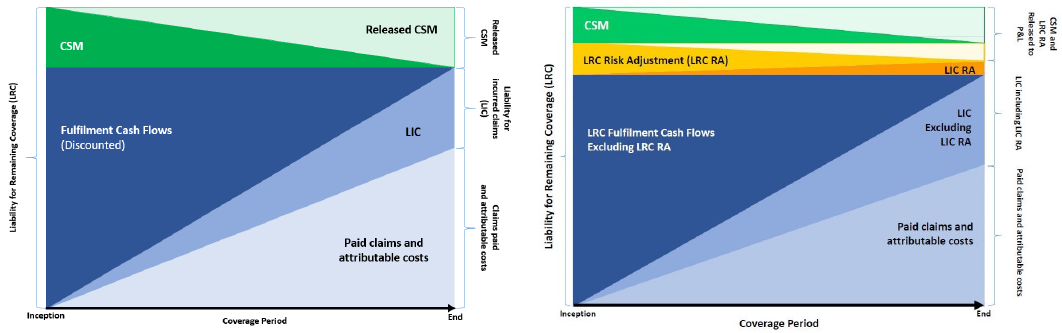

The last item in section 4.1 is a couple of diagrams for a non-onerous contract which may be more confusing than helpful. At contract inception, LRC = FCF + CSM as noted above, but the relative proportions of these components change over the contract term (or coverage period.) Referring to the diagrams below, let's start with the one on the LEFT. Here's how I would explain it in words:

- At inception of the contract, (total liabilities) + (paid amounts) = LRC = FCFLRC + CSM (because at inception, all claims are "remaining" so there are no incurred claims and both LIC and paid claims are 0.)

- As the coverage period is "earned", the height of the dark blue portion of the diagram corresponding to FCFLRC gets smaller (this looks a lot like the earnings diagram for premium that you know from pricing)

- At the same time, the height of the 2 lighter blue portions of the diagram corresponding to (FCFLIC + paid claims) get bigger

- At the end of the coverage period, LRC = FCFLRC + CSM = 0 + 0 = 0 because there are no more remaining claims and FCFLRC is fully replaced by (FCFLIC + paid claims)

- Note also that CSM = 0 at the end of the coverage period (this is indicated by the downward sloping line the upper green portion of the diagram

The diagram on the RIGHT is just a more detailed version of the diagram on the left that breaks out the risk adjustment component of the LRC. This diagram is a little confusing however because the scale of the diagram makes it look like the risk adjustment is part of CSM, but it isn't. The risk adjustment component is part of FCF, where at the beginning of the contract term, it's mostly from LRC and at the end, it's mostly from LIC.

Section 4.2: Allocations

When we considered "level of aggregation" when measuring contract liabilities in IFRS 17 we noted that expenses must be allocated to groups, but other assumptions may be applied at whatever level is most appropriate for estimating cash flows. This was discussed in In CIA.IFRS17 - Section 6: Measurement Considerations.

The current reading expands on the allocation concept for the additional items below:

- LRC and CSM must be determined at the group level

- FCFs may be determined at a different level, then allocated to groups

The second bullet point means that FCFs (Fulfilment Cash Flows) can be determined at the portfolio level, or higher, then allocated back to groups. That's all you have to know from this section.

Section 4.3: Estimates of Future Cash Flows

Section 4.3.1 (Contract Boundary):

- The definition of contract boundary is repeated and then elaborated upon. This seems far too detailed for a reasonable exam question and I would not try to memorize anything from this section. For most P&C contracts, the contract boundary is delineated by the effective date and expiry date of the policy. One exception to this may be when a policy is canceled, in which case the contract boundary is delineated instead by the effective date and cancellation date.

Section 4.3.2 (Measurement):

- The types of cash flows within the contract boundary include both inflows such as premiums and outflows such as claims and directly attributable expenses.

- The largest cash outflow usually relates to future claims and claim adjustment expenses. This section discusses methods for estimating these cash flows, but these methods are just standard reserving methods and are similar to what is done under current CIA practice. The source text provides a list of adjustments to historical loss experience such as trends and impacts from legislative changes but again, these are the same as under current practice and are not unique to IFRS. In other words, I don't think these details would be a likely exam question.

Section 4.4: Effect of Discounting

- Discounting involves determining a payment pattern for the predicted cash flows and then applying discount factors to reflect the time value of money. The general concept is the same as under current CIA practice, but the determination of a specific discount rate follows a different procedure. This is discussed in detail in CIA.IFRS17-DR. I could only see 1 reasonable exam question from this section:

Question: identify a procedure for estimating the timing of LRC cash flows on a group basis under IFRS 17

- estimate a payment pattern on a group basis or

- adjust the accident year payment pattern used for LIC to a pattern consistent with the average accident date of the group

Section 4.5: Risk Adjustment

- This section has no content. The source text refers the reader to an IFRS article that is not on the syllabus.

Section 4.6: Contractual Service Margin

- Recall that the CSM represents unearned profit from a group of insurance contracts. See CIA.IFRS17 - Section 2: IFRS 17 Overview for a more detailed review of this concept. There is a detailed discussion (I think too detailed for the exam) that lists 5 different adjustments that would be used in the formula below:

carrying amount of CSM @ end of reporting period = (carrying amount of CSM @ start of reporting period) + adjustments

- These adjustments include things like

- (i) the effect of new contracts added to the group

- (ii) interest on the CSM carrying amount during the reporting period.

