Difference between revisions of "CCIR.Instructions"

(→Investment Return - page 40.74) |

|||

| (86 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

| − | + | '''Reading''': Final 2023 IFRS 17 P&C Insurance Return, Instructions and Forms | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | ''' | + | '''Author''': CCIR (Canadian Council of Insurance Regulators) |

| − | + | [https://battleactsmain.ca/vanillaforum/categories/ccir-instructions<span style="font-size: 12px; background-color: lightgrey; border: solid; border-width: 1px; border-radius: 10px; padding: 2px 10px 2px 10px; margin: 0px;">'''Forum'''</span>] | |

| − | ''' | + | {| class='wikitable' style='background-color: navajowhite; |

| + | |- | ||

| + | || '''BA Quick-Summary''': <span style="color: green;>'''CCIR'''</span> | ||

| − | + | * This paper goes through many components of the financial statements, especially related to the calculation of essential financial ratios. | |

| + | * Understanding the layout and purpose of key financial exhibits such as those related to assets, liabilities and equity as well as metrics like net income. | ||

| + | * It is important to focus on understanding the accounting and actuarial concepts as these questions can be tricky during the exam. | ||

| + | |} | ||

==Pop Quiz== | ==Pop Quiz== | ||

| Line 31: | Line 30: | ||

:* [https://battleactsmain.ca/pdf/CCIR_Instructions.pdf Instructions] for completing the financial statements | :* [https://battleactsmain.ca/pdf/CCIR_Instructions.pdf Instructions] for completing the financial statements | ||

| − | :'''3 Excel files''': | + | :'''3 Excel files''': |

:* [https://battleactsmain.ca/Excel/OSFI.PC1_(2023)_Core_Financial_Return.xlsx PC1 - Core Return] | :* [https://battleactsmain.ca/Excel/OSFI.PC1_(2023)_Core_Financial_Return.xlsx PC1 - Core Return] | ||

| − | :* [https://battleactsmain.ca/Excel/OSFI.PC2_(2023)_Quarterly_Return.xlsx PC2 - | + | :* [https://battleactsmain.ca/Excel/OSFI.PC2_(2023)_Quarterly_Return.xlsx PC2 - Quarterly Return] |

| − | :* [https://battleactsmain.ca/Excel/OSFI.PC3_(2023)_Annual_Return.xlsx PC3 - | + | :* [https://battleactsmain.ca/Excel/OSFI.PC3_(2023)_Annual_Return.xlsx PC3 - Annual Return] |

The PDF document with the instructions is long and boring, and roughly 150 pages, <span style="color: red;">'''but you can ignore the vast majority of it'''</span>. It contains 4 sections: | The PDF document with the instructions is long and boring, and roughly 150 pages, <span style="color: red;">'''but you can ignore the vast majority of it'''</span>. It contains 4 sections: | ||

| Line 149: | Line 148: | ||

Suppose the same insurer also shows: | Suppose the same insurer also shows: | ||

| − | * E(x-1) = 2m <span style="color: red;">← ''Statement of Financial Position, page 20.11 - Liabilities & Equity, line 699</span> | + | * E(x-1) = 2m <span style="color: red;">← ''Statement of Financial Position, page 20.11 - Liabilities & Equity, line 699''</span> |

| − | * NI(x) = 3m <span style="color: blue;">← ''Statement of Profit or Loss, page 20.22, line 999</span> | + | * NI(x) = 3m <span style="color: blue;">← ''Statement of Profit or Loss, page 20.22, line 999''</span> |

| − | * OCI(x) = 1m <span style="color: brown;">← ''Comprehensive Income & Accumulated Other Comprehensive Income, page 20.42, line | + | * OCI(x) = 1m <span style="color: brown;">← ''Comprehensive Income & Accumulated Other Comprehensive Income, page 20.42, line 21'' |

Then we can use the above formulas to calculate equity for year x: | Then we can use the above formulas to calculate equity for year x: | ||

| Line 219: | Line 218: | ||

|} | |} | ||

| − | :* <span style="color: red;">'''C'''</span> | + | :* <span style="color: red;">'''C'''</span>ommon shares |

:* <span style="color: red;">'''P'''</span>referred shares | :* <span style="color: red;">'''P'''</span>referred shares | ||

:: <span style="color: red;">'''–'''</span> | :: <span style="color: red;">'''–'''</span> | ||

| Line 237: | Line 236: | ||

===Layout of Financial Statements=== | ===Layout of Financial Statements=== | ||

| + | |||

| + | ====Overview==== | ||

As noted in the ''[[CCIR.Instructions#Study_Tips | Study Tips]]'', there are 3 excel files you need to become familiar with. A full set of financial statements would combine the pages in all 3 but they are separated into different files to make clear which are '''core''' pages, which pages would be in any '''annual''' return, and which pages would be in any '''quarterly''' return. | As noted in the ''[[CCIR.Instructions#Study_Tips | Study Tips]]'', there are 3 excel files you need to become familiar with. A full set of financial statements would combine the pages in all 3 but they are separated into different files to make clear which are '''core''' pages, which pages would be in any '''annual''' return, and which pages would be in any '''quarterly''' return. | ||

| Line 254: | Line 255: | ||

::: → See ''[[Annual Statement Exhibit List]]'' for a handy list | ::: → See ''[[Annual Statement Exhibit List]]'' for a handy list | ||

| − | :: [https://battleactsmain.ca/Excel/OSFI.PC2_(2023)_Quarterly_Return.xlsx PC2 - | + | :: [https://battleactsmain.ca/Excel/OSFI.PC2_(2023)_Quarterly_Return.xlsx PC2 - Quarterly Return] |

::* According to the CAS syllabus, you should be familiar with the following 6 pages: ''(Click the page numbers to see the exhibits)'' | ::* According to the CAS syllabus, you should be familiar with the following 6 pages: ''(Click the page numbers to see the exhibits)'' | ||

::: → [[Investment_Return_-_page_40.74 | '''40.74''']] Investment Return | ::: → [[Investment_Return_-_page_40.74 | '''40.74''']] Investment Return | ||

| Line 263: | Line 264: | ||

::: → [[Commissions - page 80.15 | '''80.15''']] Commissions <span style="color: red;"> ← ''much simpler than the pre-IRFS 17 version of the Commissions exhibit''</span> | ::: → [[Commissions - page 80.15 | '''80.15''']] Commissions <span style="color: red;"> ← ''much simpler than the pre-IRFS 17 version of the Commissions exhibit''</span> | ||

| − | :: [https://battleactsmain.ca/Excel/OSFI.PC3_(2023)_Annual_Return.xlsx PC3 - | + | :: [https://battleactsmain.ca/Excel/OSFI.PC3_(2023)_Annual_Return.xlsx PC3 - Annual Return] |

::* According to the CAS syllabus, you should be familiar with the following 2 pages: ''(Click the page numbers to see the exhibits)'' | ::* According to the CAS syllabus, you should be familiar with the following 2 pages: ''(Click the page numbers to see the exhibits)'' | ||

::: → [[Summary of Selected Financial Data for FIVE YEARS - page 10.60 | '''10.60''']] Summary of Selected Financial Data for FIVE YEARS | ::: → [[Summary of Selected Financial Data for FIVE YEARS - page 10.60 | '''10.60''']] Summary of Selected Financial Data for FIVE YEARS | ||

| Line 344: | Line 345: | ||

|} | |} | ||

| − | [https://battleactsmain.ca/FC.php?selectString=**&filter=both&sortOrder=natural&colorFlag=allFlag&colorStatus=allStatus&priority=importance-high&subsetFlag=miniQuiz&prefix=CCIR&suffix=Instructions§ion=all&subSection=all&examRep=all&examYear=all&examTerm=all&quizNum=2<span style="font-size: 20px; background-color: aqua; border: solid; border-width: 1px; border-radius: 10px; padding: 2px 10px 2px 10px; margin: 10px;">'''mini BattleQuiz 2]''' | + | [https://battleactsmain.ca/FC.php?selectString=**&filter=both&sortOrder=natural&colorFlag=allFlag&colorStatus=allStatus&priority=importance-high&subsetFlag=miniQuiz&prefix=CCIR&suffix=Instructions§ion=all&subSection=all&examRep=all&examYear=all&examTerm=all&quizNum=2<span style="font-size: 20px; background-color: aqua; border: solid; border-width: 1px; border-radius: 10px; padding: 2px 10px 2px 10px; margin: 10px;">'''mini BattleQuiz 2]''' |

