GOC.Flood

Reading: ““Adapting to Rising Flood Risks – An Analysis of Insurance Solutions for Canada” 2022.

Author: Government of Canada

BA Quick-Summary: Flood Insurance in Canada

|

Contents

- 1 Pop Quiz

- 2 Study Tips

- 3 BattleTable

- 4 In Plain English!

- 5 Section 1: (Introduction)

- 6 Section 2: (Flood Risk Management in Canada)

- 7 Section 3: Flood Hazard and Damages in Canada

- 8 Section 5: Building Policy Options for Canada

- 9 Section 6: Results of Model Analysis

- 10 Section 7: Discussion

- 11 Section 8: Key Findings

Pop Quiz

Study Tips

This is a government paper that provides historical context about the flood risks faced by Canada as well as the actions that can be taken to address them. There has been numerous iterations of different flood papers in short succession these past few sittings which shows the importance of this topic to the exam committee. I would spend more time really understanding and having a holistic view of the flood situation faced in this country. I can see the questions being more conceptual in nature rather than a list-based type question.

Estimated study time: 10 hours (not including subsequent review time)

BattleTable

No past exam questions are available for this reading.

reference part (a) part (b) part (c) part (d)

In Plain English!

Section 1: (Introduction)

Globally, natural disasters have been increasing in frequency, severity and economical impact due to shifting natural hazard patterns and rising exposure of people, infrastructure and the environment. The gap between insured and economic losses has also increased significantly. A Emergency Management Strategy (EMS) has been proposed in Canada which seeks to build resilience through the following areas:

| Question: What are the priority areas for the Emergency Management Strategy? |

- Collaboration to strengthen resilience

- Understanding of disaster risks in all sectors

- Focus on disaster prevention and mitigation

- Enhance disaster response capacity and development of new capabilities

- Strengthen recovery efforts

The EMS also emphasizes the need to assist and the need to develop options for sharing financial risks of disasters.

1.1 Overview of Flood Risk in Canada

As with any risk, we can break down flood into a frequency and severity component which together form the total risk.

Frequency can be affected by:

- Increases in extreme precipitation due to climate change

Severity can be affected by:

- Development of floodplains

And the overall risk can be reduced by:

- Relocation

- Building resilient infrastructure

I'd say it is also important to define pluvial flooding which is flooding caused by extreme rainfall and fluvial flooding which is where rivers and ponds overflow.

1.2 Key Driver's of Canada's Flood Risk

I think this section, and probably the prior section, can be answered using general knowledge, so just come at problems using common sense.

- Population growth and urban development

Densification & Development of urban areas already exposed to floods is a significant source of this risk. Many cities are located close to floodplains and many people live close to coastlines. Development in populated areas drives up the value of assets due to increased economic activity which further exacerbates the exposure to loss. Increasing amounts of finished basements, especially in Metro Toronto, Montreal and Vancouver also drives flood risk.

- Climate Change

Duhh - Canada is warming at a faster rate than everywhere else in the world. Warmer temperatures increase the frequency and severity of extreme precipitation events. Extreme Rainfall causes increased pluvial risk, especially in urban areas where pavements, concrete and aging infrastructure is unable to handle increased volume of rainfall. Can also cause increase fluvial risk where more rain causes more runoff into streams and rivers, beyond what can be managed.

Canadians in coastal cities are at risk from Rising sea levels causing increased storm surges and tidal flooding.

Extreme heat could counterintuitively increase flooding risk by inducing droughts and wildfires which destroy vegetation and topsoil that reduce the ability of the ground to hold water.

1.3 Defining the problem

| How to make insurance available and affordable for those living in high risk areas |

Insurance for flood is really only available in low or medium risk areas, which means high risk areas that account for 90% of the flood risk are either getting free insurance paid by taxpayers or are forced to manage financial risk on their own.

- High costs of insurance

Flood insurance is cost-prohibitive, especially for low-income households and is further eroded by high housing costs. Recent flood events, reinsurance rates and material changes in risk can also cause premiums to increase.

- Low risk awareness

Flood maps are not easily accessible for homeowners, which means most Canadians in high risk areas are not even aware of their risk, which leads to the following problems:

- → Homeowners do not purchase coverage as they do not know about their risk or assume it is bundled in their standard home insurance

- → May not purchase enough optional flood coverage

- → Homeowners are less likely to make investments in property-level protections

- Misaligned incentives

Existing DFA programs contributes to moral hazard on the following levels

- → At the homeowner level, there are no incentives to reduce risk or purchase insurance

- → At a community level, local governments approve land-use that maintain or create new flood risks, yet they and developers are rewarded with increased property sale prices and tax revenue

- → At a regional and national level, cost sharing of post disaster funding does not incentive stakeholders at different levels to reduce risk.

The expectation that the government will always provide free post disaster financial assistance, regardless of risky decisions reduces incentives for lower level stakeholders to reduce their risk or purchase insurance.

1.4 The task force on flood insurance and relocation

Don't think this section is particularly important

Section 2: (Flood Risk Management in Canada)

This section mainly highlights how the flood management responsibilities are currently segregated. Its filled with a lot of fluff and I think just memorizing 2-3 bullets points regarding the responsibilities of each subgroup should suffice.

Traditional approaches include building structural controls that aim to keep people and property separate from flooding sources. Flood Risk Management (FRM) is an alternative method where the responsibility for flood risks is spread across a wide array of stakeholders and uses non-structural mitigation methods to complement other types of mitigation.

2.1 Roles and responsibilities for flood risk management

- Federal Government

- → Minister of Public Safety and Emergency Preparedness to coordinate and support local efforts to mitigate, prepare, respond and recover form flood emergencies

- → Provide assistance to provinces through Public Safety's Disaster Financial Assistance Arrangement (DFAA) program

- → Minister of Indigenous Services to provide emergency management services to indigenous groups

- → Minister of Environment works with provinces to regulate apportion and monitor water resources

In 1970, the federal government established the DFAA which is a cost sharing program to assist provinces with response and recovery costs for large-scale disasters such as to repair damaged infrastructure and restoration of essential services. The provinces themselves are responsible for designing and administering DFA programs to provide direct assistance to affected individuals.

- Provincial Government

- → Set regulations and policies regarding land use

- → Regulate insurance sector including product design

- → Establish land use planning standards to mitigate flood risk, investments in infrastructure, impose requirements on building design and construction

- → Regulate and permit natural resource development such as mining and logging

Provinces have some flexibility to provide DFA, either through a formalized program or through ad-hoc funding to facilitate reconstruction. Some provinces like QC do not authorize reconstruction in same location for certain high risk locations, while other provinces have opted to purchase and demolish damaged residences and move homeowners to a less risky area. DFA excludes coverage for insurable losses.

