IAA.Climate

Reading: “Climate-Related Scenarios Applied to Insurers and Other Financial Institutions,” August 2021, pp. 1, 18-19 (Section 2.1.3), and 24-26 (Section 3)

Authour: IAA (International Actuarial Association)

BA Quick-Summary: IAA Climate

|

Pop Quiz

Can you think of ways to link climate risk to the FCT?

Study Tips

This article is a relatively short one but jam-packed with important things to note.

There's been a big push towards being more proactive on climate scenario testing from OSFI so I do expect this paper to see some action in the coming exam.

Estimated study time: 2.5 hours

BattleTable

No past exam questions are available for this reading.

reference part (a) part (b) part (c) part (d)

In Plain English!

Climate scenario analysis is a key component of climate related risk assessments and disclosure to understand the impact of future climate risks.

However, there are a number of challenges associated with doing climate related scenario testing:

- Climate scenarios provided by organizations such as the IPCC are not specific enough for actuaries to model their risks

- Time horizon over which climate related risks develop is very long

- → Physical risks tend to develop over many years while the timing and impact of transition, legal and reputational risks are highly uncertain

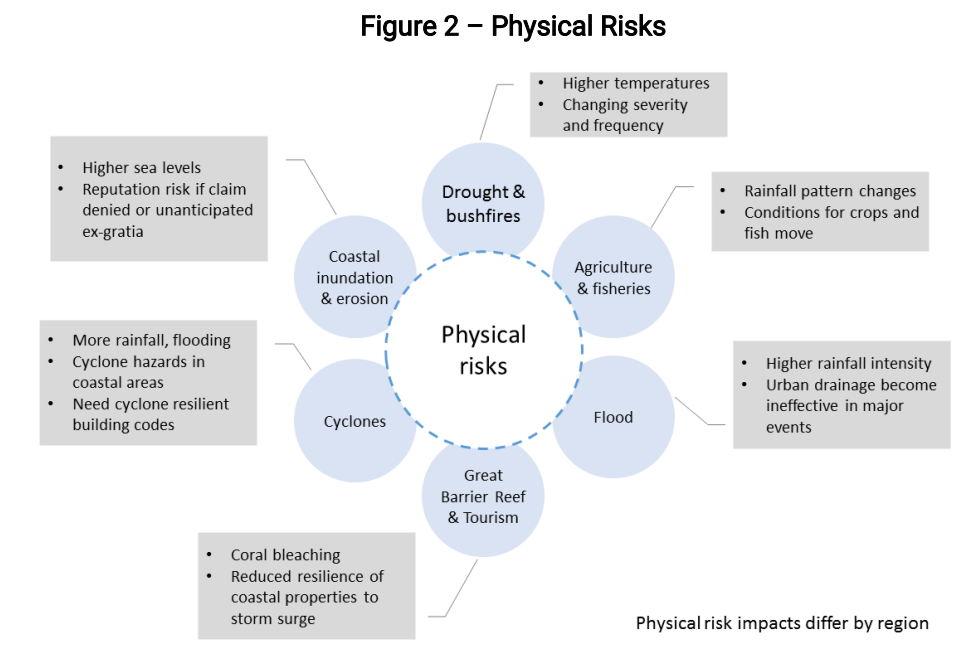

Below are the effects of the 3 main risks on P&C insurers

Physical risk:

- Increased claims (think catastrophe insurance)

- Investment values on asset portfolios

- Assessment of credit risk

- Increased workers' compensation claims due to higher mortality and morbidity at work (stress from working outdoors during heat waves, etc.)

Transition risk:

- New technologies such as Electric and Autonomous vehicles and their effect on insurance pricing and product design

- Shift is types of industries that require changes in products and coverages

- Growth and contraction of certain economic sectors can affect insurers' premium revenue

Liability risk:

- Firm's failure to address financial and strategic risks arising from climate change through mitigation, adaptation or disclosures

Insurers are able to mitigate excess losses from climate risk because they are able to:

- Reprice or refuse policies annually

- Natural hazard prices and product design can be reviewed and recalibrated frequently using the latest science and experience

That being said, actuaries also need to be aware of affordability and availability issues that can emerge when risks shift which means actuaries also need to consider regulatory and reputational risks cause by a premium increase or limitations in coverage.