[https://battleactsmain.ca/vanillaforum/categories/ccir-instructions<span style="font-size: 12px; background-color: lightgrey; border: solid; border-width: 1px; border-radius: 10px; padding: 2px 10px 2px 10px; margin: 0px;">'''Forum'''</span>] | [https://battleactsmain.ca/vanillaforum/categories/ccir-instructions<span style="font-size: 12px; background-color: lightgrey; border: solid; border-width: 1px; border-radius: 10px; padding: 2px 10px 2px 10px; margin: 0px;">'''Forum'''</span>] | ||

| Line 355: | Line 356: | ||

* '''Total Assets''': page 20.10, line 89 | * '''Total Assets''': page 20.10, line 89 | ||

| − | * '''Total Liabilities''': page 20.11, line 399 | + | * '''Total Liabilities''': page 20.11, line 399 |

* '''Total Equity''': page 20.11, line 699 <span style="color: red;"> ← ''already covered in [[CCIR.Instructions#METHOD_3 | Calculating Equity - Method 3]]''</span> | * '''Total Equity''': page 20.11, line 699 <span style="color: red;"> ← ''already covered in [[CCIR.Instructions#METHOD_3 | Calculating Equity - Method 3]]''</span> | ||

| Line 375: | Line 376: | ||

:* '''NI''' = Net Income | :* '''NI''' = Net Income | ||

:* '''ISR''' = Insurance Service Result <span style="color: red;"> ← ''calculated in the exhibits [[Statement_of_Profit_or_Loss | Statement of Profit or Loss - page 20.22]] and [[Insurance Service Result - page 60.25]]''</span> | :* '''ISR''' = Insurance Service Result <span style="color: red;"> ← ''calculated in the exhibits [[Statement_of_Profit_or_Loss | Statement of Profit or Loss - page 20.22]] and [[Insurance Service Result - page 60.25]]''</span> | ||

| − | :* '''NIR''' = Net Investment Result <span style="color: red;"> ← ''calculated in the exhibit [[Investment Return - page 40.74]]'' | + | :* '''NIR''' = Net Investment Result <span style="color: red;"> ← ''calculated in the exhibit [[Statement_of_Profit_or_Loss | Statement of Profit or Loss - page 20.22]] using the quantity "Investment Return" from [[Investment Return - page 40.74]]'' |

:* '''OIE''' = Other Income and Expenses | :* '''OIE''' = Other Income and Expenses | ||

:* '''Taxes''' consist of current & deferred taxes ''(and an exam problem might provide those separately so you'd have to sum them to get total taxes)'' | :* '''Taxes''' consist of current & deferred taxes ''(and an exam problem might provide those separately so you'd have to sum them to get total taxes)'' | ||

| Line 382: | Line 383: | ||

If you look closely at ''[[Statement_of_Profit_or_Loss | Statement of Profit or Loss - page 20.22]]'', you'll see that some of the terms in the NI formula are broken out further. For example: | If you look closely at ''[[Statement_of_Profit_or_Loss | Statement of Profit or Loss - page 20.22]]'', you'll see that some of the terms in the NI formula are broken out further. For example: | ||

| − | : '''ISR''' is itself the sum of these | + | : '''ISR''' is itself the sum of these 2 lines: |

| − | :* Total Insurance Revenue <span style="color: green;">'''(TIR)'''</span> | + | :* Line 099: Total Insurance Revenue <span style="color: green;">'''(TIR)'''</span> |

| − | :* | + | :* Line 120: Net Expenses from Reinsurance Contracts Held (NRE) |

| − | : | + | :* <span style="color: red;">'''Less'''</span> |

| + | ::: Line 110: Insurance Service Expenses (ISE) | ||

: Furthermore, <span style="color: green;">'''TIR'''</span> is the sum of: | : Furthermore, <span style="color: green;">'''TIR'''</span> is the sum of: | ||

| Line 421: | Line 423: | ||

|- | |- | ||

| 3 || Dividends || style='text-align: right;' | 150 | | 3 || Dividends || style='text-align: right;' | 150 | ||

| − | |||

| − | |||

|- | |- | ||

| 5 || Investment Expenses (other than Investment Taxes) || style='text-align: right;' | 125 | | 5 || Investment Expenses (other than Investment Taxes) || style='text-align: right;' | 125 | ||

| Line 439: | Line 439: | ||

* Other Investment Income from Derivative Assets | * Other Investment Income from Derivative Assets | ||

* Income from Other Loans and Invested Assets | * Income from Other Loans and Invested Assets | ||

| − | + | And these sum to '''Gross Investment Income''' | |

* <span style="color: red;">'''Less:'''</span> | * <span style="color: red;">'''Less:'''</span> | ||

:: Investment Expenses (other than Investment Taxes) | :: Investment Expenses (other than Investment Taxes) | ||

| Line 450: | Line 450: | ||

:: + Total Fair Value Gains (Losses) | :: + Total Fair Value Gains (Losses) | ||

:: + Dividends <span style="color: green;"> ← ''these are dividends <u>received</u> by the insurer, <u>not</u> dividends paid out''</span> | :: + Dividends <span style="color: green;"> ← ''these are dividends <u>received</u> by the insurer, <u>not</u> dividends paid out''</span> | ||

| − | |||

:: - Investment Expenses (other than Investment Taxes) | :: - Investment Expenses (other than Investment Taxes) | ||

:: - Investment Taxes | :: - Investment Taxes | ||

| − | : = 800 + 500 + 150 | + | : = 800 + 500 + 150 - 125 - 85 |

| − | : = <u> | + | : = <u>1240</u> |

Did you notice that we didn't include ''Provision for Credit Losses'' in Net Investment Income. If you look again at ''[[Investment Return - page 40.74]]'', you'll see that ''Provision for Credit Losses'' is subtracted from NII to arrive at the final value of Investment Return: | Did you notice that we didn't include ''Provision for Credit Losses'' in Net Investment Income. If you look again at ''[[Investment Return - page 40.74]]'', you'll see that ''Provision for Credit Losses'' is subtracted from NII to arrive at the final value of Investment Return: | ||

| Line 460: | Line 459: | ||

* IR | * IR | ||

: = NII - Provision for Credit Losses | : = NII - Provision for Credit Losses | ||

| − | : = | + | : = 1240 - 45 |

| − | : = <u> | + | : = <u>1195</u> |

{| class='wikitable' style='background-color: navajowhite;' | {| class='wikitable' style='background-color: navajowhite;' | ||

| Line 485: | Line 484: | ||

|} | |} | ||

| − | : [[File: CCIR.Instructions_(20.22) | + | : [[File: CCIR.Instructions_(20.22)_example_01_NI_v2.jpg]] |

| + | |||

| + | * '''Note''': Assume also that ''<u>Line 320</u>: Net finance income (expenses) from reinsurance contracts held'' is equal to 0 for the purposes of this problem. | ||

{| class='wikitable' | {| class='wikitable' | ||

| Line 492: | Line 493: | ||

|} | |} | ||

| − | : [[File: CCIR.Instructions_(20.22) | + | : [[File: CCIR.Instructions_(20.22)_example_01_NI_answer_v4.jpg| 750px]] |

| − | |||

[https://battleactsmain.ca/FC.php?selectString=**&filter=both&sortOrder=natural&colorFlag=allFlag&colorStatus=allStatus&priority=importance-high&subsetFlag=miniQuiz&prefix=CCIR&suffix=Instructions§ion=all&subSection=all&examRep=all&examYear=all&examTerm=all&quizNum=3<span style="font-size: 20px; background-color: aqua; border: solid; border-width: 1px; border-radius: 10px; padding: 2px 10px 2px 10px; margin: 10px;">'''mini BattleQuiz 3]'''</span> | [https://battleactsmain.ca/FC.php?selectString=**&filter=both&sortOrder=natural&colorFlag=allFlag&colorStatus=allStatus&priority=importance-high&subsetFlag=miniQuiz&prefix=CCIR&suffix=Instructions§ion=all&subSection=all&examRep=all&examYear=all&examTerm=all&quizNum=3<span style="font-size: 20px; background-color: aqua; border: solid; border-width: 1px; border-radius: 10px; padding: 2px 10px 2px 10px; margin: 10px;">'''mini BattleQuiz 3]'''</span> | ||

| Line 521: | Line 521: | ||

|- | |- | ||

|| Here's an example. It's long but easy. | || Here's an example. It's long but easy. | ||