- There is a numerical example in the next section that's probably more important to spend study time on.

Section 4.7: Coverage Units

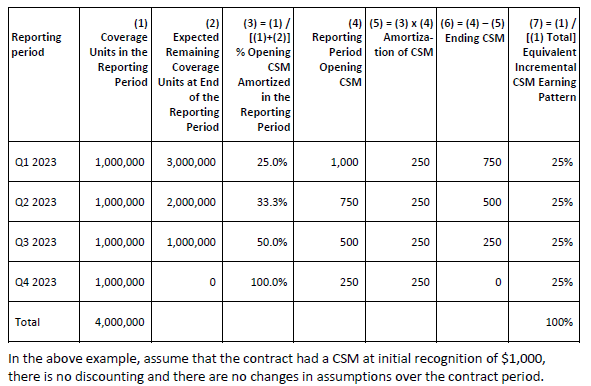

This section is quite confusing so let's start with a simple example. The definition of coverage units is further down, but for now let's just say it represents number of policies. Suppose we have the following:

- CSM @ beginning of quarter:

- → CSMbeg = $50,000 ← a certain proportion of this amount is released into profits during the quarter

To calculate how much of this CSM is released, we need the following information on coverage units:

- coverage units provided in the quarter:

- → CUqtr = 1,000

- coverage units remaining at end of quarter:

- → CUend = 3,000

Remember that the CSM (Contractual Service Margin) represents unearned profit from a group of insurance contracts. This unearned profit of $50,000 is released into profits over the life of the contract, but how is it released? Here's the key concept:

KEY CONCEPT: Coverage units determine how the CSM is released into profit (or loss.)

In particular, the CSM is amortized over the quarter in accordance with the beginning and ending values for coverage units. We'll demonstrate the amortization formula for our simple example as follows:

- proportion of CSM released during the quarter

- = CUqtr / ( CUqtr + CUend ) ← this is the key formula for amortization

- = 1,000 / ( 1,000 + 3,000 )

- = 1,000 / 4,000

- = 25%

- amount of CSM released during the quarter

- = 50,000 x 25%

- = 12,500

If you can follow the simple example above, you should be able to understand this example from the source text. It begins with CSMbeg = $1,000 and demonstrates the amortization of that amount over the next 4 quarters. The ending CSM for each quarter is shown in column (6).

Note: The terms CUqtr and CUend are abbreviated versions of the description of those quantities in the table below.

|

This example can be made more complicated in a few different ways, but I think a reasonable exam question would be to give you columns (1) and (2), and the beginning CSM value. From that you can construct the remainder of the table and show how the CSM is released into profit over subsequent quarters.

Click Coverage Units - Another Example for a second example of the above type of calculation.

Here are 2 practice problems in Excel:

Now that we've done an example, let's go back and look at some of the theory behind this. The first item we need to cover is the definition of "coverage units".

Question: define the term coverage units according to IFRS 17

- the quantity of insurance contract services provided by the contracts in the group

Question: how are coverage units determined

- determined by considering (for each contract) the quantity of the benefits provided under a contract within its expected coverage period

This definition is saying that "coverage units" is a number that reflects number of services that are provided under a contract. This number is determined by counting the number of services provided by each contract within a group and then summing across all contracts with the group. Unfortunately, the source text doesn't give any examples of the "services" or "benefits" that would be be counted when calculating coverage units. That's why for the simple example above, I just assumed that coverage units equaled the number of insurance contracts.

I think the most likely type of question from this section would be a numerical calculation as shown above, but just to be on the safe side, here's a little more of the theory. The text states that coverage units is not an accounting policy but involves judgment & estimates.

Question: what is the key principle for determining coverage units based on judgment & estimates

- to reflect the insurance contract services provided in each period

Question: identify specific ways this key principle is applied

- quantity of benefits relates to the amount that can be claimed by the policy-holder (not the expected costs to be incurred by the entity)

- discounting is optional (if discounting is applied, it is based on judgment but should be applied consistently)

- coverage period extends to the end of the period in which insurance contract services are provided (unless claims in settlement are included in LRC rather than LIC)

Ian-the-Intern is having trouble making sense of coverage units so Alice simplified for him:

- → more coverage units for a contract means more work for the insurer

- → the work the insurer does is not necessarily related to expected claims or release of risk

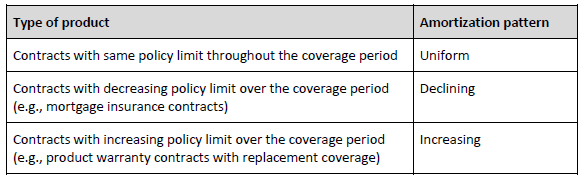

The source text has a table that actually helped me understand the concept of releasing CSM into profit. In our example above, the amortization pattern is completely determined by the coverage unit values in columns (1) and (2), and the numbers were such that the amortization pattern was uniform. We had 25% of the CSM released in each quarter. But of course if the numbers in columns (1) and (2) had been something different, the amortization pattern might not have been uniform. The table show scenarios that could lead to a non-uniform amortization pattern.

I could see an exam question asking you to describe the CSM amortization pattern for mortgage insurance, for example. You would have to realize that mortgage insurance generally has a decreasing policy limit over the coverage period so the CSM amortization pattern would be decreasing, not uniform.