- Indigenous Communities

- → Develop community emergency management plans, such as assessing hazards risk and vulnerabilities faced by community

- → Indigenous Services Canada (ISC) works with First Nations to support structural mitigation projects such as dikes and sea walls

- → Crown-Indigenous and Northern Affairs Canada (CIRNAC) provides funding to help these communities responds to climate change impacts

- Insurance Industry

- → Financial transfer of flood risk from homeowners to insurers

- → Participate in data collection, research and public outreach

- → Incentivize policyholders to undertake risk reduction measures by charging a risk based premium

- → Help shift some of the burden away from government DFA programs

- → Insurance generally compensates policyholders more fully and quickly than the government

To enable the private market to function, the following preconditions are needed: [Hint: LIAA]

- → Limited or restructured post-disaster financial assistance to encourage flood mitigation investments

- → Improved public awareness of flood risk

- → Accurate and up-to-date flood maps

- → Adequate and ongoing investments in public and private flood defences

- Non-governmental and Civil Society Organizations

- → Canadian Red Cross and similar organizations support flood recovery efforts, emergency planning and public education

- → Boots on the gorund during incidents

- → Best suited to attract, coordinate and harness emergent groups of volunteers towards meaningful post disaster contributions

- Communities and individuals

- → Seek out information to help understand flood risks

- → Undertake non-structural and structural risk mitigation efforts such as purchasing adequate flood insurance and flood-proofing homes

2.2 Impact of Risk Reduction

Risk reduction either reduces the frequency or severity of a flood event. The frequency can rarely be controlled, so these measures are mostly focused on severity.

| Question: Explain how each stakeholder can reduce the severity of a flood event? |

- Households: Install backwater valves, basement sump pumps, maintaining appropriate lot grading, clearing eaves troughs and extending downspouts

- Community: Adopt climate-resilient best practices for regulations, land use, urban planning and developments; proactively upgrading and retrofitting infrastructure

- Government: Up-to-date national climate and disaster resilient building codes and standards, improved flood risk information, investing in climate-resilient investments, funding watershed level mitigation projects

While the above question highlights the key activities that can be undertaken to reduce risk, the most effective strategy is that of Strategic Relocation. This is done by completely removing all assets and properties at highest risk of repetitive flood damage through buyouts done by the government. The high-risk area is then can be repurposed as green infrastructure or left as is.

| Question: What are the challenges associated with strategic relocation? |

- A strategic relocation is challenging, time-consuming and expensive.

- There is an affordable housing shortage in Canada

Section 3: Flood Hazard and Damages in Canada

3.1 Methodology for Estimating Flood Damages

Personally, I don't think you'd need to know too much detail here. I see this paper as focusing more on the higher level discussion points rather than specific technical details of each of the models.

- Flood Hazard: Size of flood and probability of occurrence

- Households: People, property, infrastructure and other social or economic assets at risk

- Consequence: How much damage floodwater is likely to cause to people or assets

- Risk: Predicted losses which consists of AAL (Average Annual Losses) and return-period losses

The text then goes into a long-winded way of saying they used catastrophe models from external vendors for their analysis.

These models require a comprehensive national database of flood exposures that includes building specific data such as structure replacement cost, presence of a basement and other risk based information.

Flood damage is estimated using the damage functions in each of the catastrophe models.

3.2 Results of Flood Damage in Canada

The average of 6 catastrophe models was used to estimate AAL across Canada, with there being an annual estimated cost of 2.97B of residential flooding nationwide. Quebec, Ontario and British Columbia lead the way in terms of loss estimates, and this is mainly because of their population density.

There are a number of pretty neat graphs that you can view in the text document, but honestly none of them seem testable in terms of specifics.

| Question: Why is the estimate from these report higher than previous national flood damage assessments which are closer to 1-1.5B? |

- Prior analysis has undercounted true number of properties

- Current analysis factors in tail events which are not captured in historical data

- Most historical flood damage estimates based on insured losses which does not capture flood damage borne by homeowner or not recorded centrally

Section 5: Building Policy Options for Canada

5.1 International Examples of Flood Insurance Solutions

This section compares the flood program in Australia, France the UK and the US. I think this is quite important and am summarizing just what I would write as my high-level notes for memorization if I were to take 6C again. This paper is LOADED with fluff.

- Australia

- → Fully private market with regulation from the government

- → Take-up is voluntary and varies by insurer

- → Premiums are risk-adjusted and not regulated or subsidized by the government

- → Premiums generally affordable for low-medium risk but very costly for high-risk policyholders

- → Government encourages retrofits which reduces premiums

- → Low-cost to government

- → Strong use of private partnership

- → Lower value to homeowners as they have to assume more risk

- → Insurers and insureds benefit from standardized definition of flood which reduces coverage disputes which increases market penetration through better understanding of marketplace products

- France

- → Homeowners pay a 12% surcharge on home insurance policies to cover natural perils including flood regardless of risk through CatNat scheme

- → Local governments to adopt a risk prevention plan that delineates 100-year flood areas and provides mandatory and recommended measures to reduce flood exposure and vulnerability

- → Deductibles are lower for communities with approved plan

- → Insurers can cede premium to a state-owned reinsurer through a quota share for up to 50%

- → For extreme disasters, the insurer is fully compensated for the loss less a deductible

- → Purchase is optional if you don't have a mortgage on the property but mandatory otherwise

- → Most homes are covered by the scheme and it is affordable and easily available with a low cost to the government

- → However, it does not provide an incentive for risk reduction, does not differentiate between risks, the program could be stressed by successive major events and there is ambiguity around the definition of an extreme disaster

- UK

- → Private insurers provide coverage to high-risk areas

- → Premiums are ceded to high-risk reinsurance pool for those that fall above a pre-determined affordability cap

- → Affordability prioritized instead of risk

- → Flood Re (The reinsurer) is a non-profit entity accountable to the government

- → Government sets affordability cap

- → Supposed to run until 2039 by which everything will be risk-based pricing

- → Minimal cost to government, good value for money, affordable with high take up rate

- → Does not provide incentive for risk reduction, lack of equity as high-value property owners are subsidized by the broader population

- US

- → Administered by the National Flood Insurance Program (NFIP) and operated by the Federal Emergency Management Agency (FEMA)

- → Policies written by federal government

- → Private insurers assist by writing, selling and settling policies for the NFIP

- → Mandatory for federally backed mortgages in flood prone areas, optional otherwise

- → Premiums risk-based and based on rate maps developed by government

- → FEMA operates a community rating system program to reward risk reduction measures through lower premiums

- → NFIP is available and affordable

- → Weaknesses of ther NFIP is that it has low market penetration as few policies sold outside of high risk areas with participation decreasing over time. It also does not really encourage risk reduction as there is no penalty for repetitive loss properties. Cost to the federal government is also very high due to unfunded discounts provided.