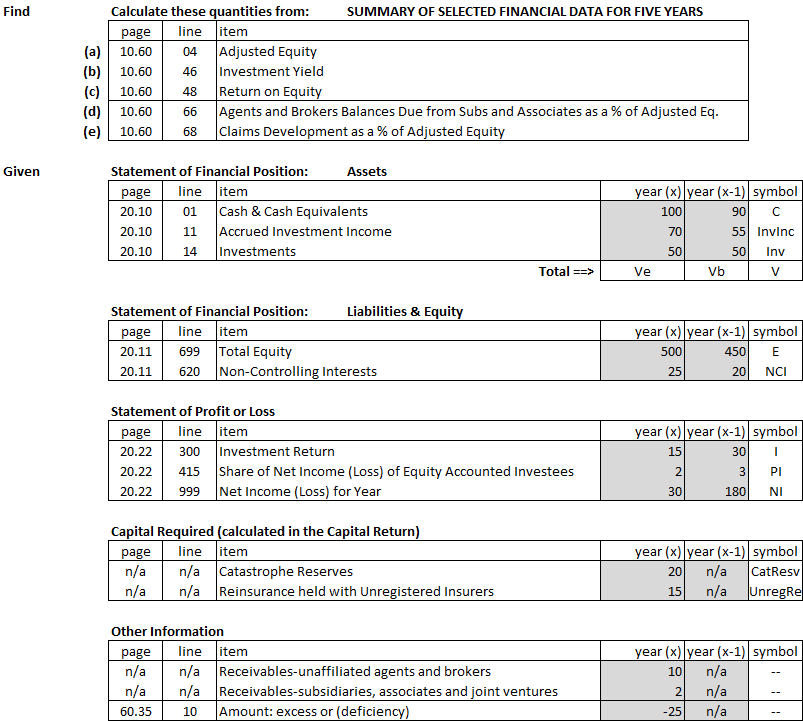

| + | * The source text for the CCIR instructions has an '''error''' in the formula for: ''Claims Development as a Percentage of Adjusted Equity'' | ||

| + | * See part (d) below: The numerator in the formula should refer to '''column (29)''', not column (10). | ||

|} | |} | ||

| Line 563: | Line 565: | ||

:: [[File: CCIR.Instructions_(60.25)_snippet.png | 1250px]] | :: [[File: CCIR.Instructions_(60.25)_snippet.png | 1250px]] | ||

| − | : | + | <span id="formula_ISR"></span> |

| + | : The exhibit does not provide a formula but the annual statement instructions for page 20.22 imply that COLUMN (45) is equal to (19) ''<u>minus</u>'' (29) ''<u>plus</u>'' (39). Let's define the following notation: | ||

:* '''ISR''' = Insurance Service Result | :* '''ISR''' = Insurance Service Result | ||

| Line 570: | Line 573: | ||

::* '''NRE''' = Net Reinsurance Expenses from Contracts Held | ::* '''NRE''' = Net Reinsurance Expenses from Contracts Held | ||

| − | : Then: | + | : Then: ''(This formula was corrected. Originally, the term '''NRE''' was shown as subtracted but it should be <u>added</u>.)'' |

:: {| class='wikitable' style='background-color: navajowhite;' | :: {| class='wikitable' style='background-color: navajowhite;' | ||

|- | |- | ||

| − | || '''ISR''' = TIR | + | || '''ISR''' = TIR <span style="color: red;">'''–'''</span> ISE <span style="color: green;">'''+'''</span> NRE |

|} | |} | ||

| − | ::* I'm assuming that the expenses ISE | + | ::* I'm assuming that the expenses ISE is reported as positive numbers in the financial statements and so is subtracted in the above formula. |

| − | :: | + | ::: → If they are instead reported as negative numbers then they would be added ''(not subtracted.)'' |

| − | ::* | + | ::* The quantity NRE is actually <u>added</u> to ISR according to the annual statement instructions ''(which strikes me as a bit strange since it's listed as an expense.)'' |

| + | ::: → The reason it's added ''(not subtracted)'' may be that it's ''"Reinsurance expenses <u>from</u>..."'' instead of ''"Reinsurance expenses <u>for</u>..."''. | ||

::{| class='wikitable' | ::{| class='wikitable' | ||

| Line 591: | Line 595: | ||

:{| class='wikitable' | :{| class='wikitable' | ||

|- | |- | ||

| − | || The CCIR instructions <u>do</u> provide ''[[Formulas_-_Basic_Financial_Statement_Metrics#Formulas_for_Pages_60.25_and_60.35 | formulas]]'' for | + | || The CCIR instructions <u>do</u> provide ''[[Formulas_-_Basic_Financial_Statement_Metrics#Formulas_for_Pages_60.25_and_60.35 | formulas]]'' for the following 2 metrics however: ''(Unfortunately, you need to memorize them.)'' |

|} | |} | ||

:* Number of Direct Claims <span style="color: red;"> ← ''I seriously doubt this will be asked on the exam''</span> | :* Number of Direct Claims <span style="color: red;"> ← ''I seriously doubt this will be asked on the exam''</span> | ||

| − | :* Excess (Deficiency) <span style="color: | + | :* Excess (Deficiency) <span style="color: green;"> ← ''This was the most frequently asked calculation on the pre-IFRS 17 exams!''</span> |

=====Excess (Deficiency) using Page 60.35===== | =====Excess (Deficiency) using Page 60.35===== | ||

| − | As noted above, the '''excess (deficiency)''' calculation was asked on every exam prior to the adoption of IFRS 17 | + | As noted above, the '''excess (deficiency)''' calculation was asked on every exam prior to the adoption of IFRS 17, but it's a much simpler calculation now. ''(Note that the source text provides only a formula with no explanation or examples.)'' |

First of all, the reason the calculation is simpler versus the pre-IFRS 17 version is: | First of all, the reason the calculation is simpler versus the pre-IFRS 17 version is: | ||

| Line 612: | Line 616: | ||

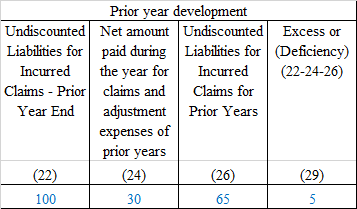

:[[File: CCIR.Instructions_(60.35)_snippet.png]] | :[[File: CCIR.Instructions_(60.35)_snippet.png]] | ||

| − | I inserted the blue numbers for illustration purposes. ''(The CAS statement blank does not provide any numbers.)'' Note that page 60. | + | I inserted the blue numbers for illustration purposes. ''(The CAS statement blank does not provide any numbers.)'' Note that page 60.35 </span> has many rows that show the breakout by line of business, but the excess (deficiency) calculation is exactly the same for each row. If the exam questions provides information in this format then it's a very easy problem The excess of 5 shown in the table is for a single line of business but for all AYs EXCEPT the current AY. That's because you can't calculate the excess (deficiency) for the current AY. This is explained further down. |

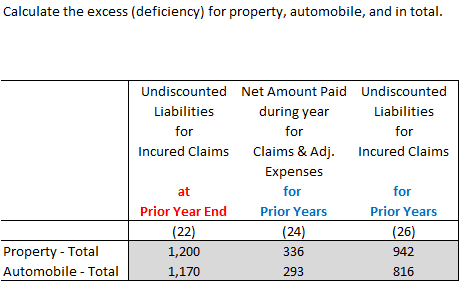

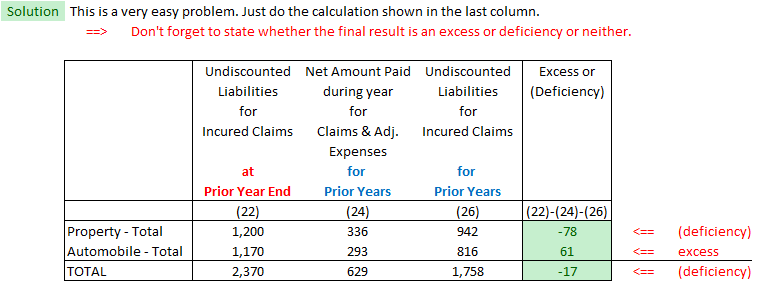

Anyway, suppose instead you're provided with the relevant information in this slightly different format: | Anyway, suppose instead you're provided with the relevant information in this slightly different format: | ||

| Line 636: | Line 640: | ||

* excess (deficiency) | * excess (deficiency) | ||

| − | : = (Undiscounted Liabilities for incurred claims | + | : = (Undiscounted Liabilities for incurred claims <u>at</u> Prior year end) |