For more details, the source text refers the reader to external documents that are not on the syllabus.

Section 4.8: Loss Component

Initial Recognition:

This section starts by reviewing the definition of onerous contract from a previous article. Make sure you know it. (Click the link to review.) Continuing on, recall the formula for LRC from Section 4.1 - Definitions earlier in this article:

LRC = FCF + CSM

Recall also from Section 1: Introduction that the calculation of LRC can also be expressed as follows by splitting it into 2 components:

LRC = (LRC excluding LC) + LC

Remember from here that LC represents expected net outflows for onerous groups. So the term (LRC excluding LC) seems like it should represent cash (in)flows for both onerous and non-onerous groups.

| Side note: All these terms and concepts can be hard to keep straight but on the bright side, you can see how repetitive these IFRS readings are. Much of what's discussed in this particular reading simply repeats what's covered in other readings. In other words, there is less to learn that it appears. Anyway, back to the grind... |

The two formulas above for LRC look different so how are they reconciled? Well, the first formula is true for both onerous and non-onerous groups but we can break the FCF term down further. (Note that the term RA stands for Risk Adjustment)

- for non-onerous groups:

- → LRC

- = FCF + CSM

- = (Future cash inflows - Future cash outflows + effect of discounting - RA) + CSM

- for onerous groups, the CSM is floored at 0 and it drops out:

- → LRC

- = FCF

- = (Future cash inflows - Future cash outflows + effect of discounting - RA)

Click GMA LRC at Initial Recognition if you'd like to see the diagram from the source text that compares onerous and non-onerous contracts. Note that for onerous contracts, after the CSM is floored at 0, a loss is recorded in the financial statements and the LRC for the onerous contracts is simply equal to the FCF as shown in the formula above. This loss, LC, is reflected in the LRC on the issue date of the insurance contracts.

The diagram also provides a formula for FCF which might be useful to know:

GMA Formula: FCF = (Future cash in-flows) – (Future cash out-flows) + (effect of discounting) – RA (this formula does not have a CSM term)

Note that CSM = 0 for onerous contracts.

Subsequent Measurement:

This subsection within Section 4.8 seems too detailed for a reasonable exam question. I've mentioned this before, but I really wish we had some examples of exam questions on this topic. (These IFRS readings were put on the syllabus after the CAS stopped releasing exams.) Not only is this subsection very detailed, it refers to external IFRS documents that are not on the syllabus. In any case, here are 3 broad factoids that aren't too hard:

Question: is an entity required to separately track the two components: LRC excluding LC and LC

- yes (because they want to keep non-onerous and onerous contracts separate)

Question: briefly describe the measurement of an onerous group of contracts subsequent to initial recognition

- if there are no changes in underlying assumptions:

- → LC is expected to be systematically decreased

- if there are changes in underlying assumptions that are favourable:

- → allocate changes to the LC until it reaches 0 then a CSM may be re-established

Question: briefly describe the measurement of a non-onerous group of contracts that becomes onerous subsequent to initial recognition

- reduce CSM to 0 and establish an LC

- (this would happen when unfavourable changes in the fulfilment cash flows exceed the carrying amount of the CSM)

| Alice had to take Ian-the-Intern aside for a heart-to-heart talk because he was getting super-confused. Here's what she told him: |

- When measuring LRC:

- 😀 Non-onerous groups are good. They have net cash inflows!

- 😕 Onerous groups are bad. They have net cash outflows.

- We have to track them separately for accounting purposes because:

- Non-onerous contracts have a CSM (but no LC)

- Onerous contracts have an LC (but no CSM)

- CSM and LC are kind of like DPAE and PDR when we calculated the premium liabilities using the old CIA method. Policies where the UPR covers the expected losses have a DPAE (good) and policies where they don't have a PDR (bad) See CIA.PrLiabs for a review.

Alice also brought him a nice cup of hot chocolate so now he's happy. 😊 Alice also brought him a nice cup of hot chocolate so now he's happy. 😊

|

Final comment: There are a few more paragraphs of details in this subsection, and you can refer to the source text if you want, but Alice is 95% certain you can safely skip it.

Section 5: LRC under PAA – Insurance contracts issued

Keep this firmly in mind: This section is essentially a repeat of Section 4 except that here we discuss LRC under PAA (Premium Allocation Approach) whereas in the previous section we discussed LRC under GMA (General Measurement Approach.)

This section of the source text is basically just a more detailed version of another IFRS reading, CIA.IFRS17-PAA. You should at least skim that reading and go through the BattleQuiz there before continuing. There is only 1 BattleQuiz for that reading and only 6 BattleCards, but they will be helpful before trying to understand the numerical examples presented further down.

As a quick knowledge check, you should absolutely know these basic facts before proceeding:

- GMA stands for General Measurement Approach

- PAA stands for Premium Allocation Approach

- PAA is a simplified version of GMA for measuring LRC (PAA does not apply to LIC)

Okay, even Ian-the-Intern knows those things. Now, what is it about PAA that makes it simpler than GMA?