5.2 Guiding Insights for Canada

The following are the 4 themes for Canada to consider when setting up a flood program. This is a very important table and I would recommend that you memorize it.

| Theme | Description |

|---|---|

| Uncertainty |

|

| Market penetration, adverse selection and mutuality |

|

| Affordability |

|

| Moral Hazard |

|

5.3 Policy Objectives for Flood Insurance

Another very important table to memorize

| Theme | Description |

|---|---|

| Adequate and Predictable Financial Compensation |

|

| Risk-Informed Price Signals and Mitigation |

|

| Affordability |

|

| Wide Availability |

|

| Maximized Participation |

|

| Value for Money for Governments and Taxpayers |

|

| Question: What are the trade-offs that need to be considered when focusing on one objective over another? (Tables are really nice here :)) |

| Theme | Description |

|---|---|

| Availability vs. Affordability |

|

| Risk-Based Pricing |

|

| Balancing Affordability and Coverage |

|

| Cost-Effectiveness |

|

| Maximized Participation |

|

5.4 Insurance Models for Canada

The 4 models will be described in a later section, but they have a limited life-span of 25 years to allow a full transition to risk-based pricing

- Flat cap high-risk pool

- Tiered high-risk pool

- Public insurance

- Public reinsurance (layered)

Section 6: Results of Model Analysis

6.1 Assumptions

Another huge section with loads of fluff. I'll try to simplify the key facts to remember by starting with another table. These section mainly describes each of the actuarial models considered

| Theme | Description |

|---|---|

| Total Flood Risk |

|

| Organizational Start-up Costs |

|

| Lifespan of Model |

|

| Climate Change |

|

| Inflation |

|

6.2 Insurance Model Design Features

I've simplified the text as much as I can. It's LONG

- High Risk Homeowners Threshold

- → High risk defined as top 10% by Average Annual Loss (AAL), with the highest risk in the top 1%.

- → A price-based threshold is used: premium > 0.1% of coverage ($300 for a $300,000 policy).

- → This threshold aligns with international affordability standards.

- → Approximately 10% of households fall under this category.

- Affordability

- → Measured by the ratio of premiums to household wealth or income.

- → Home value often accounts for 70% of household net worth.

- → Premium caps and subsidies can help make insurance affordable.

- → Premium caps phase out over time.

- → Subsidies decrease as income increases.

- Premium Loading Factors

- → Includes administration, overhead, reinsurance, and safety margins.

- → Calculated based on average annual loss (AAL).

- → No profit margin included.

- Cross Subsidization

- → Redistributes premiums to lower high-risk homeowner costs.

- → Low-risk homeowners pay slightly more.

- → A levy of $20-$45 provides $250-$650 million per year.

- Deductibles

- → Initial costs are paid by homeowners.

- → Can be used to reduce moral hazard and incentivize risk reduction.

- → A $5,000 deductible is used for model costing.

- → Higher deductibles can reduce participation.

- Participation

- → Low participation rates reduce financial stability while homeowners have to bear more residual risk.

- → Higher rates needed to spread risk and lower premiums.

- → Current participation is 40-60%, mainly in low/medium risk areas.

- → Participation can increase with public awareness and affordability supports.

- Standardization of Flood Insurance Policies

- → Government involvement increases standardization.

- → Policies may standardize language, perils covered, and bundling of water-related perils.

- Automatic Ceding of Flood Policies

- → Risk is transferred from insurers to another entity.

- → Insurers are assumed to automatically cede high-risk coverage.

| Question: What is residual risk? |

- Financial risk remaining after applying insurance.

- Important for transitioning from public disaster financial assistance (DFA) to an insurance-based system.

6.3 Insurance Models for Actuarial Costing

I think its more important to understand the key principles of each model here rather than the specific assumptions, as I do not expect the CAS to test you on the actual specifics of each policy.

- Model 1: Flat Cap High-Risk Pool

This model features a high-risk pool for homeowners with minimal government intervention in the insurance market but significant government support for affordability. A flat premium cap is applied to high-risk properties, stabilized by market-based reinsurance and a government backstop. Insurers must offer standardized coverage to high-risk homeowners, but take-up is optional. Premiums are risk-based up to the cap, with government funding the cost of capping premiums and a small levy on all residential property policies. No additional income-based subsidies are included. Low-to-medium risk homeowners have no market intervention, resulting in high variability in coverage.

Key Features:

- → Inclusion: High-risk households (premium > 0.1% of coverage)

- → Flood Premium Cap: $500

- → Income-based Subsidies: None

- → Coverage Cap: $300,000 per event

- → Deductible: $5,000

- → Cross Subsidization: $20 levy on all residential property policies

- → Stabilization: Reinsurance and government backstop

- → Participation Assumptions: Mandatory offer, optional purchase. 80% for low risk, 50% for medium and high risk

- → Premium Loading Factor: 96% of Average Annual Insured Loss

- → Policy Standardization: Standardized policies for high-risk homeowners

- Model 2: Tiered High-risk pool

This model is also based on a pool for high-risk homeowners, but with added government intervention compared to the Flat Cap model. Instead of a single flat premium cap, estimated home reconstruction costs divide high-risk homes into quintiles. Each quintile gets a premium cap that increases with reconstruction costs. Reconstruction costs are a proxy for wealth and ability to pay. Governments require mandatory purchase of flood insurance for those with a mortgage. The cost of tiered premium caps is funded by governments and a higher levy on all residential property policies. No additional income-based subsidies are applied. As with the Flat Cap High-risk pool, this model has variability in coverage for households not leveraged by a mortgage.