:: - (Net amount paid during the year for claims and adjustment expenses of prior years) | :: - (Net amount paid during the year for claims and adjustment expenses of prior years) | ||

| − | :: - (Undiscounted Liabilities for Incurred Claims for Prior Years) | + | :: - (Undiscounted Liabilities for Incurred Claims <u>for</u> Prior Years) |

: = (undiscounted liabilities at Dec 31, 2021 for AYs 2021 & prior) | : = (undiscounted liabilities at Dec 31, 2021 for AYs 2021 & prior) | ||

| Line 722: | Line 726: | ||

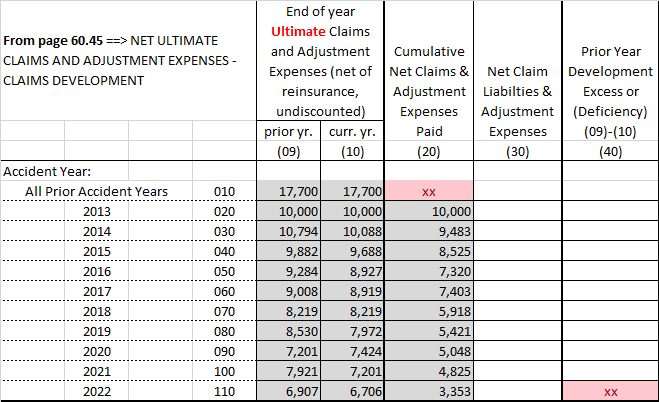

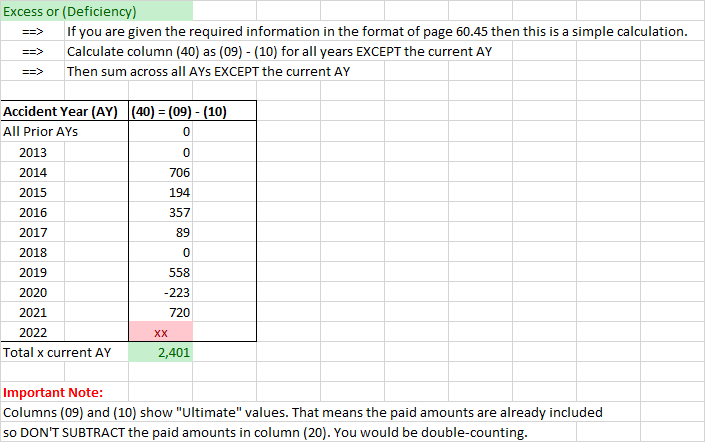

We covered the concept of excess (deficiency) in the previous section and looked at an example based on page 60.35. Let's now look at example where the information is given in the format of page 60.45. It is still a very easy calculation: The answer is in column (40) and is simply equal to column (09) ''minus'' column (10). | We covered the concept of excess (deficiency) in the previous section and looked at an example based on page 60.35. Let's now look at example where the information is given in the format of page 60.45. It is still a very easy calculation: The answer is in column (40) and is simply equal to column (09) ''minus'' column (10). | ||

| + | |||

| + | '''Typo''': The entry of 6,907 for column (09) for AY 2022 should be "xx". There should be no prior year estimate for AY 2022 when it's still CY 2022. | ||

: [[File: CCIR.Instructions (60.45) example 01.png]] | : [[File: CCIR.Instructions (60.45) example 01.png]] | ||

| Line 792: | Line 798: | ||

==POP QUIZ ANSWERS== | ==POP QUIZ ANSWERS== | ||

| − | The minimum acceptable MCT ratio is | + | The minimum acceptable MCT ratio is 100%, but OSFI usually expects companies to maintain an MCT ratio well above this minimum. |

Latest revision as of 01:30, 29 January 2025

Reading: Final 2023 IFRS 17 P&C Insurance Return, Instructions and Forms

Author: CCIR (Canadian Council of Insurance Regulators)

BA Quick-Summary: CCIR

|

Contents

- 1 Pop Quiz

- 2 Study Tips

- 3 BattleTable

- 4 In Plain English!

- 5 POP QUIZ ANSWERS

Pop Quiz

What is the minimum acceptable MCT ratio? Click for Answer

Study Tips

| Note on 2022-Fall update: This wiki article has been completely rewritten based on the updated source text and the incorporation of IFRS 17. Unfortunately, the published exam problems on this topic refer to terms and concepts that are no longer used so the relevance of old exam problems as a study aid are limited. If you'd like to see the old exam problems, please refer the BattleTable in the old wiki article CCIR.ARinstr. |

If you've taken an accounting class, you'll get through this reading more quickly. If you haven't, it may take a little longer but you can learn what you need as you go. The syllabus lists 4 files related to this material:

- 1 PDF document:

- Instructions for completing the financial statements

- 3 Excel files:

The PDF document with the instructions is long and boring, and roughly 150 pages, but you can ignore the vast majority of it. It contains 4 sections:

- I - Introduction

- III - Definitions

- IV - Detailed Instructions ← Historically, this is where all the exam questions came from.

- V - Jurisdictional Requirements

The only section with testable information is IV - Detailed Instructions and everything you need is covered in the wiki, BattleCards, and web-based problems anyway. If look at the source text you will get a headache and need an aspirin. 😖

| Study Strategy: Based on the syllabus, as well as styles of questions from past exams, here's what's important: |

- general understanding of the layout and purpose financial statement exhibits (you do not have to be familiar with all of the exhibits in PC1, PC2, and PC3.)

- basic understanding of how to calculate common financial statement items such as: assets, liabilities, equity, net income

- performing other calculations related to certain financial statement exhibits

One question that had appeared on every prior exam was calculating the excess (deficiency) of prior reserves. This calculation is now much simpler however, so it may no longer make for a good exam question but we're going to cover it anyway (just to be safe.)

This wiki article will guide you through these items using web-based and Excel-based practice problems.

Note: According to the syllabus, there are roughly 24 exhibits or pages from the financial statements covered on the exam. In practice however, there are likely only a handful that you need to know in depth. I've extracted the information I felt was most important and testable but of course you have to the option of going back to the source text for specific items that I haven't covered. Remember however that there is far too much material on the syllabus to learn everything in depth. Use your judgement to assess what's important (and what isn't) and allocate your time accordingly. That's the whole point behind the Ranking Table - it shows you how to allocate your time to maximize your odds of passing.

| Alice-the-Actuary's Pro-Tip! For numerical web-based problems, the given numerical information can be copied from the web page and pasted into Excel. You can then do the calculations in Excel as you would on the actual exam then type your answers back into the web page to be scored. |

Estimated study time: 1-2 weeks (not including subsequent review time)

BattleTable

No past exam questions are available for this reading.

reference part (a) part (b) part (c) part (d)

In Plain English!

Calculating Equity

This is a skills-based reading and your primary focus is on how to do calculations related to the financial statements. There is some memorization required, like the formulas for various financial statement metrics, but much less than for certain other readings like the Landmark Legal Cases, which is basically all memorization.

Anyway, let's start with a few basic formulas for calculating equity. This will often be part of a larger problem.

METHOD 1

| Calculating Equity - Method 1: Fundamental Accounting Equation |

Define the notation:

- A(x) = Assets for year x

- L(x) = Liabilities for year x

- E(x) = Equity for year x

If you've had an accounting class, you may already know the Fundamental Accounting Equation:

A(x) = L(x) + E(x)

As a very simple example, suppose an insurer's financial statements show:

- A(x) = 20m ← Statement of Financial Position, page 20.10 - Assets, line 89

- L(x) = 14m ← Statement of Financial Position, page 20.11 - Liabilities & Equity, line 399

Rearranging the Fundamental Accounting Equation, we can calculate equity for year x as:

- E(x) = A(x) - L(x) = 20m - 14m = 6m

METHOD 2

| Calculating Equity - Method 2: From prior year's equity and current year's income. |

Define the notation:

- CI(x) = Comprehensive Income for year x

- NI(x) = Net Income for year x

- OCI(x) = Other Comprehensive Income for year x

Then the following relationships hold:

E(x) = E(x-1) + CI(x)

CI(x) = NI(x) + OCI(x)

Suppose the same insurer also shows:

- E(x-1) = 2m ← Statement of Financial Position, page 20.11 - Liabilities & Equity, line 699

- NI(x) = 3m ← Statement of Profit or Loss, page 20.22, line 999

- OCI(x) = 1m ← Comprehensive Income & Accumulated Other Comprehensive Income, page 20.42, line 21

Then we can use the above formulas to calculate equity for year x:

- E(x) = E(x-1) + CI(x) = E(x-1) + NI(x) + OCI(x) = 2m + 3m + 1m = 6m

| Warning! There is a potential complication with this method: |

- It assumes the company did not make certain kinds of capital transactions, like dividends for example.