- PAA does not require estimation of FCFs (Future Cash Flows)

- PAA does not require a CSM (Contractual Service Margin)

Ian-the-Intern is loving this! PAA really does look simpler, but what's the catch? Well, you cannot use PAA unless certain eligibility criteria are met, and assessing eligibility is the main topic in the reading CIA.IFRS17-PAA, specifically Sections 2-8: Details on Assessing PAA Eligibility. There's a numerical example in that reading but you can come back to that later. For now, what you need to know are these basic facts about PAA eligibility from CIA.IFRS17 - Valuation Methods under IFRS 17:

PAA may be used for LRC when one of these eligibility requirements assessed at contract inception is met:

- can be used for short-term contracts (policy term ≤ 1 year)

- can be used for longer-duration contracts IF PAA is a reasonable approximation to GMA over the life of the contract

- (applies only to LRC component of insurance contract liabilities)

It's actually a little more complicated than those simple bullet points above, but at least it gives you something easy to remember if you find yourself getting lost in the details. And it's another great example of how much all of these IFRS readings overlap.

Here's one last thing from the intro to Section 5 that I call the PAA Factoid: (It seems kinda important so pay attention!)

PAA Factoid: If a group of contracts qualifies for the PAA, the LRC excluding the LC (“LRC ex. LC”) is calculated the same way for onerous and non-onerous contracts.

That makes things simpler 🙂. Of course, the onerous group still has the LC (Loss Component) that you have to calculate. Remember this useful diagram from the introduction?

Section 5.1: Initial Recognition

There are 2 formulas you should memorize for the calculation of LRC (excluding LC) under PAA. The first is the formula for LRC at initial recognition of the contract, and is covered below. The second is the formula for LRC at subsequent recognition and is covered in the next subsection.

LRC (ex. LC) at initial recognition = + Premiums

- insurance Acquisition cash flows (unless the entity chooses to recognize the payments as an expense)

+/- amounts arising from Derecognition of "certain" assets & liabilities

There is no example in the source text so any exam problem asking you to calculate this will probably be very simple. My memory trick for this formula is PAD and stands for:

- Premiums

- Acquisition cash flows

- Derecognition

The only other part of the formula requiring an explanation is what's meant by "certain" assets in the term for derecognition. According to the text, the derecognized items would include:

- any asset for insurance acquisition cash flows

- any other asset or liability previously recognized for cash flows related to the group of contracts

I think the term for derecognition is way too detailed for an exam question, so here's a really simple example:

- Given:

- premiums from a group of contracts received at initial recognition = 900

- acquisition cash flows not recognized as an expense = 150

- no relevant assets or liabilities have been derecognized

- Find: LRC (ex. LC) under PAA at initial recognition

- Solution:

- LRC (ex. LC)

- = P - A + D

- = 900 - 150 + 0

- = 750

The next section has a more substantial example of calculating LRC under PAA at subsequent measurement.

Section 5.2: Subsequent Measurement

Here's the second formula you should probably memorize:

LRC (ex. LC) at subsequent measurement = + carrying amount at start of reporting period

+ Premiums received in period

- insurance Acquisition cash flows

+ amortization of insurance acquisition cash flows recognized as an expense in the reporting period

+ adjustments to a financing component

- insurance revenue (premium earned for insurance contract services provided in that period)

- investment components paid/transferred to LIC

The way I remember this formula is as follows:

- The 1st term is obvious: carrying amount from last period

- The 2nd & 3rd terms are P & A, same as the formula for initial recognition.

- The 4th term is amortization of the previous term

- The 5th & 7th terms are related: financing & investment components, but are probably zero anyway (they are indeed zero in the text example)

- (These components are discussed very briefly in Section 5.6: Financing and Investment Components)

- The 6th term is very important and will not be zero: insurance revenue (which is mainly earned premium)

You also have to remember which terms are added and which are subtracted. If you always write the formula as above then you can just remember the sequence:

+ + – + + – –

Or you can try to understand what the formula is doing and then deduce which terms should be added and which should be subtracted. It helped me to compare it to the formula for premium liabilities or policy liabilities related to the UPR (Unearned Premium Reserve). You can review that in Basic Formulas in the CIA.PrLiabs wiki article:

- DPAE = UPR - PolLiabs(UPR) + UEComm

And if you rearrange it:

- PolLiabs(UPR) = UPR - DPAE + UEComm

It looks to me like "UPR" corresponds to "premiums received" in the LRC formula, and "DPAE" corresponds to "insurance acquisition cash flows". There won't be a perfect correspondence between the CIA version of premium liabilities and the IFRS version of LRC because CIA and IFRS represent different accounting frameworks. Remember also that unearned revenue, like UPR or UEComm (Unearned Commission), are liabilities. Similarly, deferred expenses, like DPAE, are assets.

I hope the above discussion helped at least a little bit so that you aren't just memorizing a big long formula that otherwise makes no sense! There's an example of calculating LRC under PAA - Source Text in the source text. You can click the link to see it. The only thing that might throw you off in that example is that the given information is labelled differently from the terms given in the formula. Alice was kind enough to create an Excel spreadsheet that lays out the solution in a step-by-step manner. You're welcome. 🤓 I put it in a separate wiki page so as not to clutter up the presentation. The link is below:

Update: 2022-09-23: Calculation of LRC at initial recognition was added to the problems below.

And here's the quiz...

