BCAR.Cdn

Updates COMPLETE: (for Spring 2024)

|

Reading: Understanding BCAR for Canadian Property/Casualty Insurers August 4, 2022 → pp. 1-9 (up to Section C), 21-29 (B5 Reserve Risk and B6 Premiums Risk), 30-31 (B8 Catastrophe Risk) only.

Authour: A. M. Best

Contents

Pop Quiz

Do you remember what IMCO stands for? (Click here to go to the subsection of the OSFI.MCT article with the answer.)

Study Tips

This reading provides an overview of the calculation & interpretation of BCAR (Best's Capital Adequacy Ratio). Note that BCAR is analogous to the MCT ratio in that they both assess the financial strength of an insurer.

BCAR has been on the syllabus for a very long time, but A.M. Best recently changed the BCAR formula. (shout-out to OnePass). This version is totally different from the previous version. That means past questions are not applicable. Question #14 on the 2014.Fall exam tested the detailed calculation of BCAR in the same way that MCT is now tested, but that level of detail is no longer required. Future BCAR questions will likely be a mixture of essay and simpler calculations.

Alice thinks a good question would be to compare BCAR with MCT. That isn't discussed in the reading, but we'll cover it in the wiki article below.

Estimated study time: 1-2 days (not including subsequent review time)

BattleTable

- this reading was new for 2019.Fall

| Questions held out from Fall 2019 exam: #24. (Skip these now to have a fresh exam to practice on later. For links to these questions, see Exam Summaries.) |

* There is an error in the examiner's report solution to 2019.Fall #24. Although their final answer of 52.5 is correct, their formula should be: BCAR = (AC - NRC)/AC. (The examiner's report put "NRC" in denominator.)

(shout-out to v1995!)

reference part (a) part (b) part (c) part (d) no questions prior to fall 2019

In Plain English!

The source reading has a bunch of useless crap at the beginning. Instead, we're going to dive right into the calculation & interpretation of BCAR. Once you can do that, we'll come back and examine some of the underlying concepts.

A Simple BCAR Calculation

Before doing anything...

Question: what is the purpose of A.M. Best's financial strength ratings

- to provide an opinion on the financial strength of an insurer (and it's ability to meet ongoing obligations to policyholders)

We'll be following the example from page 3 of the source reading. Click the link below, then either print it or keep it open in a separate tab. For now, we only need the totals rows for Net Required Capital and Available Capital.

- BCAR example (page 3 source text) ← Note: Each new version of this reading has slightly different numbers in the example.

The first thing you need is the BCAR formula:

BCAR = (AC – NRC) / AC x 100

where

- AC = Available Capital

- NRC = Net Required Capital

From the totals row of the RECAP of AVAILABLE CAPITAL, we have AC = 206,358. ← shout-out to wc18!!

Notice however that NRC is calculated at 4 different VaR values: 95%, 99%, 99.5%, 99.6%. Let's review what that means:

NRC @ VaR = 95%: For NRC at this level, the company can cover 95% of all possible loss outcomes (probability of insolvency = 5%)

Here's a quick question to test your understanding:

- Is NRC @ 99% higher or lower than NRC @ 95%.

Well, at 99%, the NRC has to cover 99% of all possible outcomes instead of just 95%. That represents "4% more" bad outcomes so NRC @ 99% will be higher. The NRC values in the example are:

Var 95 Var 99 Var 99.5 Var 99.6 NRC 119,536 162,819 197,231 216,841 BCAR 42.1 21.1 4.5 -5.0

I also filled in the corresponding BCAR values. You should take a minute to verify the calculations using the BCAR formula.

When you've done that, note that the source text doesn't tell you until several pages later how to interpret these BCAR values to arrive at a strength rating for the insurer, but I'd like to do that now. I had trouble wrapping my head around the interpretation table on page 8, so I wrote it out in a way that makes more sense to me:

Assessment Var 95 Var 99 Var 99.5 Var 99.6 strongest 25 < BCAR ≤ 100 very strong 10 < BCAR ≤ 25 strong BCAR > 0 BCAR ≤ 10 adequate BCAR > 0 BCAR ≤ 0 weak BCAR > 0 BCAR ≤ 0 very weak BCAR ≤ 0

The idea is to start at the top row of the table and check the conditions as you work your way down. Stop when you reach a row where the conditions are satisfied.