- If dividends were paid, they must be subtracted from Net Income to arrive at the correct value for Equity.

There's an external web page that explains this pretty well and Alice highly recommends you spend 15 minutes reading it over:

Once you understand how to take dividends into account, try calculating equity for 2015 in this old exam problem. See also Alice's comments below:

- E (2016.Fall #22)

Alice's comments:

- For now, don't worry about part (a.i), ROE (Return On Equity) - just use the given information to calculate equity using Method 2.

- TRICK: You have to subtract the dividends from NI to arrive at the correct value.

- (This is because if you think of dividends as being paid out of income, this would also reduce the equity. Dividends leave the company to go to shareholders.)

- Sample answer #2 given in the examiner's report has 2 errors: They wrote "change in net income" and "change in OCI" but you shouldn't use the change in these values - just use the 2015 values as given.

METHOD 3

| Calculating Equity - Method 3: Sum the appropriate line items from the Statement of Financial Position - Liabilities & Equity, page 20.11. |

If you're directly given the appropriate items from the Statement of Financial Position - Liabilities & Equity, page 20.11, you can calculate equity simply by summing. Define:

- PHE(x) = Policyholders' Equity for year x

- SHE(x) = Shareholders' Equity for year x

- nci(x) = non-controlling interests for year x

Then

E(x) = PHE(x) + SHE(x) + nci(x)

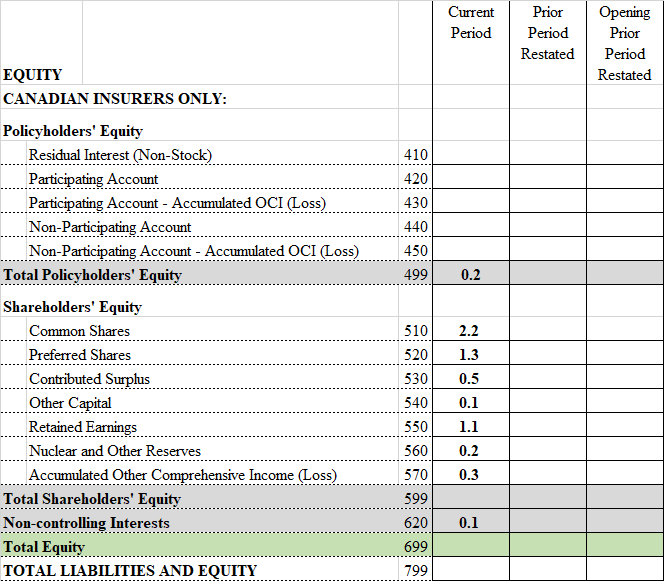

Anyway, here's a snippet of the lower portion of page 20.11 showing the relevant components of equity:

To calculate equity from the numbers in this exhibit, you first have to sum the appropriate lines to calculate Shareholders' Equity for year x or SHE(x). I will let you do that as an easy exercise. The values are in millions and you can check your answer by comparing it to the value of E(x) calculated in methods 1 and 2.

Bonus Fun Fact! AOCI (Accumulated Other Comprehensive Income) from line 570 includes unrealized gains/losses on OCI.

|

In an exam question that requires the value of equity, they might just give it to you directly. If not, it's probably a good idea to know the following:

Question: identify the components of SHE (Shareholders' Equity) from page 20.11. [Hint: CP-CORNA]

- Common shares

- Preferred shares

- –

- Contributed surplus

- Other capital

- Retained earnings

- Nuclear reserves

- AOCI (Accumulated Other Comprehensive Income)

I don't think they would ask you to calculate PHE (Policyholders' Equity) by summing the appropriate line items from page 20.11. The other component of equity, non-controlling interests, doesn't have any subcomponents.

Interesting side issue: There was a forum question on the difference between capital and surplus. You should read this because there's a very good chance it will help you on the exam.

Layout of Financial Statements

Overview

As noted in the Study Tips, there are 3 excel files you need to become familiar with. A full set of financial statements would combine the pages in all 3 but they are separated into different files to make clear which are core pages, which pages would be in any annual return, and which pages would be in any quarterly return.

Note that some of the terms in the financial statements likely won't be familiar to you because they are specific to IFRS 17 and the IFRS 17 material appears further down in the Ranking Table. Don't worry too much about that for now. You're going to be reviewing this CCIR article later anyway.

|

- PC1 - Core Return

- According to the CAS syllabus, you should be familiar with all pages in this document

- → See Annual Statement Exhibit List for a handy list

- PC1 - Core Return

- PC2 - Quarterly Return

- According to the CAS syllabus, you should be familiar with the following 6 pages: (Click the page numbers to see the exhibits)

- → 40.74 Investment Return

- → 60.25 Insurance Service Result (specific to IFRS 17) ← discussed in detail in the IFRS 17 wiki articles

- → 60.80 Onerous Contracts (specific to IFRS 17) ← discussed in detail in the IFRS 17 wiki articles

- → 70.50 REINSURANCE CONTRACTS HELD SUMMARY - Registered Reinsurance

- → 70.60 REINSURANCE CONTRACTS HELD SUMMARY - Unregistered Reinsurance

- → 80.15 Commissions ← much simpler than the pre-IRFS 17 version of the Commissions exhibit

- PC2 - Quarterly Return

- PC3 - Annual Return

- According to the CAS syllabus, you should be familiar with the following 2 pages: (Click the page numbers to see the exhibits)

- PC3 - Annual Return

In the next few sections, we're going to look at some of these exhibits in a little more detail.

Brief Discussion of PC1 - Core Return

The 3 most important pages in the core return are: (Click the page numbers to see the exhibits)

- → 20.10 Statement of Financial Position - ASSETS

- → 20.11 Statement of Financial Position - LIABILITIES & EQUITY

- → 20.22 Statement of Profit or Loss

| Let's first consider pages 20.10 & 20.11. |

It's obvious why these are important - they list all of your company's assets (page 20.10) and your company's liabilities (page 20.11). You must also be able to recognize line items from this page. For example, an exam problem may give you a table of information and ask you to calculate the total assets of the company:

- (Assume that any values not provided are equal to 0.)

# Item Value 1 Cash and Cash Equivalents 500 2 Investments 400 3 Goodwill 100 4 Deferred Tax Assets 100 5 Insurance Contract Liabilities 350 6 Reinsurance Contract Liabilities 25 7 Employment Benefits 150 8 Policyholders' Liabilities 40

Solution:

- You have to recognize that only the first 4 items in the table are assets.

- Then total assets = 500 + 400 + 100 + 100 = 1,100.

Suppose further that the question asked for total liabilities:

- You have to recognize that items #5-8 are liabilities.

- Then total liabilities = 350 + 25 + 150 + 40 = 565.

Then equity can be calculated as the difference between the assets and liabilities:

- Total equity = 1,100 - 565 = 535.