Section 5.3: Onerous Groups of Contracts

The source text states that IFRS 17 does not prescribe actuarial responsibilities regarding the identification and measurement of onerous groups of contracts. I find that a little surprising. Anyway, the source text then provides what they call practical guidance on the following topics:

- Qualitative assessment: facts and circumstances indicating onerous contracts

- Quantitative assessment: calculation of fulfilment cash flows and deriving the LC

- LC reporting

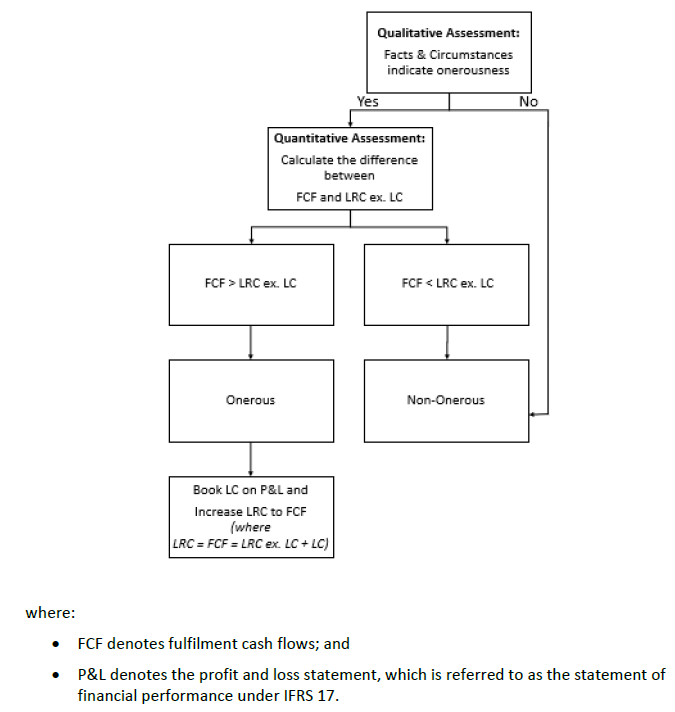

This is a long section with several subsections but I've extracted what I think is the most likely testable information. There is a diagram at the beginning, a decision tree, that provides a nice visual summary (see below.)

No example of how to apply it is provided so an exam question is probably not likely, but I wouldn't rule it out. In fact, I think you could make a pretty good exam question based on this. You could be given information about a group of contracts and be asked to use the decision tree to assess whether the group is onerous. If it is indeed onerous, then you could be asked how the onerous contract is treated in the financial statements. That would be the box at the very bottom that starts with "Book LC (Loss Component) on P&L." This is explained a little further below the diagram.

| Decision tree for onerous contracts (how to determine if a group is onerous and what to do if it is) |

| 😎 |

Qualitative Assessment: Facts and Circumstances

The top box in the decision tree asks you to decide based on "facts & circumstances" whether the group of contracts is onerous, but IFRS 17 does not specify what this means. There are some things that can be considered however.

Question: identify facts & circumstances that could be used to qualitatively assess whether a group of contracts is onerous

- a group of contracts in the portfolio that are known to be onerous at initial recognition

- past losses in the portfolio

- aggressive underwriting or pricing

- unfavourable experience trends

- unfavourable external conditions

If these circumstances exist, the group of contracts is more likely to be onerous. Ian-the-Intern has created an actual example at the end of this section to help make this more understandable. For now, just try to absorb them. I'm not sure if I would recommend memorizing them specifically because they are all common sense.

Quantitative Assessment

According to the decision tree, if a qualitative assessment of facts & circumstances indicates a possibility of the group being onerous, then a quantitative assessment is required.

Question: describe the quantitative assessment of a potentially onerous group of contracts

- calculate the difference: D = FCF – (LRC ex. LC)

- D > 0 → group is onerous

- D ≤ 0 → group is not onerous

- if onerous → Book LC on P&L

- increase LRC to FCF

- [ where LRC = FCF = (LRC ex. LC) + LC ]

- calculate the difference: D = FCF – (LRC ex. LC)

The answer above is just rewriting the part of the decision tree below the "qualitative assessment" box. It seems like a reasonable course of action but the source text doesn't really tell you how to calculate FCF and (LRC ex. LC). There's an example of calculating FCF in another wiki article, CIA.IFRS17-DR, but it's long and complicated. And unless I've missed something I couldn't find a specific example of calculating the LC (Loss Component.)

Loss Component Reporting

Note the title of this subsection: Loss Component Reporting. In other words, this section doesn't cover the Loss Component Calculation. That's discussed briefly in Section 7: Illustrative Example - Loss Component Calculation.

This section is long, but there are a few obviously important facts about the LC you should definitely know. (Wake up Ian-the-Intern. He needs to know this too.)

Question: briefly describe the accounting steps required if a quantitative assessment indicates a group of contracts is onerous

- recognize a loss in the insurance service expense immediately for the net outflow for the onerous group

- establish an LC as part of the LRC for the onerous group

This is saying that onerous groups need to go on the books immediately. You can't' wait until adverse experience actually occurs - you've got to prepare so you don't get any nasty surprises later on. This represents a conservative approach to accounting, which is very sensible for an insurance company. Note also that LRC excluding LC and LC must be tracked separately in the accounting system. This is the same treatment the LC receives under GMA, which you can review here.

Question: briefly describe the accounting steps required for the LC at subsequent measurements

- the LC is released into the insurance service expense and amortized from the LRC over the duration of the contracts

- (so LC = 0 by the end of the coverage period.)