Pop Quiz A! :-o

- What is the appropriate BCAR assessment for the insurer above? Click for Answer

Of course, the hard part of BCAR is calculating AC (Available Capital) and NRC (Net Required Capital). In the above example, I simply gave you those values directly.

Pop Quiz B! :-o

- Given the following BCAR scenarios determine the A.M. Best rating according to the strength assessment table. Click for Answer

Var 95 Var 99 Var 99.5 Var 99.6 BCAR scenario 1 73.1 60.7 55.6 53.9 BCAR scenario 2 51.3 29.0 19.7 16.6 BCAR scenario 3 43.7 18.3 7.8 4.3 BCAR scenario 4 41.0 16.5 19.7 -1.8 BCAR scenario 5 39.4 11.3 -0.2 -4.1 BCAR scenario 6 24.8 -9.6 -23.7 -28.5 BCAR scenario 7 -19.8 -74.1 -96.5 -104.1

Calculating BCAR Available Capital

This calculation requires you to know the following table from page 6 of the source reading: [Hint: EDO - the former name of Tokyo]

Available Capital REPORTED CAPITAL (Total Equity) EQUITY Adjustments 1 ← lura loss reserves unearned premiums reinsurance assets DEBT Adjustments ← sd surplus notes debt service requirements OTHER Adjustments ← fig future operating losses intangibles goodwill

- 1 Alice suggested reordering the equity adjustments versus how they were listed in the text. This is so the first letters of each would spell lura, not a real word, but it makes a memory trick to remember the individual adjustments.

To calculate AC:

- start with reported capital (total equity) from the balance sheet

- adjust this starting amount by either adding or subtracting the given adjustments

- (aside from the example on page 3, the source reading provides no details on which items should be added and which should be subtracted)

If you look at the example pdf from the previous section, you'll see the AC calculation in the table looks much like the above table. They also threw in some extra adjustments not listed in table as follows: [Hint: off-p]

- off-balance sheet losses

- fixed income equity (this would be part of assets)

- future dividends

- protected cell surplus

I'd be a little surprised if you had to know off-p. I just wanted to point it out because the explanation of Available Capital within the text is inconsistent with the example that was provided. (Alice really wants to make a snarky comment here, but I'm holding her back!) You should however memorize lura-sd-fig. But also realize that the source text doesn't explain it very well. If you were given the full balance sheet for a company and asked to calculate AC, you could figure out some of the adjustments that have to made to the reported capital, but there would likely be other necessary adjustments that are not listed here. The full detailed calculation appears to be beyond the scope of this reading.

- → Before proceeding, however, you should make sure you see how they get AC = 206,358. (It's tricky because they add the equity adjustments but subtract the intangibles and goodwill.) ← shout-out to JZ!

But here is a good question that is answered:

Question: why don't we use the unadjusted reported capital as the value for AC (Available Capital)

- incorporating these adjustments provides for a more economic and consistent view of capital available

All these memory hints can get confusing, but if you don't like the ones I've suggested, you've got to find some way of learning this. I think calculating BCAR is a very likely exam question.

Question: summarize the memory hints from this section

- EDO:

- Equity, Debt, Other adjustments to reported capital

- each of these 3 adjustment categories can be broken down further: lura-sd-fig

- E adjustments: lura

- D adjustments: sd

- O adjustments: fig

- some further adjustments to capital: (from the example on page 3)

- off-p

(The quiz in the next section has a practice template that ties all of this together.)

Calculating BCAR Net Required Capital

Easier Version

The easy version of the BCAR problem is where you're directly given the individual capital risk components B1 through B8. Think back for a moment to the risk categories from OSFI.MCT. Remember IMCO? That was the memory hint for the MCT risk categories: (In My Crummy Opinion)

- Insurance risk (shout-out to MZ!)

