Difference between revisions of "IBC.Flood2019"

(→International Review) |

(→Conclusion) |

||

| (One intermediate revision by the same user not shown) | |||

| Line 464: | Line 464: | ||

:: → setup & operation of the pool may take many years because of negotiations required among federal government, provinces, and territories | :: → setup & operation of the pool may take many years because of negotiations required among federal government, provinces, and territories | ||

| − | [https:// | + | [https://battleactsmain.ca/FC.php?selectString=**&filter=both&sortOrder=natural&colorFlag=allFlag&colorStatus=allStatus&priority=importance-high&subsetFlag=miniQuiz&prefix=IBC&suffix=Flood2019§ion=all&subSection=all&examRep=all&examYear=all&examTerm=all&quizNum=7<span style="font-size: 20px; background-color: aqua; border: solid; border-width: 1px; border-radius: 10px; padding: 2px 10px 2px 10px; margin: 10px;">'''mini BattleQuiz 7]'''</span> |

====Conclusion==== | ====Conclusion==== | ||

| Line 478: | Line 478: | ||

|} | |} | ||

| − | [https:// | + | [https://battleactsmain.ca/FC.php?selectString=**&filter=both&sortOrder=natural&colorFlag=allFlag&colorStatus=allStatus&priority=importance-high&subsetFlag=miniQuiz&prefix=IBC&suffix=Flood2019§ion=all&subSection=all&examRep=all&examYear=all&examTerm=all&quizNum=all<span style="font-size: 20px; background-color: lightgreen; border: solid; border-width: 1px; border-radius: 10px; padding: 2px 10px 2px 10px; margin: 10px;">'''Full BattleQuiz]'''</span> |

: [https://www.battleactsmain.ca/vanillaforum/categories/ibc-flood<span style="font-size: 12px; background-color: lightgrey; border: solid; border-width: 1px; border-radius: 10px; padding: 2px 10px 2px 10px; margin: 0px;">'''Forum'''</span>] | : [https://www.battleactsmain.ca/vanillaforum/categories/ibc-flood<span style="font-size: 12px; background-color: lightgrey; border: solid; border-width: 1px; border-radius: 10px; padding: 2px 10px 2px 10px; margin: 0px;">'''Forum'''</span>] | ||

==POP QUIZ ANSWERS== | ==POP QUIZ ANSWERS== | ||

Latest revision as of 00:41, 7 July 2022

| Important Information Added July 7, 2021: See Study Tips below. |

Reading (2019): “Options for Managing Flood Costs of Canada’s Highest Risk Residential Properties,” June 2019, pp. 1-36.

Reading (2015): “The financial management of flood risk,” 2015

Author: Insurance Bureau of Canada

Contents

Pop Quiz

Study Tips

|

Sept. 27, 2021 Update: The CAS has clarified that both flood readings are currently on the syllabus. |

There's good news and bad news. I'll start with the bad news:

- This reading has a lot to memorize and it's going to take significant effort to do it.

But here's the good news:

- Based on past exams, this is a high-ranked reading and is virtually 100% certain to appear on the exam. That means your efforts will not be wasted.

Even though new exams are not currently being published, the relative importance of flood insurance within the syllabus has not changed. Unfortunately, the new source text, introduced for 2021.Fall, is quite different from prior versions, so old exam questions won't always be relevant anymore. (I'll point out when they are.) This isn't as big a problem as you might think, however, because questions on flood insurance are very predictable. Even if the CAS throws in a weird Bloom's Taxonomy question, if you have a very solid grasp of the basic facts then you should be in good shape... but let me emphasize that you have to be extremely solid. People always tell me they thought they were prepared for a flood insurance question but when they got into the exam, they realized they hadn't spent enough time memorizing and everything got mixed up in their brain. Don't be one of those people!

Alice's pro-tip: As much time as you think you need to spend on memorizing, multiply that by about 5.

If you find yourself pressed for time, here's another gem from Alice...

Alice's life hack: It's a good bet that questions from this reading will come mostly from the Executive Summary.

What this means is that after you've studied the Executive Summary, which is pages 2-12 in the source text, you can cover the much longer section on Options for Managing Flood Costs of Canada's Highest Risk Residential Properties pretty quickly because a lot of it just repeats the executive summary. Alice and I have gone through that section looking for testable items that might not have been mentioned in the executive summary. The one item you must learn from the Canadian Considerations section however, is the preconditions for strong flood risk management. That question has been asked 3 times on past exams.