Ian-the Intern's Decision Tree Example

Part of Ian-the-Intern's training is thinking up practice problems so here's what he came up with:

Problem 1: Given the following information about a group of contracts, asses whether the group is onerous and take appropriate action (if any) - company has been stable and profitable for the past 10 years

- no unfavourable trends are projected

- FCF = 100

- LRC ex. LC = 105

- LC = 0

- Answer

Problem 2: Given the following information about a group of contracts, asses whether the group is onerous and take appropriate action (if any) - company is growing by implementing aggressive underwriting and pricing

- no unfavourable trends are projected

- FCF = 100

- LRC ex. LC = 80

- LC = 20

- Answer

Problem 3: Given the following information about a group of contracts, asses whether the group is onerous and take appropriate action (if any) - company is growing by implementing aggressive underwriting and pricing

- no unfavourable trends are projected

- FCF = 100

- LRC ex. LC = 110

- LC = 0

- Answer

Based on the above example problems Ian-the-Intern created, Alice rated him as Outstanding Performer on his summer performance evaluation. 😃

The material goes further to talk about how you can measure the loss component at subsequent measurement:

- Recalculate the LC = FCF - LRC excl LC at each period (A more cumbersome approach)

- Use a pre-defined pattern, something that is pro-rata to unexpired coverage like the premium earning pattern

We are almost done here :) so let's talk about how subsequent adjustments to the LC are presented in the P&L statement:

- Amortization of the loss component would increase the insurance service expense

- Or the insurer can choose to separate subsequent adjustments of the loss component between current service (release of LC associated with coverage provided) and future service (changes to the unearned portion of LC due to assumption changes as well as addition of new onerous contracts)

Section 5.4: Premium

This section elaborates on the 6th term in the LRC formula given in Section 5.2. The 6th term in the formula is "insurance revenue", which is similar to earned premium in current accounting methods. This section discusses whether insurance revenue should be recognized (or earned) uniformly based on the passage of time, or in some other way if the release of risk differs significantly from the passage of time. This would be the case for seasonal coverage such as boats in the summer and snowmobiles in the winter.

There don't appear to be any testable facts here.

Section 5.5: Acquisition Costs

You can safely skip this section. The only testable fact appears in the Summary Comparison of the GMA and PAA LRC a little further down in this wiki article. All it says is:

- under GMA: cannot recognize acquisition costs immediately

- under PAA: can recognize acquisition costs immediately if the coverage period of all contracts in the group ≤ 1 year

Section 5.6: Financing and Investment Components

Financing Component

This is a short section that won't take you long. The main fact is this:

PAA simplification: In PAA, you do not have to reflect the time value of money on the LRC unless there is a significant financing component.

If you look further down in this wiki article at Initial Measurement of LRC, you'll see the GMA formula for LRC has a PV or Present Value component, but the PAA formula for LRC does not. The text didn't highlight this but I think that, and the above statement are connected, and that's how I remember this.

Anyway, you might be wondering what's meant by "significant financing component". The text gives a nice simple explanation:

- If the period between premiums being due and the provision of service is ≤ 1 year, then the group is deemed not to have a significant financing component.

If the period is > 1 year, it's still possible there's no significant financing component, but you'd have to provide evidence of such. This section has a small numerical example of calculating LRC when a financing component exists, but I think you can skip it. It's basically the same as the example from Section 5.2 except here the financing component is non-zero. The LRC formula is the same.

Investment Component

An "investment component" refers to the amounts an insurance contract requires the entity to repay to a policyholder in all circumstances, regardless of whether an insured event occurs. But P&C contracts typically do not have investment components - that's more of a life insurance item - so there's nothing to learn here.

Summary Comparison of the GMA and PAA LRC

The source text has a table showing 8 differences between GMA and PAA for LRC. You should memorize 4 of them. (You can memorize all 8 if you want but 4 should be enough to answer any likely exam questions.) Click below to see the table:

I found this table a little bit confusing because the discussion mixes onerous and non-onerous contracts. Also, the item labelled Loss Component is not a difference between GMA and PAA because in both cases, the table states: Yes, if onerous. And if the contract is non-onerous, there is no loss component anyway. Anyway, Alice tried explaining it to Ian with concrete examples by looking at these 3 potential exam questions below.

Side note: Whenever Alice tries to make sense of something confusing, she makes up her own questions, then tries to answer them by carefully analyzing the source text. That's her way of doing active reading. (Passive reading would be to keep reading it over and over, hoping it will eventually start to make sense. Spoiler alert That doesn't work nearly as well!)

| Alice's awesome time-saving study tip! Make sure you can answer Question A below. (Questions B & C are much less likely to be asked so skip them if you're pressed for time.) |

Question A (easy): identify any 2 differences between GMA and PAA for LRC

- → You can select any 2 of the 8 differences described in the table. For example:

- Application:

- GMA: applies to any P&C contract

- PAA: applies to P&C contracts with a coverage period of 1 year or less (PAA must be specifically tested if coverage period is more than 1 year)

- Application:

- Cash Flow Projections:

- GMA: for non-onerous contracts → yes (cash flow projections are required to estimate LRC)

- PAA: for non-onerous contracts → no (cash flow projections are not required to estimate LRC)

- Cash Flow Projections:

Question B (hard): describe the differences between GMA and PAA for LRC for onerous contracts

- → This is tricky but if you study the table carefully, you'll see there are only 2 differences for onerous contracts.