Appointed Actuaries should also be aware of:

- Leading indicators that prompt pricing to reflect climate change risks

- Regulatory and legal changes that can emerge rapidly over short timeframes

- New products, product designs and other industry developments

When modelling catastrophes, actuaries should also consider [Hint: CUACDAS]:

: →(Click for an alternate hint)

Click for a an updated memory hint!! (You might have to scroll down.

- Capturing climate related risks in underlying assumptions

- Updating exposures in model

- Allowing for factors other than damage (demand surge and business interruption)

- Consider non-linearity or step changes that impact climate risks

- Develop scenarios and metrics to estimate transition and liability risk

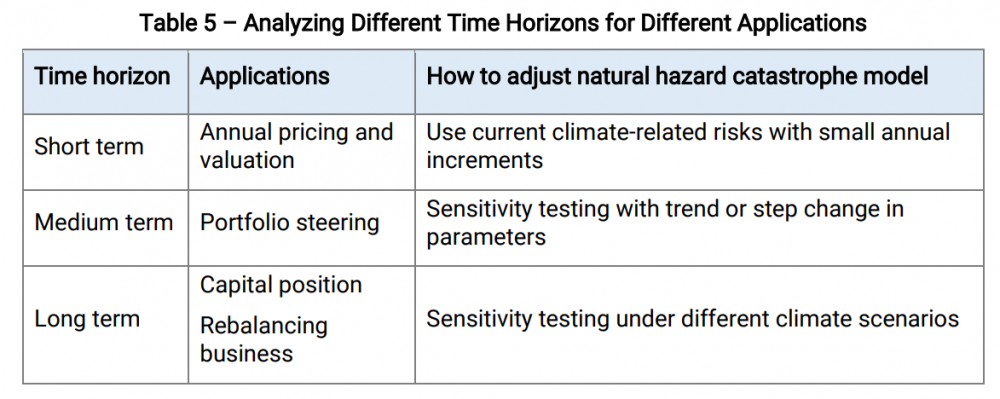

- Analyzing different time horizons (table below)

- Segregating the effect of climate change by geography

Systems thinking is a tool used to take into account the social, economic, political and technological environment in which the firm operates when considering how it will be affected by climate risk. Basically a broader view of the entire system.

Benefits of Systems Thinking:

- Assist firm with thinking of interconnectedness of the modern economy

- Helps derives value for the variables needed to estimate impact of climate scenarios

The TCFD describes two scenarios on scenario analysis for climate risks:

Exploratory Scenarios

- Used to explore a range of alternative plausible scenarios

- Tests strategies for resilience taking into account a wide range of future states

- Stress Tests fall in this category

Normative Scenarios

- Future outcomes are set from plotted pathways

- Used to assess targets and implementation plans

- Reverse stress testing falls in this scenario (Scenarios which make a business unviable are identified)

When using IPCC reports to conduct scenario analysis, it is important to consider crucial impacts of risks that may be missed which include:

Click for a a super-awesome memory hint!!

- Implicit assumptions that financial markets, healthcare systems, supply chains and communication will be function at required level

- Inherent assumptions in the modelling approach used to estimate value of assets and liabilities

- Importance of sequencing, correlation and cascading effects

- Paths and impacts of climate-related risk on critical infrastructure to determine the resilience and cost of impacts

- Correlation between assets and liabilities

- Actions by one firm to address its climate related risk may create risk for another

Scenario Storylines link historical and present events with hypothetical futures by describing the causal pathways and drivers, assumptions and affected systems.

POP QUIZ ANSWERS

Climate physical and transition risk can be used as one of the scenarios to project the conduct a FCT on an entity