Key Features:

- → Inclusion: High-risk households (premium > 0.1% of coverage)

- → Flood Premium Cap: 5 levels based on reconstruction cost quintiles: $250; $500; $1,000; $2,000; $4,000

- → Income-based Subsidies: None

- → Coverage Cap: $300,000 per event

- → Deductible: $5,000

- → Cross Subsidization: $40 levy on all residential property policies

- → Stabilization: Reinsurance and government backstop

- → Participation Assumptions: Mandatory offer to all; mandatory purchase with mortgage and optional without. 80% for low risk, 65% for medium and high risk

- → Premium Loading Factor: 96% of Average Annual Insured Loss

- → Policy Standardization: Standardized policies; comprehensive bundling of water coverage

- Model 3: Public Insurer

This model features a Crown corporation which underwrites comprehensive flood insurance through the insurance industry as an intermediary, with an automatic government backstop. Unlike the first two models where a pool covers only high-risk properties, the Crown corporation covers all overland flood risk in Canada. Both the offer and purchase of flood insurance are mandatory. Private insurers act as intermediaries, collecting premiums, paying claims, and servicing policies for the Crown corporation, in exchange for a fee. The Crown corporation is stabilized through pooling, private reinsurance, and a government backstop. High-risk premiums are capped at a higher level than pooled models, with an income-based subsidy to increase affordability. The premium cap and subsidies are funded by governments and a higher levy on all residential home insurance policies. Due to government-provided coverage, policies and coverage levels are likely to be standardized.

Key Features:

- → Inclusion: All households (low, medium, and high risk)

- → Flood Premium Cap: $3,000

- → Income-based Subsidies: Sliding scale based on income, funded by FPT governments

- → Coverage Cap: $300,000 per event

- → Deductible: $5,000

- → Cross Subsidization: $45 levy on all residential property policies

- → Stabilization: Reinsurance and government backstop

- → Participation Assumptions: Mandatory offer and purchase via bundling with home insurance. 95% for low and medium-risk households, 90% for high-risk households

- → Premium Loading Factor: 66% of Average Annual Loss, includes annual living expenses

- → Policy Standardization: Standardized policies for all with home insurance; comprehensive bundling of water coverage

- Model 4: Public Reinsurer

This model introduces a layered approach that builds on both public and private-based elements of previous models. Flood insurance is provided in two layers: the first layer allows homeowners to purchase insurance from the private market at full risk-based prices, covering up to a modest limit ($25,000). The second layer requires the mandatory purchase of insurance above this limit, up to a high limit ($300,000), from the insurance industry. The Crown corporation sells subsidized XOL reinsurance to private insurers and reimburses them for losses covered in the second layer. The second layer follows the premium cap, funding structure, and support for low-income homeowners as specified in the Public Insurer model. Stabilization is achieved through a government backstops and market-based reinsurance. The first layer's policies are less likely to be standardized due to market dynamics, while the second layer may be standardized as a condition for access to subsidized reinsurance. Full risk-based pricing for the first layer signals homeowners of their risk, incentivizing property-level mitigation, moving, or self-insuring, but protects against catastrophic costs through the second layer.

Key Features:

- → Inclusion: All households (low, medium, and high risk)

- → Flood Premium Cap: None for first layer; $3,000 for second layer

- → Income-based Subsidies: None for first layer; sliding scale based on income, funded by FPT governments for second layer

- → Coverage Cap: $25,000 for first layer; $300,000 for second layer

- → Deductible: $5,000 for first layer; N/A for second layer

- → Cross Subsidization: $20 levy on all residential property policies

- → Stabilization: Determined by individual insurers’ business model for first layer; reinsurance and government backstop for second layer

- → Participation Assumptions: Mandatory offer and voluntary purchase for first layer (80% for low risk, 50% for medium risk, 35% for high-risk households); mandatory offer and purchase via bundling with home insurance for second layer (same participation rate as Public Insurer model)

- → Premium Loading Factor: 166% of Average Annual Insured Loss for first layer; 66% of Average Annual Loss for second layer

- → Policy Standardization: Non-standardized policies for first layer; standardized policies for second layer

6.4 Actuarial Results of Four Models

Again, there are many graphs here that are nice to look at, but unlikely to be tested. You should continue to focus on the core text, while skimping through the graphs in the source.

Participation

For modelling purposes, participation in each insurance model is treated as an input, not as a result of the modeling analysis. Future participation rates are difficult to predict and influenced by factors like the withdrawal of DFA for flooding, risk mitigation investments, and strategic relocation supports. This analysis considers participation using current market take-up rates for optional flood insurance (40-60%), adjusted for each model's circumstances and categorized by risk level. Public education efforts on flood risk are included in the participation rates for each model.

It is important to compare the models based on household participation from a risk perspective:

- Flat Cap High-risk Pool:

* Low-risk: 80% due to low cost * Medium-risk: 50% * High-risk: 50% due to low cap

- Tiered High-risk Pool:

* Low-risk: 80% * Medium-risk: 65% (mandatory for mortgages) * High-risk: 65% (mandatory for mortgages)

- Public Insurer:

* All risk levels: 90-95% due to mandatory bundling with property insurance

- Public Reinsurer (First Layer):

* Low-risk: 80% * Medium-risk: 50% * High-risk: 35% (full-risk-based pricing)

- Public Reinsurer (Second Layer):

* Same as Public Insurer due to mandatory bundling with property insurance

Required Annual Funding

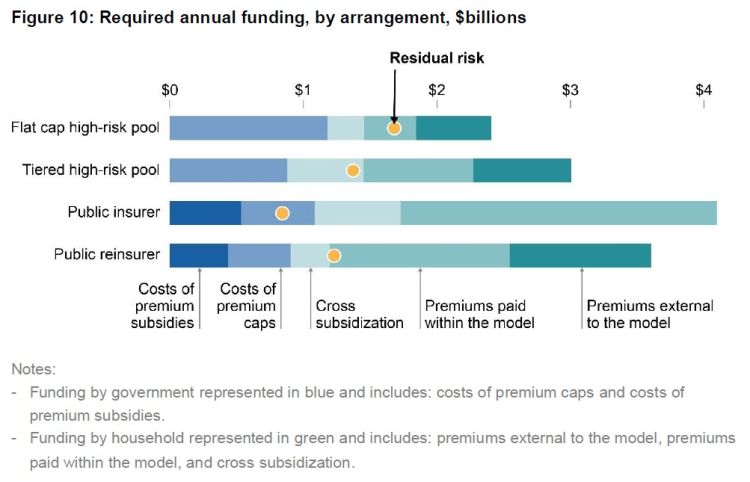

The Public Insurer model requires significantly more funding from all sources, but it lowers the residual risk as a higher proportion of homeowners are covered at all risk levels. The trend for residual risk is inversely correlated to the funding required in each plan. The analysis distinguishes between premiums funded by households and those funded by the government through caps and subsidies, and considers external funding sources as well. This is one of the charts that I think is important in the source.