- Option to Immediately Recognize Acquisition Costs: (this difference applies to both onerous & non-onerous contracts)

- GMA: no

- PAA: yes, if the coverage period of all contracts in the group is one year or less

- Option to Immediately Recognize Acquisition Costs: (this difference applies to both onerous & non-onerous contracts)

- Onerous Contract Test at Initial Recognition:

- GMA: quantitative test is always required

- PAA: quantitative test is indicated by a qualitative assessment of facts & circumstances

- Onerous Contract Test at Initial Recognition:

- → Another way of looking at this is that PAA is advantageous primarily for non-onerous contracts.

Question C (hard): describe any 2 differences between GMA and PAA for LRC that pertain only to non-onerous contracts

- → If I've interpreted the table correctly, there are 4 differences that pertain only to non-onerous contracts.

- Initial Measurement:

- GMA: LRC = PV(Cash Flows) + RA + CSM ← same formula for both onerous contracts and non-onerous contracts

- PAA: LRC = premiums – (initial acquisition costs UNLESS recognized as expenses when incurred) ← non-onerous contracts

- Initial Measurement:

- Cash Flow Projections:

- GMA: cash flow projections are required for non-onerous contracts

- PAA: cash flow projections are not required for non-onerous contracts

- Cash Flow Projections:

- Risk Adjustment:

- GMA: RA is required for non-onerous contracts

- PAA: RA is not required for non-onerous contracts

- Risk Adjustment:

- CSM:

- GMA: CSM is required for non-onerous contracts

- PAA: CSM is not required for non-onerous contracts

- CSM:

- → The 4 remaining items in the table would not be acceptable answers because the are not specific only to non-onerous contracts:

- Application applies to BOTH onerous and non-onerous contracts

- Option to Immediately Recognize Acquisition Costs applies to BOTH onerous and non-onerous contracts

- Revenue applies to BOTH onerous and non-onerous contracts

- Onerous Contract Test at Initial Recognition applies only to onerous contracts

- → And recall that the following item is not actually a difference between GMA and PAA even though it's listed in table:

- Loss Component applies only to onerous contracts (because non-onerous contracts don't have a loss component)

Section 6: Considerations for Reinsurance Contracts Issued and Held

This section is quite long at 7 pages, and crazy detailed. There are some numerical examples but they don't look like reasonable exam questions. Recall that the IFRS 17 readings cover over 200 pages of material and should account for 7-10% of the points on the exam according to the syllabus. The exam typically has about 70 points so 7-10% translates to 5.0 - 7.0 points in total. That means up to 3 questions of 2.0 point each. If you were to rank the topics within the IFRS 17 readings, this section would be way down the list and I think you can safely ignore almost all of it.

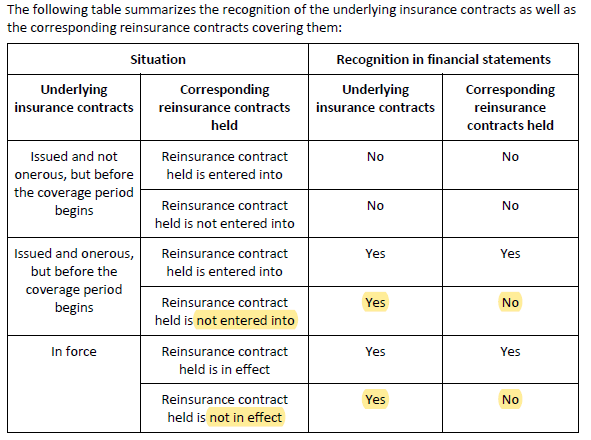

The only thing I might consider looking at is the table I've included below. It specifies when underlying insurance contracts and reinsurance contracts are recognized in financial statements. Note that underlying contracts are just "normal" insurance contracts an insurer carries on their books. I think it's common sense and if you thought about it, you could probably guess which cells should be "yes" and which cells should be "no" without having to memorize it. In fact, Alice remembers this table as follows:

Alice's 1-sentence summary: If an underlying insurance contract is onerous, it must be recognized even before coverage begins.

This just reflects a conservative accounting philosophy. If a contract looks like it might lose money, you want to get it on the books right away to avoid a nasty surprise later. The highlighted cells indicate rows where the answer is different for the underlying contract versus the reinsurance contract.

Here's what you should notice from the table. I just put it in my own words because it makes more sense to me that way. First of all, there are 4 variables:

- underlying contract is issued

- underlying contract is in effect

- reinsurance contract is signed (entered into)

- reinsurance contract is in effect

The table tells you whether the underlying contract and the reinsurance contract must be recognized in the primary insurer's financial statements. Here's my interpretation of the table:

- Rows 1 and 2: If the underlying contract is non-onerous and has been issued, it does not have to be recognized in financial statements until the coverage period begins. (In other words, non-onerous contracts don't need to be recognized in advance.)

- Rows 3 and 4: If the underlying contract is onerous and has been issued, then both the underlying contract and the reinsurance contract must be recognized, even before coverage begins. (If no reinsurance contract has been entered into, then obviously it can't be recognized. That's the "no" answer in row 4.)

- Rows 5 and 6: If the underlying contract is in force then it must be recognized. If a reinsurance contract has been entered into, then it must be recognized also. So policies in force must be recognized in financial statements regardless of whether the contract is onerous or non-onerous.