- Market risk

- Credit risk

- Operational risk

It's the same idea in BCAR except the risk categories are broken down differently: [Hint: BICEP-FCR] → Or a better hint is here in the forum ←(shout-out to FC!)

Net Required Capital (B1) Fixed Income Securities (B2) Equity Securities (B3) Interest Rate (B4) Credit (B5) Reserves (part of U/W risk) (B6) Premiums (part of U/W risk) (B7) Business Risk (B8) Catastrophes (part of U/W risk)

- investment risk = (B1) + (B2) + (B3)

- asset risk = investment risk + (B4)

- U/W risk = (B5) + (B6) + (B8) ← shout-out to NZ!

Unfortunately, I can't reorder the above list to make it properly match the memory trick because that would jumble up the numbering B1-B8. But still, the hint gives you a way to remember all the categories, even if it isn't in the right order. At least BICEP begins with the same letter as BCAR. Weird flex, but ok.

Anyway, looking back at the example from the first section: (page 3 of the source reading)

- NRC @ Var 95 = 119,536

How was this calculated? Well, it's pretty easy. It's the same kind of square-root formula that's used for MCT capital required, but with a twist for the (B4) & (B5) terms. (See formula below.)

NRC = (B7) + SQRT [ (B1)2 + (B2)2 + (B3)2 + (0.5 x (B4))2 + (0.5 x (B4) + (B5))2 + (B6)2 + (B8)2 ]

You should verify the numbers, at least for the Var 95 column. It's actually slightly confusing the way they presented it because they show a bunch of subtotals that aren't part of the calculation.

Anyway, the Gross Required Capital or GRC is just the direct sum of the quantities (B1)→(B8). (That's how much capital would be required if all risks were to develop simultaneously.) Then the Net Required Capital is obtained using the above covariance formula. And here's an easy question that's been asked multiple times on prior versions of this BCAR reading:

Question: what is the purpose of the covariance adjustment in the NRC formula

- the covariance adjustment reflects the assumed statistical independence of 7 of the 8 risk components: (B1)-(B6) and (B8)

- it reduces GRC (Gross Required Capital) because it's unlikely that these 7 components will be near their maximum levels simultaneously (shout-out to MZ!)

(This is the exactly same idea as for the covariance adjustment in the MCT formula for capital required.)

Question: why is (B7) excluded from the covariance adjustment

- A.M. Best expects an insurer to maintain capital for business risks without the benefit of diversification.

Here's an example to show you how the BCAR rating is done: (Note that "B8 - Catastrophe Risk" is shown under "Other Risk" but it should have been under "U/W Risk". Shout-out to felixc5!)

The next quiz has a practice template for this type of problem. (Note that in the web-based problem, "B8 - Catastrophe Risk" is shown under "Other Risk" but it should have been under "U/W Risk".)

Harder Version

The harder version of the BCAR problem is where you're not directly given the required capital for all the individual risk categories (B1)-(B8). But don't worry – you don't have to know how to calculate all 8 of them. According to the current syllabus, you have to know further details only for:

- (B5) - Reserve risk

- (B6) - Premium risk

- (B8) - Catastrophe risk

To learn these calculations, you have to study a few examples, then practice with the practice templates in the next quiz.

Question: what is the key idea in calculating the required capital for each risk category

- multiply the liability from each risk category by a specific capital factor (similar to MCT)

- (derivation of capital factors is based on industry risk factors and adjusted for company's volatility in case loss development)

The first link below shows the example calculation for (B5) from the source text. This example looks complicated because it has 20 lines of business but it's well laid out and easy to follow. For studying however, you need a simplified version that's broken into separate steps you can practice. The second link below shows how I've done this.

- BCAR example for B5 (page 22 source text) ← The actuary who did this clearly used the Fit-All-To-Page option when they translated the Excel doc to a pdf!