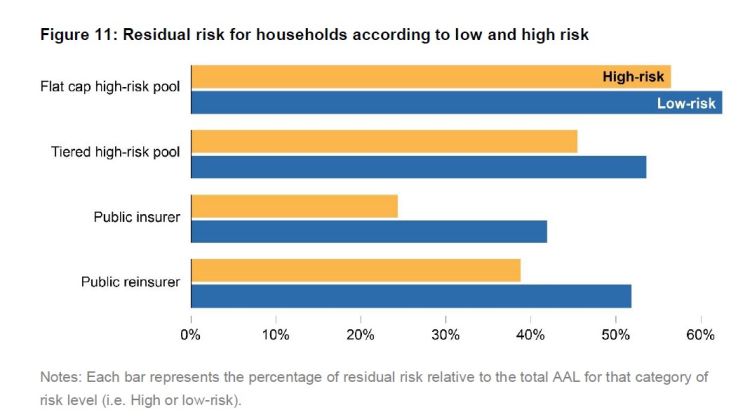

Residual Risk

Each model calculates the percentage of losses remaining on homeowners due to:

1. Homeowners choosing not to purchase insurance. 2. Deductibles paid by homeowners. 3. Damages above the coverage cap.

Differences between models are mainly due to assumed participation rates:

- Public Insurer: Lowest residual risk due to mandatory take-up linked with property insurance coverage.

- Flat Cap High-Risk Pool: Higher residual risk due to lower participation rates.

- Tiered High-Risk Pool: Higher residual risk similar to Flat Cap due to lower participation rates.

- Public Reinsurer: Residual risk between Pool models and Public Insurer, as Layer 1 is optional and Layer 2 is mandatory.

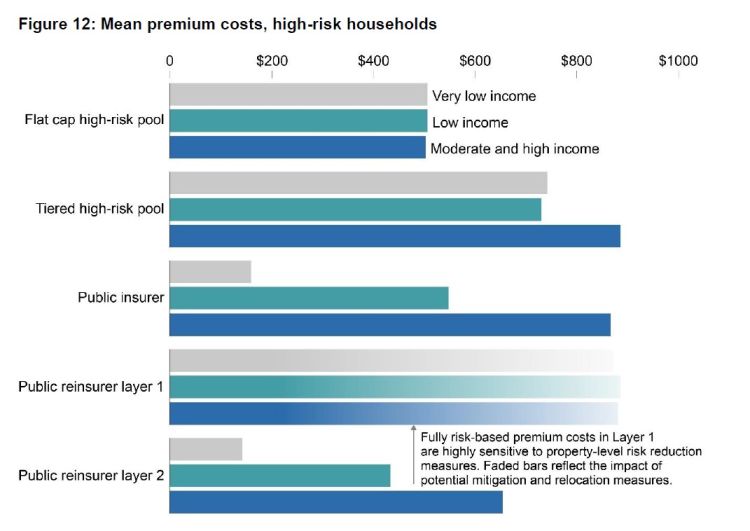

Premium Costs by Income Group

The table below shows costs associated with premiums for only high-risk households and according to income group:

- Flat Cap High-Risk Pool: Premium costs are stable across income groups due to the single cap, limiting excessive premium costs for all high-risk households.

- Tiered High-Risk Pool: Slightly lower premiums for low and very low income groups due to tiered premium caps based on home reconstruction costs, acting as a proxy for income and wealth.

- Public Insurer: Caps limit the highest premium costs, and income-based subsidies bring costs down, leading to significant differences in mean premiums between income groups.

- Public Reinsurer:

* Layer 1: High mean costs relative to coverage due to concentration of losses below $25,000 for high-risk households. Participation is optional and fully risk-based, designed to incentivize property-level risk reduction without subsidies or caps. * Layer 2: Caps and income-based subsidies similar to the Public Insurer model provide targeted support to lower-income households.

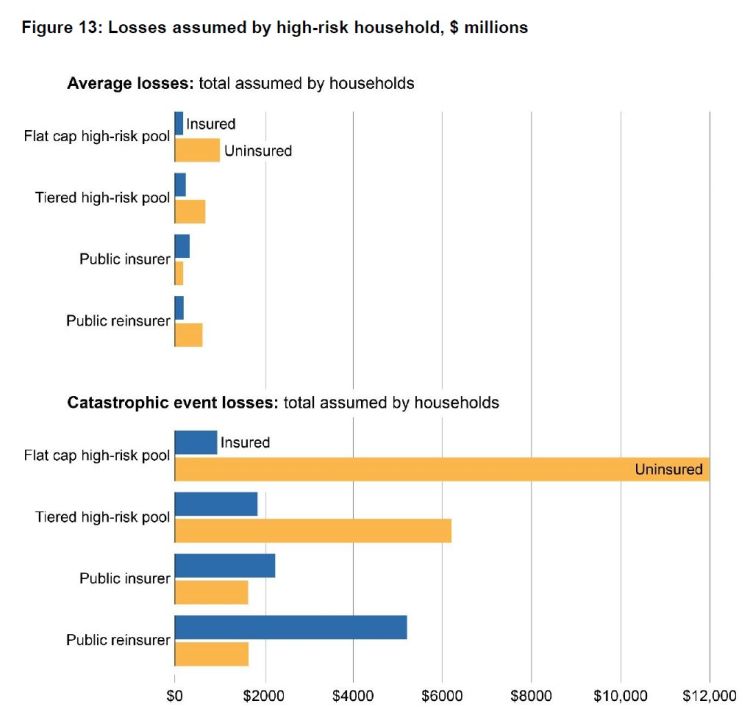

Average losses and those during a large-scale catastrophic event

In low-risk households affected by a major flood, uninsured households shoulder significant losses. This effect is magnified in high-risk households during catastrophic events, where lower participation rates in pool models result in substantial costs for uninsured households.

The following table sets out the rationale for insurance given the probability of flooding for high-risk households, considering two scenarios: average annual events and large-scale ones:

- Flat Cap High-Risk Pool: Uninsured households incur significant losses during large-scale events.

Participation rates and government tools influence insurance requirements:

- Optional Insurance: A share of households remain uninsured, suffering the most during catastrophic events. Governments face a difficult choice: let homeowners manage impacts on their own or provide additional post-disaster supports.