Take a quick look at pre-IFRS 17 exam problem. You can't solve this problem anymore because the financial statements are different but it shows you how financial statement information may be presented to you:

- E (2018.Fall #24)

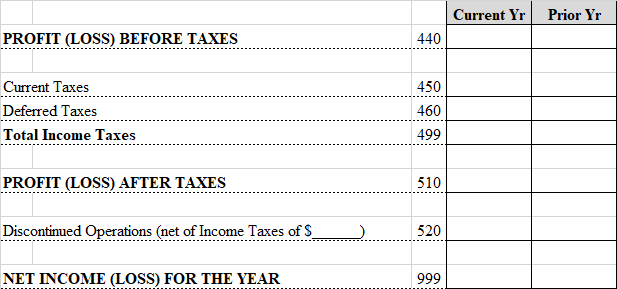

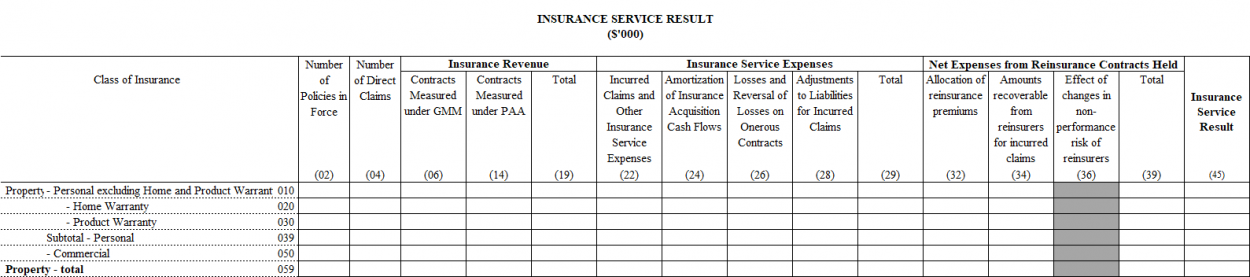

| Let's now consider page 20.22 - Statement of Profit or Loss. |

Here's a snippet from page 20.22. (Click to see the complete exhibit: Statement of Profit or Loss) Note the last line showing Net Income. Old exam problems often asked you calculate net income. There's a formula for net income that we'll cover further down but for now, just be aware of where it's shown in the financial statements.

About BattleQuiz #2: There are 4 web-based problems in the quiz to familiarize you with the financial statements:

You don't have to get a perfect score on these the first time through. It's probably enough to do the EASY ones for now. You can come back to the HARD ones later. |

Financial Statement Calculations - Basic Quantities

Statement of Financial Position - page 20.10 and 20.11

Earlier in this article in the section Brief Discussion of PC1 - Core Return, we looked at an example of how to calculate total assets and total liabilities. You can do a quick review if necessary. It's just a matter of knowing which line items are assets and which are liabilities and then summing the appropriate items. If you've done the web-based problems from the previous section on identifying the correct location of various financial statement items, then this type of calculation shouldn't be a problem. Here are 3 basic financial statement quantities that will likely appear somewhere on your exam:

- Total Assets: page 20.10, line 89

- Total Liabilities: page 20.11, line 399

- Total Equity: page 20.11, line 699 ← already covered in Calculating Equity - Method 3

I don't think the examiners will try to trick you here, but when they provide a financial statement information, they may not tell you which items are assets, which are liabilities, and which are part of equity. As I've already mentioned, you need to know that without being told. And many of these items are obvious anyway because they use the term "assets" or "liabilities" in the description. For example, Assets Held for Sale or Intangible Assets. Even items that don't specifically use the term "assets" are often easy to pick out. For example, Cash & Cash Equivalents is clearly an asset.

You probably don't need to memorize all the different assets and liabilities, but you should be able to list a few off the top of your head and be able to recognize the rest. You'll absorb this just from working with the financial statements and doing the quiz problems.

Something I would memorize however are the line items that are part of Shareholders' Equity. Those items often show up in MCT problems and my feeling is that it's good to know what they are. This was covered in Calculating Equity - Method 3 and Alice-the Actuary's memory hint for the components of equity was CP-CORNA.

Statement of Profit or Loss - page 20.22

Another very important page in the financial statements is the Statement of Profit or Loss - page 20.22. And a formula that you absolutely have to memorize is:

page 20.22: Net Income: NI = ISR + NIR + OIE - Taxes + Discontinued Operations

- NI = Net Income

- ISR = Insurance Service Result ← calculated in the exhibits Statement of Profit or Loss - page 20.22 and Insurance Service Result - page 60.25

- NIR = Net Investment Result ← calculated in the exhibit Statement of Profit or Loss - page 20.22 using the quantity "Investment Return" from Investment Return - page 40.74

- OIE = Other Income and Expenses

- Taxes consist of current & deferred taxes (and an exam problem might provide those separately so you'd have to sum them to get total taxes)

- Discontinued Operations - this is not explained further will probably be 0 in any exam problem

If you look closely at Statement of Profit or Loss - page 20.22, you'll see that some of the terms in the NI formula are broken out further. For example:

- ISR is itself the sum of these 2 lines:

- Line 099: Total Insurance Revenue (TIR)

- Line 120: Net Expenses from Reinsurance Contracts Held (NRE)

- Less

- Line 110: Insurance Service Expenses (ISE)

- Furthermore, TIR is the sum of:

- Revenue from PAA Contracts

- Revenue from GMM Contracts (excluding VFA contracts)

- Revenue from VFA Contracts

There is an example of calculating net income at the end of the next section on investment return.

| Alice's Pro-Tip: Memorize the components of ISR and TIR (Insurance Service Result and Total Insurance Revenue).

(The rough equivalent of TIR for pre-IFRS 17 financial statements was "Written or Earned Premium" but those terms aren't used anymore.)

|

The components of TIR listed above are absolutely central to the way IFRS 17 records revenue and it is 99.99999% certain that you will totally flunk the exam if you don't know them. 😭

Investment Return - page 40.74

Take a look at Investment Return - page 40.74. This is another financial statement page where you at least have to be familiar with the line items. For example, suppose you are asked to calculate:

- Net Investment Income (NII)

- Investment Return (IR)

And this is the information you're given:

# Item Value 1 Total Realized Gains (Losses) on Sale 800 2 Total Fair Value Gains (Losses) 500 3 Dividends 150 5 Investment Expenses (other than Investment Taxes) 125 6 Investment Taxes 85 7 Provision for Credit Losses 45

If you have page 40.74 in front of you then it's easy. You can clearly see that NII is the sum of these items:

- Total Realized Gains (Losses) on Sale ← in bold font because it is a subtotal

- Total Fair Value Gains (Losses) ← in bold font because it is a subtotal

- Dividends

- Rental Income Including $ ____________ for Insurer's/ Society's Own Use

- Other Investment Income from Derivative Assets

- Income from Other Loans and Invested Assets

And these sum to Gross Investment Income

- Less:

- Investment Expenses (other than Investment Taxes)

- Investment Taxes

Note that not all of the above items were provided in the given information. You can assume that ones not listed are 0 and just sum the rest:

- NII

- = Total Realized Gains (Losses) on Sale

- + Total Fair Value Gains (Losses)

- + Dividends ← these are dividends received by the insurer, not dividends paid out

- - Investment Expenses (other than Investment Taxes)

- - Investment Taxes

- = 800 + 500 + 150 - 125 - 85

- = 1240

Did you notice that we didn't include Provision for Credit Losses in Net Investment Income. If you look again at Investment Return - page 40.74, you'll see that Provision for Credit Losses is subtracted from NII to arrive at the final value of Investment Return:

- IR

- = NII - Provision for Credit Losses

- = 1240 - 45

- = 1195

| Alice's Pro-Tip: Most of the items on Investment Return - page 40.74 are obviously part of the investment return. The only thing you really have to remember is that Provision for Credit Losses is subtracted from NII to get the final value of IR. |

One last thing: It's possible an exam question won't directly give you Total Realized Gains (Losses) on Sale. They may provide the components and you would have to know to sum them to get the total:

- Bonds

- Mortgage Loans

- Preferred & Common Shares

- Investment Properties

- Income from Derivative Activities

The same holds for Total Fair Value Gains (Losses) and the components are the same. So the question would have to tell you whether the items pertained to the Realized Gains or the Fair Value Gains. I suspect they would just give you the totals directly otherwise it just gets ridiculous.