- BCAR B5 (practice) ← start with net loss & LAE reserves (shout-out to exam6pass!)

The (B6) calculation is very similar to the (B5) calculation except that you start with the financial statement amount for net written premium instead of net loss & LAE reserves. (shout-out to exam6pass!) Actually, (B6) is a little simpler because there is no deficiency factor or discount factor like there is for (B5). Here's the text example from page 27.

Regarding (B8), catastrophe risk, the text doesn't provide enough information to actually do the calculation; they discuss it only in very general terms. But recall there is a separate syllabus reading devoted entirely to BCAR catastrophes, BCAR.Cat, and everything you need to know for the exam can be found there. (Even there, I don't think they can ask you to calculate B8 – they still only talk about it in fairly general terms.)

BCAR Concepts

Now that you understand the BCAR calculation, you have a better foundation for understanding the underlying concepts. Recall the purpose of BCAR:

- to provide an opinion on the financial strength of an insurer (and it's ability to meet ongoing obligations to policyholders)

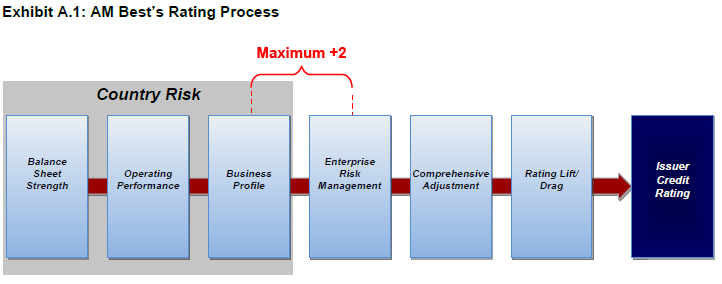

We saw how you can assign a financial strength rating to an insurer based on its BCAR score at various levels of VaR: 95, 99, 99.5, 99.6. There were 6 ratings that ranged from strongest all the way down to very weak, but the BCAR scores are not the sole determiners of the final rating. The practice templates provided a very simplified version of how A.M. Best reaches its final rating. There is a diagram the source text showing 6 different steps (see boxes) leading to the final rating:

The first box is labeled: Balance Sheet Strength The basis of this is the BCAR score, but there are many other considerations impacting the assessment of balance sheet strength.

Question: identify considerations other than the BCAR score that impact balance sheet strength assessment [Hint: Q2-SALAMI]

- Q2 → Quality of capital, Quality of reinsurance

- –

- Stress testing (how well does the company perform under stress)

- Adequacy of reserves

- Liquidity of capital

- Actions of affiliates (affiliates could drag you down or pull you up)

- Matching of assets & liabilities (this is desirable for paying your bills on time)

- Internal capital models (does the company have a good procedure for assessing its own capital needs)

- In my head, I hear the hint as: Cured Salami. It puts meat on the bones of the basic BCAR numbers.

Anyway, it's another list, which is often what the examiners like to ask. Here's another, and the answers are the labels from the 6 steps (boxes) in the diagram from page 1.

Question: identify the 6 steps in A.M. Best's rating process (leading to the final issuer credit rating) [Hint: BOB-ECL]

- Balance sheet strength (based mainly on the BCAR scores, but subject also subject to Cured Salami.)

- Operating performance

- Business profile

- –

- Enterprise risk management

- Comprehensive adjustment

- Lift and/or drag

- In my head, I hear the hint as somebody's name: Bob Eckle. He's the one who does the rating for A.M. Best. (not really, but I pretend he is to help me remember the list.)

The details of these steps are not discussed in any detail, but note there have been questions on past exams similar to the above. (You can access those problems from the archived BCAR.Cdn reading but the answers in the examiner's reports are not necessarily accurate because they were from a prior reading and the BCAR methodology has changed since then.)

Based on the calculation problems from the previous sections, you should be able to describe company characteristics that may tend to lower (or raise) the BCAR score.