- High Participation Plans: Mandatory provisions ensure no one is left behind, giving homeowners confidence in their coverage. Although it may seem inexpensive today, it could become more costly in the future.

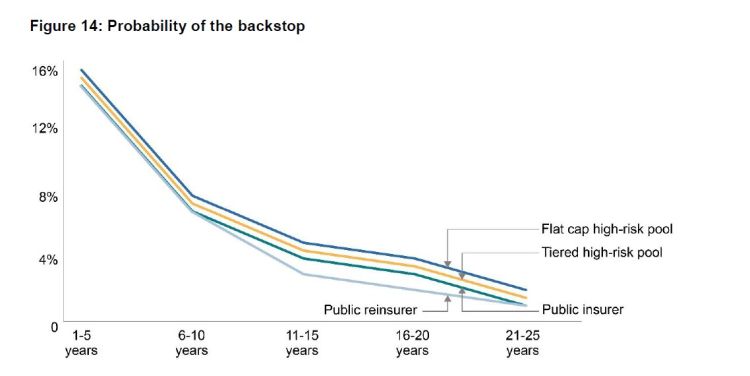

Government Backstop: Probability of use and value

Each model follows the same general curve regarding the probability of using the backstop:

- Initial capital investment and accumulation of reserves reduce the probability of drawing down the backstop over time.

- In the initial years, with fewer accumulated funds, the probability of using the backstop is higher.

- There is a sharp decline around the 10-year mark, where the probability of drawing on the backstop if it has not already occurred is approximately 7%.

- Additional capital at this point may be released to fund risk reduction measures.

- Average Probability (1 to 25 years):**

- → Flat Cap High-Risk Pool: 25%

- → Tiered High-Risk Pool: 25%

- → Public Insurer: 29%

- → Public Reinsurer: 27%

In all models, the value of the backstop required is directly proportional to the level of participation and coverage:

- Calculated to support potential risk in the initial years.

- Potential value of the backstop may reduce over time, but is dependent on the series and scale of early events.

- Accumulation of funds may be used to enhance stability, promote risk reduction, or reduce premium costs.

- Model Specific Notes:

- → Flat Cap High-Risk Pool: Lower value due to lowest participation.

- → Public Reinsurer: Only the second layer is subject to the backstop.

- Average Value of Backstop (1 to 25 years) in millions:

- → Flat Cap High-Risk Pool: $4,238

- → Tiered High-Risk Pool: $5,243

- → Public Insurer: $10,786

- → Public Reinsurer: $6,849

Summary of Results

The Flat Cap and Tiered High-Risk pool models require less funding, there remains a significant amount of residual risk. If a large-scale flood occurs, many homeowners will be at risk, with governments facing pressure to provide relief.

Evident as well is the cost associated with the Public Insurer model. This plan is most costly to governments in absolute terms; however, on a cost per-capita basis for high-risk households, it performs well according to costing metrics.

Layered insurance provides flexibility to homeowners, and provides strong risk reduction incentives to homeowners. This model requires reduced funding to support the arrangement while retaining a high level of coverage for major and catastrophic events.

6.5 The effect of risk reduction

Cost of Flood Risk Will Increase Over Time

The costs of providing flood insurance for all Canadians are very significant and will grow faster than inflation and GDP in the future. This is because inflation on re/construction costs is typically larger than inflation on common goods and services, and climate change and population growth in the floodplains will put increasing pressure on any risk-sharing plan.

Re/construction Inflation: Historically about 3-4% annually over the last 30 years, currently at 6-7%.

Climate Change: Expected to increase the frequency and severity of flooding by approximately 0.5-1% annually.

Population Growth in Floodplains: If it continues at the same pace as outside floodplains (1% per year), the accumulated effect is an average growth rate of losses of 5-6% per year.

Such a growth rate is unsustainable, and Canada must make risk reduction a top priority.

De-risking of the Insurance Arrangement Will Be Required

One strategy to de-risk the insurance arrangement is to restrict eligibility for the highest-risk homeowners. However, this would leave many homeowners unprotected and could require significant government spending in the event of catastrophic flooding.

The insurance models were designed to include all high-risk properties, without factoring in any risk reduction measures in their costing. This ensures all households can obtain flood insurance in the near term, while efforts would be made to de-risk the insurance arrangement over time.

Risk Reduction Efforts: Should target the riskiest properties through strategic relocation or other mitigation measures.

- The AAL represented by the top 1%, 0.5%, and 0.1% of the riskiest homes is significant.

- De-risking or relocating about 77,000 homes (0.5% of riskiest properties) could decrease annual costs of caps and subsidies by more than 50% for FPT governments.

- Relocating risky households also avoids future sharp increases in losses due to inflation on re/construction and climate change.

All Options for Risk Reduction Need to Be on the Table

Given the extent of flood risk across the country, rapid de-risking is critical. A concerted and coordinated risk reduction effort requires measures to:

- Reduce the risk associated with existing buildings.

- Prevent the construction of new buildings in flood-prone areas.

Risk Reduction Efforts: Must be underpinned by:

- An accelerated push to identify high-risk areas.

- Implementation of mitigation measures at all levels.

Section 7: Discussion

7.1 Adequacy and Predictability of Compensation

What the task force learned

- Adequacy Matters

It is essential to ensure that coverage is sufficient for homeowner's expected losses. Currently, people may have some flood coverage but still rely on government assistance for larger events. Across all risk levels, it is vital to ensure that ‘having flood insurance’ means having enough flood insurance.

- Coverage Needs to Be Clear

Standardized policy language, including coverage types, can help simplify policies and empower consumers. Comprehensive flood insurance that covers all water infiltration (e.g., overland flooding, seepage, sewer back-up) could make policies clearer both pre- and post-event by reducing ambiguity regarding coverage amounts or responsibility based on the source and cause of flooding.

- Post-disaster Is Not the Ideal Time to Find Out What Insurance Coverage Includes

Coverage and exclusions should be clear so Canadians can understand and prepare for the risks they assume on their own. Comprehensive flood coverage can greatly reduce post-disaster stress and mental anguish, which are often worsened by confusing, overlapping, and sometimes inadequate private and public compensation mechanisms.