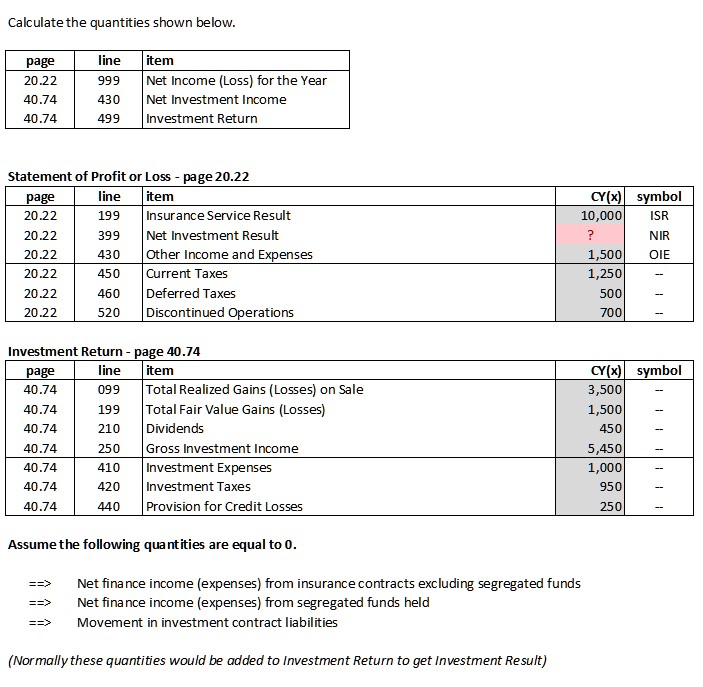

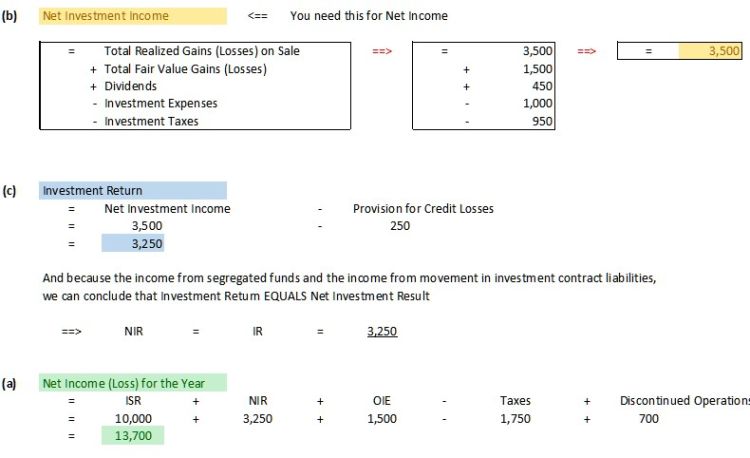

Here's an example of calculating net income and investment return that's similar to the web-based problem in the next quiz.

| Here's the problem: |

- Note: Assume also that Line 320: Net finance income (expenses) from reinsurance contracts held is equal to 0 for the purposes of this problem.

| Here's the solution: |

Financial Statement Calculations - Formulas from CCIR Instructions

Page 10.60

| Financial Statement Metrics (A) from page 10.60 - SUMMARY OF SELECTED FINANCIAL DATA FOR FIVE YEARS |

- In this section, we look at how to calculate metrics from the financial statements using formulas provided in the CCIR instructions. The first web-based problem from the quiz in this section covers:

- adjusted equity

- investment yield ← not a %-value according to the CCIR definition - the %-sign is explicitly added on page 10.60

- ROE (Return on Equity) ← not a %-value according to the CCIR definition - the %-sign is explicitly added on page 10.60

- Claims Development as a % of Adjusted Equity

- Agents and Brokers Balances Due from Subs and Associates as a % of Adjusted Eq.

- You just have to memorize the formulas and then practice them using the web-based problem in the quiz.

Here's an example. It's long but easy. - The source text for the CCIR instructions has an error in the formula for: Claims Development as a Percentage of Adjusted Equity

- See part (d) below: The numerator in the formula should refer to column (29), not column (10).

And here's the answer.

Pages 60.25, 60.35, and 60.45

| Financial Statement Metrics (B) from page 60.25 and 60.35 |

- The CCIR instructions don't label these metrics as "A" and "B". I did that just to emphasize that the group "A" comes from page 10.60, while group "B" comes from 60.25 and 60.35. Note that as of July 7, 2022, there is an inconsistency in the Fall 2022 syllabus:

- Learning Objective C.1 lists the excess (deficiency) ratio calculation under the Knowledge Statements.

- But page 60.35, which is where the excess (deficiency) calculation is done, is not listed as a financial statement page that you're required to know.

- So, it isn't clear whether or not you have to learn the excess (deficiency) calculation. I have contacted the CAS Exam Committee about this but have not received a response. (Furthermore, learning objective C.1 refers to the excess (deficiency) ratio, which is from the old version of the CCIR instructions. This quantity is no longer a ratio so it looks like they didn't accurately update the syllabus.) Anyway, the safest assumption is that the excess (deficiency) calculation is intended to be on the syllabus. It's actually a much easier calculation than in the new version of the CCIR instructions.

- So here are the formulas you should probably learn from page 60.25:

- Insurance Service Result

- Number of Direct Claims

- And from page 60.35 or page 60.45:

- Excess or (Deficiency)

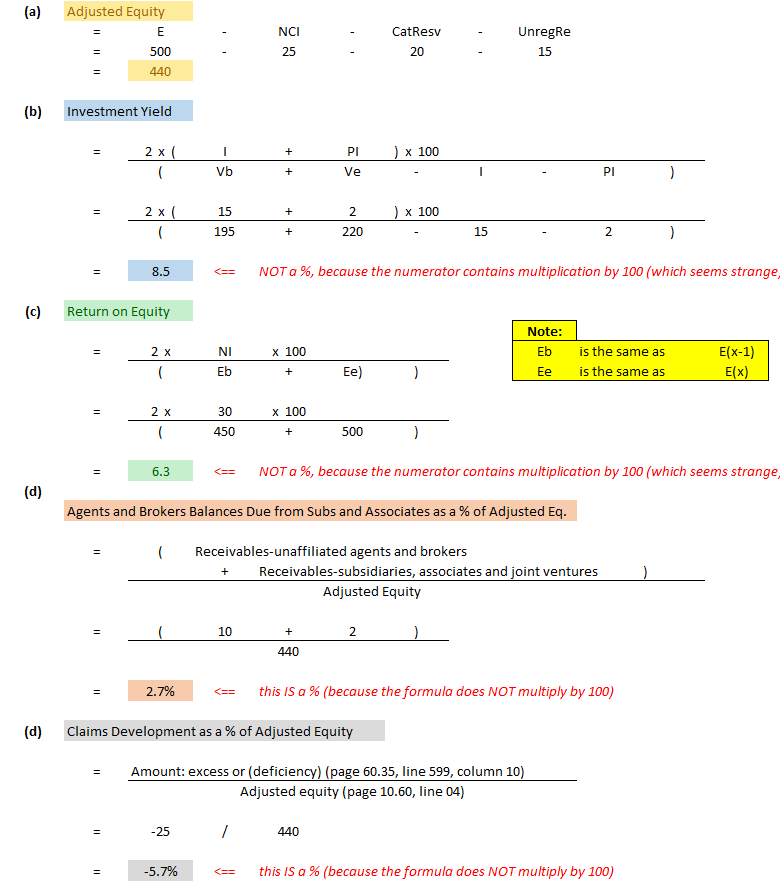

- Let's start by taking a quick look at page 60.25. Here are the first few rows. Note that the rows show a breakdown by product:

- The exhibit does not provide a formula but the annual statement instructions for page 20.22 imply that COLUMN (45) is equal to (19) minus (29) plus (39). Let's define the following notation:

- ISR = Insurance Service Result

- TIR = Total Insurance Revenue

- ISE = Insurance Service Expenses

- NRE = Net Reinsurance Expenses from Contracts Held

- Then: (This formula was corrected. Originally, the term NRE was shown as subtracted but it should be added.)

ISR = TIR – ISE + NRE

- I'm assuming that the expenses ISE is reported as positive numbers in the financial statements and so is subtracted in the above formula.

- → If they are instead reported as negative numbers then they would be added (not subtracted.)

- The quantity NRE is actually added to ISR according to the annual statement instructions (which strikes me as a bit strange since it's listed as an expense.)

- → The reason it's added (not subtracted) may be that it's "Reinsurance expenses from..." instead of "Reinsurance expenses for...".

In any case, the grand totals from page 60.25 should match to the top portion of page 20.22, lines 099, 110, 120, 199:

The CCIR instructions do provide formulas for the following 2 metrics however: (Unfortunately, you need to memorize them.)

- Number of Direct Claims ← I seriously doubt this will be asked on the exam

- Excess (Deficiency) ← This was the most frequently asked calculation on the pre-IFRS 17 exams!