Question: identify company characteristics that may tend to lower a company's BCAR score

- here are just a few of the many possible answers to this question:

- - aggressive investment portfolio (increases NRC for investment risk categories B1, B2, B3)

- - loans to high-risk entities or reinsurance with low-rated reinsurers (increases NRC for credit risk category B4)

- - reserve deficiency (increases NRC for reserve risk category B5)

- - excessive growth or high U/W leverage (increases NRC for premium risk category B6)

- - concentration of property risks in Florida (increases NRC for catastrophe risk category B8)

And of course the opposite of the above would tend to raise a company's BCAR score.

Question: why does A.M. Best calculate NRC and BCAR at more than 1 level of VaR

- to gain more insight into the company's balance sheet strength and assess its ability to withstand tail events

Just a few miscellaneous facts to finish up...

Question: why does A.M. Best use a sensitivity analysis to supplement its BCAR calculation

- assess capital required to support future business

- assess impact of a pro-forma transaction (acquisition of a subsidiary)

- assess projected year-end capital position

Question: identify an aspect of the BCAR model that may make it more robust than MCT

- the BCAR model permits qualitative adjustments to it's final assessment due to market & economic conditions such as:

- - interest rate changes

- - stage of U/W cycle

- - changes in reinsurance arrangements

There's a lot to memorize here. Since this is a new reading, it's hard to know what will be emphasized on the exam. My prediction is that because of the numerical nature of this new BCAR reading, BCAR is a more likely exam topic than past exams might indicate. You should prepare for mixture of essay and calculation.

BCAR versus MCT

Recall from OSFI.MCT:

MCT ratio = CapAv / minCapReq

- CapAv is based on balance sheet amounts

- minCapReq is based on an analysis of the risk factors: IMCO

- (the key idea in calculating required capital is to multiply liability amounts by capital factors)

Recall from earlier in this wiki article the formula that A.M. Best uses. It also uses capital available and capital required but in a slightly different way:

BCAR = (AC - NRC) / AC x 100 ← calculated at 4 VaR levels

- AC is based on balance sheet amounts

- NRC is based on an analysis of the risk factors (B1)-(B8): BICEP-FCR

- (the key idea in calculating required capital is to multiply liability amounts by capital factors)

Question: describe 3 similarities between the BCAR model and MCT

- purpose (assess financial strength and ability to meet policyholder obligations)

- key idea (apply capital factors to liabilities in various risk categories)

- covariance adjustment (to account for the statistical independence between risk categories)

Question: describe 3 differences between BCAR model and MCT

- formula is different, and

- BCARmax = 100%, no minimum

- MCTmin = 0%, no maximum

- robustness is different

- A.M. Best is more robust because the final assessment includes qualitative economic conditions (like stage of U/W cycle)

- time horizon is different

- BCAR capital must support current & future premium risk

- MCT focuses more on current year's risk

- formula is different, and

Pop Quiz A - Answer

- BCAR assessment = strong

Pop Quiz B - Answer

Var 95 Var 99 Var 99.5 Var 99.6 rating BCAR scenario 1 73.1 60.7 55.6 53.9 strongest BCAR scenario 2 51.3 29.0 19.7 16.6 very strong BCAR scenario 3 43.7 18.3 7.8 4.3 strong BCAR scenario 4 41.0 16.5 19.7 -1.8 strong BCAR scenario 5 39.4 11.3 -0.2 -4.1 adequate BCAR scenario 6 24.8 -9.6 -23.7 -28.5 weak BCAR scenario 7 -19.8 -74.1 -96.5 -104.1 very weak

POP QUIZ ANSWERS

IMCO are the 4 broad areas of risk from OSFI.MCT. (IMCO = In My Crummy Opinion)

- Insurance Risk

- risk of loss FROM the potential for claims (from policyholders & beneficiaries)

- Market Risk

- risk of loss FROM changes in prices in various markets

- Credit Risk

- risk of loss FROM counterparty's potential (inability OR unwillingness) to fully meet contractual obligations due to the insurer

- Operational Risk

- risk of loss FROM inadequate or failed (internal processes, people, systems) OR FROM (external events)