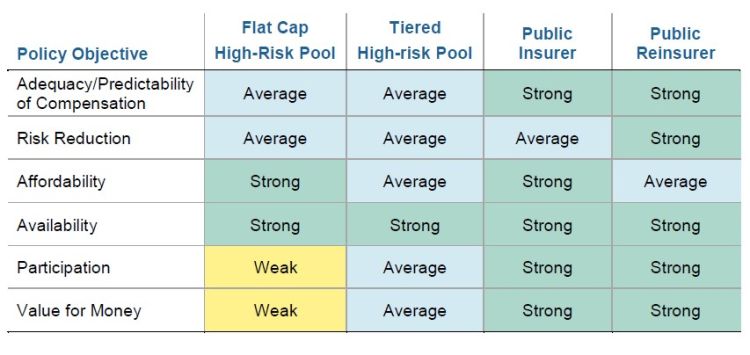

What this means for the 4 models

- Flat Cap High-risk Pool - Evaluation Average

- → Allows consumers to choose the risks they are willing to self-insure

- → Standardized coverage makes it easy to understand

- → Low and medium risks have varying policy structures and optionality reduces potential for broad adequacy

- → Some may choose coverage that is inadequate for their level of risk or may choose none

- Tiered High-Risk Pool - Evaluation Average

- → Mandatory take-up for mortgage holders

- → Greater need for policy language standardization

- Public Insurer - Evaluation Strong

- → Min level of adequacy for policyholders up to coverage cap

- → Comprehensive bundling reduces financial uncertainty and mental health impacts

- → Less choice to self insure

- Layered Public Reinsurer - Evaluation Strong

- → Mandatory take-up in layer 2 ensures big events are sufficiently covered

- → Optional coverage in Layer 1 allows homeowners to self-insure

7.2 Risk Reduction

From this section onwards, most of the points are testable and pertains to the high-level findings of the paper which I believe to be more important than the specifics

What the Task Force Learned:

- Insurance alone is not likely to substantially reduce risk.

- Price signals through risk-based premiums are important for people to appreciate their risk and can incentivize some mitigation; however, the impact of such actions is unlikely to be significant at the aggregate level due to high up-front costs.

- Necessary to mobilize governments and communities to improve risk-informed decision-making and target substantial investments in flood mitigation.

Willingness to Undertake Risk Reduction Comes Down to ‘Skin in the Game’:

- The likelihood that individuals will seek ways to reduce their flood risk depends on the level of awareness of the risks, premium price, deductible, capacity to pay, and extent to which premiums reflect risk.

- Individual risk reduction behaviour can be incentivized if the costs of premiums and deductibles are explicitly linked to mitigation actions.

- Property-level protections can be incentivized with use of public education tools and financial incentives, however, such protections are only effective to a point.

- The extent to which governments bear the costs for premium caps and affordability subsidies provides incentive to invest more in mitigation and better land-use practices.

- Community-level mitigation can have a greater impact on reducing overall flood risk and is fundamental to achieving the risk reduction levels necessary to address climate change over time.

In All Models:

- Community-level mitigation could be further incentivized by linking insurance with the development of a community rating system that could reward communities that adopt flood-resilient land-use planning rules and invest in mitigation.

What this means for the four models

- Flat Cap High-Risk Pool – Evaluation Average

Low premium cap encourages high take-up but provides weak incentive for property-level mitigation. High government costs incentivize community-level investments.

- Tiered High-Risk Pool – Evaluation Average

Progressive premium caps offer better risk signals, incentivizing property-level mitigation more effectively than Flat Cap model. Stronger signal than Public models due to lack of income-based subsidies.

- Public Insurer – Evaluation Average

High premium cap provides strong mitigation incentive, though income-based subsidies may reduce this for some households. Aligns with public mitigation efforts, and high government costs promote strategic investments.

- Layered Public Reinsurer – Evaluation Strong

Balances homeowner and government mitigation incentives. Layer 1 encourages property-level protection, while Layer 2 incentivizes strategic community/watershed-level risk reduction.

7.3 Affordability

What the Task Force learned

- Defining an Affordability Threshold Is Complex

Determining a single price point oversimplifies factors like ability to pay, relative risk, income, housing costs, type of coverage, and regional differences. The Task Force examined different methods:

- → Premium Caps: Effective at keeping costs reasonable for most, especially when varied by home value to support vulnerable households. However, this method is imprecise.

- → Means-tested Subsidies: Better target assistance based on income and/or wealth, adjusting for regional differences. More challenging to implement and may lack transparency.

- → Investments in Affordable Insurance Protect Canadians Better Than the Status Quo

Ensuring affordable insurance could cost FPT governments around $1 billion collectively, comparable to current recovery program costs. Insurance-based programs provide better protection and improve recovery outcomes. Affordability supports should be designed with a paced withdrawal to transition people to risk-based prices and encourage risk reduction actions at individual, community, and regional levels.

- Affordability Is Critical for Program Equity

High-risk areas have more social vulnerability compared to lower-risk areas. In the North and many off-reserve Indigenous communities, housing affordability and lower income levels are persistent issues. Insurance solutions must avoid worsening these challenges. Consideration is also needed for how secondary or vacation properties are treated with respect to affordability measures.

What this means for the 4 models

Flat Cap High-Risk Pool – Evaluation Strong

Single low premium cap provides highly affordable insurance in high-risk areas, reducing need for income-based subsidies. However, it benefits wealthy homeowners with significant price discounts subsidized by governments, while low-income Canadians may still struggle with premium affordability.

Tiered High-Risk Pool – Evaluation Average

Range of premium caps tied to risk and home value provides an alternative to a single low cap and income-based subsidies. Easier to implement than means-tested approach but may not effectively target those with the least capacity to pay.

Public Insurer – Evaluation Strong

Combines a single higher premium cap and means-tested subsidies for a balanced approach to affordability. The cap reduces excessive costs for the highest risk properties, while means-tested subsidies attenuate premiums for others in high-risk areas.

Layered Public Reinsurer – Evaluation Average

Layer 2 has the same premium cap as the Public Insurer model but with lower premiums due to removal of Layer 1 risks. Competitive reinsurance rates and income subsidies reduce costs for low-income households. Households are responsible for losses up to Layer 1 coverage cap, incentivizing property-level risk reduction.

7.4 Availability

What the Task Force learned

Insurance is not uniformly available across Canada:

- Difficult or impossible to acquire in parts of the North, some off-reserve Indigenous communities, and for certain risks.

- After flooding, obtaining insurance becomes harder, even if the risk remains the same.

Private market models must ensure coverage remains available post-flood.

What this means for the 4 models

- All Models – Evaluation Strong

All models assume compulsory coverage for all flood hazards in all regions where home insurance is offered.