Excess (Deficiency) using Page 60.35

As noted above, the excess (deficiency) calculation was asked on every exam prior to the adoption of IFRS 17, but it's a much simpler calculation now. (Note that the source text provides only a formula with no explanation or examples.)

First of all, the reason the calculation is simpler versus the pre-IFRS 17 version is:

- the excess (deficiency) value was calculated for a particular period - now it's calculated only in aggregate according to the current definition provided in the source text

- the liabilities are now undiscounted (whereas before you needed the APV or Actuarial Present Value of the liabilities)

- investment income is not considered (so you don't have to retrieve or calculate this value)

If you never studied the old version of the calculation then the bullet points above may not mean anything to you. If so, that's fine - just ignore them. Let's now look at a simple example of what this excess (deficiency) calculation is actually telling you. The calculation using the formula from the CCIR instructions is shown on page 60.35 and is extremely simple:

I inserted the blue numbers for illustration purposes. (The CAS statement blank does not provide any numbers.) Note that page 60.35 has many rows that show the breakout by line of business, but the excess (deficiency) calculation is exactly the same for each row. If the exam questions provides information in this format then it's a very easy problem The excess of 5 shown in the table is for a single line of business but for all AYs EXCEPT the current AY. That's because you can't calculate the excess (deficiency) for the current AY. This is explained further down.

Anyway, suppose instead you're provided with the relevant information in this slightly different format:

undiscounted liabilities at Dec 31, 2021 for AYs 2021 & prior $100 paid during CY 2022 for AYs 2021 & prior $30 undiscounted liabilities at Dec 31, 2022 for AYs 2021 & prior $65

Below, I've copied the exact formula from the source text and then substituted the values from my example:

- excess (deficiency)

- = (Undiscounted Liabilities for incurred claims at Prior year end)

- - (Net amount paid during the year for claims and adjustment expenses of prior years)

- - (Undiscounted Liabilities for Incurred Claims for Prior Years)

- = (undiscounted liabilities at Dec 31, 2021 for AYs 2021 & prior)

- - (paid during CY 2022 for AYs 2021 & prior)

- - (undiscounted liabilities at Dec 31, 2022 for AYs 2021 & prior)

- = 100 - 30 - 65

- = 5

This means the original liability of 100 was too high, or excessive, by 5. Let's now think through what this means:

- At the end of 2021, the actuary had estimated the liabilities for AYs 2021 & prior to be $100.

- → In other words, the actuary thought it would require $100 to settle those claims.

- Then during 2022, $30 was paid out

- Also during 2022, those liabilities were reduced to $65 (a reduction of $35)

Now, if the original liability of $100 had been accurate, and we paid out $30, the total liability should also have been reduced by $30. But it was reduced by $35 instead. The implication is that the original liability of $100 was too high by $5 and this was corrected at the end of 2022.

| Alice's Pro Tip: After calculating the excess or deficiency, make sure you state explicitly whether the result is an excess, deficiency, or neither.

(On past exams, those pesky graders deducted 0.25 points for not doing that.) |

Ian-the-Intern created a quiz to test your understanding. Click here for the answers.

Problem 1: Calculate and interpret the excess (deficiency).

undiscounted liabilities at Dec 31, 2021 for AYs 2021 & prior $100 paid during CY 2022 for AYs 2021 & prior $30 undiscounted liabilities at Dec 31, 2022 for AYs 2021 & prior $70

Problem 2: Calculate and interpret the excess (deficiency).

undiscounted liabilities at Dec 31, 2021 for AYs 2021 & prior $100 paid during CY 2022 for AYs 2021 & prior $30 undiscounted liabilities at Dec 31, 2022 for AYs 2021 & prior $73

Note that the value of excess (deficiency) says nothing about the actuary's estimate of liabilities for the current AY. This is something students sometimes have trouble understanding. 😐 You cannot draw any conclusions about the accuracy of the actuary's estimate of liabilities for the current AY until the end of the following CY. The reason is that you need a second data point for comparison. The liabilities for a particular AY are always 0 at the beginning of the corresponding CY. Your first true value isn't available until the end of the year, then you have to wait a whole other year to get your second data point.

For the example above, you don't get your first estimate of AY 2022 liabilities until the end of CY 2022. You then have to wait until the end of CY 2023 to get your second estimate for AY 2022. It's only then you can incorporate AY 2022 in your calculation of excess (deficiency). If I were creating an exam question on this topic, I would ask a question that tests your understanding of that! Not sure if they CAS thinks like I do, but it's something you should understand nonetheless.

Here's another example similar to the web-based problem in the next quiz.

| Here's the problem: |

| Here's the solution: |

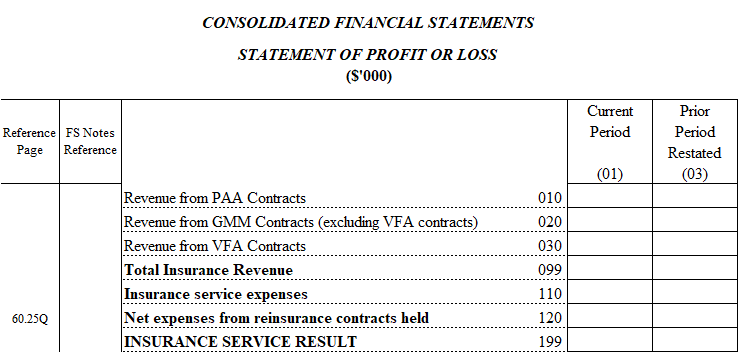

Excess (Deficiency) using Page 60.45

We covered the concept of excess (deficiency) in the previous section and looked at an example based on page 60.35. Let's now look at example where the information is given in the format of page 60.45. It is still a very easy calculation: The answer is in column (40) and is simply equal to column (09) minus column (10).

Typo: The entry of 6,907 for column (09) for AY 2022 should be "xx". There should be no prior year estimate for AY 2022 when it's still CY 2022.

| Here is the answer, both by AY and in total: |

Warning! Warning! Pay attention to whether the exam problem gives you "net" claims (which do not include paid amounts) or "ultimate claims" (which do include paid amounts).

|

Basic Accounting Formulas from pre-IFRS 17 Syllabus

There are basic accounting formulas that were often needed to solve accounting problems from the pre-IFRS 17 syllabus. They were not covered in the syllabus material but it was still expected you knew them so I assume the same is true going forward. They have been appropriately restated using IFRS 17 terms. For example, "Insurance Service Result" replaces "Underwriting Income".

The concept of Actuarial Present Value or APV still exists but it is calculated differently in IFRS 17. (The old method used margins for adverse deviation for claims development, interest rate, and reinsurance recovery.) According to the current Consolidated Standards of Practice:

- Actuarial present value method is a method to calculate the lump sum equivalent at a specified date of amounts payable or receivable at other dates as the aggregate of the present values of each of those amounts at the specified date, and taking into account both the time value of money and, where appropriate, contingent events.

So APV consists of the present value of future payments along with a risk margin. For example, if you have 3 future year-end payments of 100, 110, and 120, and a discount rate of 5%, the present value would be

- 100/1.05 + 110/1.05^2 + 120/1.05^3 = 298.67.

If you then add a 10% risk margin, the APV would be:

- 298.67 x 1.10 = 328.54.

Note that these metrics normally pertain to a particular AY (not a single point in time.):

metrics formula NLR (Net Loss Ratio) = APV(incurred claims) / EP NCOR (Net Combined Operating Ratio) = [ APV(incurred claims) + operating expenses ] / EP (operating expenses exclude investment expenses.) NI (Net Income) = (1 – tax rate) x [ ISR + NIR + OIE + Discontinued Operations ]

- The NI formula for net income in the above table works if you're given the tax rate. If you were instead given total tax, you would subtract total tax from the income amounts to get net income. In the case, "net" means net of taxes

supporting metrics formula APV(incurred claims) for a particular period = (paid loss in period) + change [ APV(unpaid claims) ] EP for a particular period = WP – change(UEP) Insurance Service Result for a particular period = EP – APV(incurred claims) – operating expenses (operating expenses exclude investment expenses.) Investment Income for a particular period = (investment revenue) – (investment expenses)

The "particular period" is usually 1 year. Note also that the change in the formulas above generally means (current year-end) – (prior year-end).

POP QUIZ ANSWERS

The minimum acceptable MCT ratio is 100%, but OSFI usually expects companies to maintain an MCT ratio well above this minimum.