The section continues to elaborate on a few of the core LRC components, but from the point of reinsurance held and issued which I have summarized below:

- Non-performance risk for reinsurance contracts held and this is included in the estimate of future cash flows (undiscounted), taking into account the risk of defaults and disputes.

- The actuary should consider the financial strength of the reinsurer, 'concentration risk and duration in determining this provision.

- CSM which now represents the net cost or gain from purchasing the reinsurance contract and can now be negative or positive (Recall it is not possible for an insurance contract to have a negative CSM). A negative CSM represents a net gain on purchase of reinsurance

- Coverage units would be the same as a direct insurance contract for a loss occurring reinsurance contract. For a risk attaching contract, the coverage units would typically rise and then decline as the underlying policies expire. There is an example of how you would determine the coverage units for an adverse development cover, but given how niche this coverage is I would be very surprised if this were to be tested so we can skip it.

- Loss Recovery component which is part of the ARC and represents the amount you can 'recover' from a reinsurance contract that covers an onerous group of contracts

- Under GMA, the ARC = FCF + CSM + Loss Recovery Component

- Under PAA, the ARC = ARC excl Loss Recovery Component + Loss Recovery Component

- The loss recovery component is calculated by multiplying a % of expected claims to be recovered onto the loss component

Section 7: Illustrative Example - Loss Component Calculation

This looks like it should be an important section because it supposedly contains an illustrative example. Unless I missed something however, the text within this section refers to an appendix that is not provided. (There is an appendix called "Appendix 1" but that seems to be about something different.) The only example provided in the main text is the calculation of AAD or Average Accident Date but that uses integration (calculus) so it shouldn't be asked given the exam is now in CBT format.

The only thing that could reasonably be asked from this section is a very general description of how the LC (Loss Component) is calculated. It's quite similar to the calculation of premium liabilities under the current CIA methodology.

Question: briefly describe the steps in calculating the LC under PAA (Premium Allocation Approach) within IFRS 17

- Add FCF (Calculated using these 4 steps)

- (1) Determine the UPR (Unearned Premium Reserve).

- (2) Estimate future claims and loss adjustment expenses as follows:

- apply a selected ELR and an unallocated loss adjustment expense (ULAE) factor to the UPR by contract group

- (this is the largest component of the FCFs)

- (3) Discount the result of step 2 to the evaluation date.

- (4) Apply the RA (Risk Adjustment), acquisition costs, other attributable expenses to the result of step 3

- Subtract (LRC ex. LC)

- Add FCF (Calculated using these 4 steps)

That should be all you have to know from section 7.

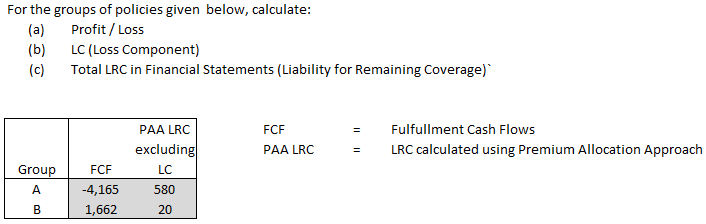

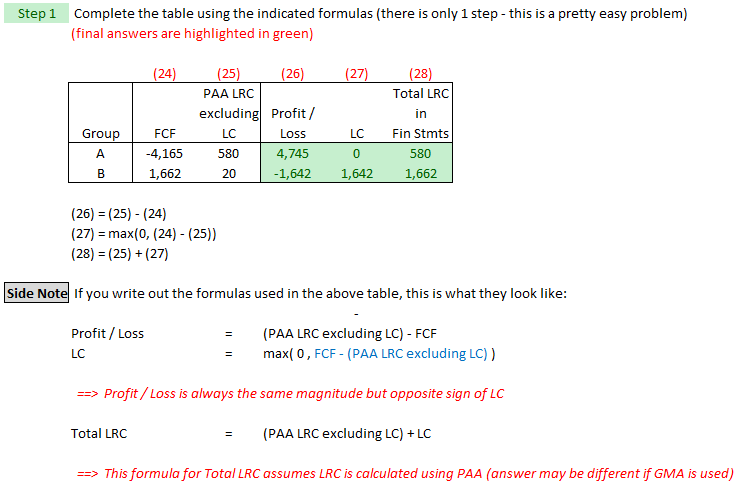

Update (Oct 01, 2022): A very easy practice problem based on the Excel appendix to this reading. More examples will be added.

|

| Here's the problem: (This version of the problem is simpler than the steps for calculating LC under PAA listed above.) |

| Here's the solution: |

| End of example: Here are some practice problems. |

Section 8: MCT Considerations

The source text states the following:

- The Office of the Superintendent of Financial Institutions Canada, l’Autorité des marchés financiers, and other provincial regulatory authorities have indicated their intention to adapt the insurance capital guidelines (Minimum Capital Test or MCT Guidelines) applicable to P&C entities effective with the implementation of IFRS 17.

This section quite short and discusses in general terms how to select the ELR (Expected Loss Ratio) for MCT. I couldn't see anything that would make a good exam question and I think the topic of how MCT will need to be adjusted for IFRS 17 is more appropriately discussed in a dedicated MCT reading like the one currently on the syllabus, but updated accordingly.