- Public Insurer and Layer 2 of Public Reinsurer include mandatory offer and purchase with home insurance, leveraging the private insurance market for customer-facing services.

Challenges:

- Limited presence of insurance companies in northern, remote, and some Indigenous communities.

- Unsuitability of residential insurance in certain areas due to different home ownership forms.

- Risk of insurers leaving certain markets or regions.

7.5 Participation

What the Task Force learned

Current Take-up of Flood Insurance Is Low

- Estimated 40-60% of Canadian homeowners have some flood coverage, mostly in low/medium risk areas.

- High-risk areas see low participation due to lack of availability and prohibitive costs.

- Compared to OECD countries, Canada's participation is low due to different offer and purchase requirements.

Mandatory Offer of Flood Insurance Is Required

- Studies show mandatory offer by insurers is crucial for success in Canada.

- Market penetration beyond current levels is not possible without mandatory offer.

Mandatory Purchase Is the Best Way to Protect Most People

- Target high-risk areas through mandatory or quasi-mandatory measures (bundling with other perils, automatic inclusion with home insurance, or mortgage requirements).

- Consider feasibility and impacts (e.g., mortgage requirements may exclude seniors).

If Insurance Is Not Mandated, Use Other Tools

- Increase risk awareness and apply behavioral insights to nudge participation rates up.

- Public education on risk and available compensation is key for implementation.

What this means for the 4 models

With enhanced public awareness of property-level flood risk, expanded availability of insurance in high-risk areas, and withdrawal of FPT DFA programs, all models are expected to raise participation rates above current levels.

- Flat Cap High-Risk Pool – Evaluation Weak

* Single low cap attracts high-risk homeowners due to low coverage costs. * Optional coverage leaves substantial residual risk for homeowners. * Prioritizes consumer choice but could incorporate policy tools to increase participation.

- Tiered High-Risk Pool – Evaluation Average

* Mandatory purchase for mortgage holders increases participation across risk levels. * Significant decrease in residual risk for high-risk homeowners due to mortgage requirements.

- Public Insurer – Evaluation Strong

* Mandatory bundling with home insurance achieves near-complete participation across all risk levels. * Lowest residual risk among models, covering damages above the cap, deductibles, and those without home insurance.

- Layered Public Reinsurer – Evaluation Strong

* Layer 2 achieves participation rates similar to Public Insurer due to mandatory bundling. * Layer 1 participation aligns more with pool models. * Overall residual risk between Tiered High-Risk Pool and Public Insurer.

7.6 Value for Money

What the Task Force learned

Assessing value for money requires extensive investigation:

- Prioritize research on flood insurance governance to understand cost-benefits and financial sustainability.

A government backstop can reduce insurance risk, but at a cost:

- Government currently acts as the backstop for uninsured losses.

- More risk assumed by a backstop makes insurance more affordable annually, but increases government costs during catastrophic events.

- A smaller backstop requires more annual funding but offers fiscal predictability.

Government intervention in flood risk management should be clear and predictable:

- Target investments in the highest-risk areas for better value.

- Use a risk-based approach to address systemic inequalities.

- Provide predictable, long-term funding for complex risk reduction efforts like relocation.

- Erratic government interventions and ad-hoc disaster relief undermine risk reduction incentives and penalize those who purchase insurance.

- What This Means for the Four Models

Taxpayers currently fund disaster recovery through DFA programs, providing little motivation for risk reduction. The models examined shift some costs to homeowners through predictable premiums, offering more predictable fiscal expenditures for governments, especially under mature conditions with sufficient reserves. Government backstop involvement can lower costs annually but requires flexibility for catastrophic events. Public intervention models bring higher government costs but reduce residual risk and improve outcomes for Canadians. All models have a 25-year lifespan to transition to risk-based pricing and drive risk reduction.

- Flat Cap High-Risk Pool – Evaluation Weak

* Requires significant government funding for affordable coverage. * High residual risk with many homeowners not purchasing optional insurance. * Potential for ad-hoc relief pressure on governments when significant events occur.

- Tiered High-Risk Pool – Evaluation Average

* Mandatory take-up for mortgages and tiered premium caps balance government funding and residual risk. * Residual risk concentrated in high-risk areas. * Similar risk of ad-hoc relief as the Flat Cap model.

- Public Insurer – Evaluation Strong

* Lowest overall residual risk, offering comprehensive protection at higher government costs. * Predictable annual fiscal liabilities, economical on a per high-risk homeowner basis. * Incentivizes and rewards mitigation efforts over the 25-year lifespan.

- Layered Public Reinsurer – Evaluation Strong

* Balances government funding and residual risk, with lower risk for smaller events. * Focuses on protecting against significant flood events. * Early risk-based pricing in Layer 1 helps transition to risk-based pricing in Layer 2.

7.7 Summary of Discussion Results

Just a summary of each model and its corresponding rankings

Section 8: Key Findings

8.1 Current Flood Risk

1. Total residential flood risk in Canada is estimated at $2.9 billion per year.

* Includes larger ‘tail risk’ events and more accurate estimations (2020 data).

2. The vast majority of risk is concentrated in a small number of the highest risk homes.

* 89.3% of $2.9 billion is in the top 10% highest risk homes, 34.1% in the top 1%.

8.2 Insurance Considerations

3. Some standardization is needed in the market.

* Clear, standardized language in flood insurance reduces confusion. * Comprehensive flood coverage and seamless bundling improve outcomes.

4. Participation is key.

* Maximizing participation through affordability measures, incentives, or mandates is critical.

5. Greater public intervention can more fully close protection gaps, but at a cost.

* Government costs aim for higher participation rates and increased affordability. * Without significant risk reduction investments, costs remain.

8.3 Relocation Considerations

6. Relocation can be a powerful risk reduction tool.

* Removes risk and improves insurance viability. * Practicality in areas with housing shortages requires consideration.

7. Relocation must be informed at the community level.

* Early engagement with communities and jurisdictions is crucial. * Significant for Indigenous communities with strong ties to their land.

8.4 Equity Considerations

8. Affordability of flood insurance premiums is key to enabling equitable access.

* Supports for socio-economically disadvantaged groups are essential. * Considerations for those for whom insurance may not be appropriate.

9. Pathways to accessing insurance are about more than just money.

* Remove barriers, promote financial literacy, and build community capacity. * National solutions must adapt to regional or cultural contexts.

10. The cultural connections of Indigenous peoples to water and land must be respected.

* Indigenous knowledge and perspectives should inform flood risk management. * Further engagement with Indigenous communities is essential.