Web-based problems: I have created 3 web-based problems for the flood reading that drill you on basic facts. (These are not calculation questions.)

So that's it. This is not a difficult reading, just a lot to memorize. If you want to glance at the old exam problems from prior versions of the reading, click to go to the BattleTable for the old flood reading. (But don't spend a lot of time there.)

Estimated study time: several days (not including subsequent review time)

BattleTable

- No past exam questions are available for this reading.

- Refer to the BattleTable for the old flood reading to get a sense for the types of questions the CAS like to ask.

reference part (a) part (b) part (c) part (d)

In Plain English!

Executive Summary

Introduction

This paper considers options for transferring residential property risk from public sector disaster financial assistance programs (which are funded by the taxpayer) to private sector insurance solutions (which are primarily funded by the property owner.) The financial management of flood in high-risk zones is based on 6 principles. This is a very obvious candidate for an exam question. If you learn nothing else form this reading, learn these 6 principles!

Question: identify and briefly describe the 6 principles for the financial management of flood risk [Hint: SEA-FOI]

- Shield the taxpayer - reduce taxpayer-funded subsidies by encouraging private insurance market

- Efficiency - should be risk-based to incentivize risk mitigation among stakeholders

- Affordability - ensures maximum participation by high-risk insureds

- –

- Financially sustainable - reduce systemic losses to support sustainability

- Optimal compensation - insurance should be predictable & sufficient to reduce publicly funded disaster assistance

- Inclusivity - all primary-residence property owners should be covered for any type of flood risk

The SEA part of the hint is because the sea is filled with water and water causes floods. The FOI part of the hint doesn't mean anything - it just uses the leftover letters. If you can think of something better, post it in the forum. I will link to it and give you a shout-out. :-)

shout-out to meenuarora! Click for an alternate memory trick! → The Elegant Alice Is So Cool. 👸 shout-out to DeerBambi! Here's another alternate memory trick! → SEA-SCI 😏

If you stop and think about these 6 principles, you might see that some of them are in opposition to others. For example, affordability is improved by lower prices but efficiency is improved by higher risk-based prices. We want premiums to cover the risk but this may be unaffordable for low-income homeowners. Consequently, premiums may need to be capped. In any case, the government plays an essential role in any flood disaster risk reduction approach.

Question: identify and briefly describe the 3 prongs in Canada's flood disaster risk reduction approach.

- ELEVATE RISK AWARENESS/ENGAGEMENT

- → convey risk-assessment information to all participants during property development, transaction, financing and insurance processes

- IMPROVE RISK IDENTIFICATION

- → continuously updated public-facing risk maps

- AGGRESSIVELY MITIGATE RISK

- → discourage building in high-risk areas, incorporate natural infrastructure to lower maintenance costs

- I copied the above 3 bullet points directly from the source text but I'm going to rephrase them as follows:

- risk awareness

- risk identification

- risk mitigation

- When I write it like this, it forms a pattern that makes it easier for me to remember because I can clearly see that each point relates to "risk". First you have to be broadly aware of the potential for flood risks. Then you need a way to identify specific flood risks. Lastly, you need to take steps to mitigate these risks.

I think both of these are likely exam questions but you have to be careful. You must understand that the 6 principles relate to financial management while the 3 prongs relate to risk reduction. It would be easy to get them mixed up on the exam. Make sure you clearly understand the difference.

One last point to mention in this introduction is a term that appears several times: whole-of-society approach.

Question: describe the whole-of-society approach to financial management of flood risk and disaster risk reduction

- leverage government partnerships in infrastructure to reduce climate risk in the most exposed communities

- elevate risk awareness among consumers and businesses

- incent de-risking efforts among consumers and businesses

- enable insurers to introduce new products and premium structures to encourage responsible behaviour

I don't think a question asking you to describe the whole-of-society approach is as likely as the others, but you should at least be familiar with the term in case it comes up.

Options for Managing Flood Costs of Canada's Highest Risk Residential Properties

After reviewing international experience, stakeholders focused on 3 options to address the financial management of residential properties at high-risk for flooding. The options can be considered as being along a spectrum from low intervention (pure market option) to high intervention (flood insurance pool.) Note that these options don't provide immediate solutions but must be in place over decades to achieve the desired results. A key element in any option should be to incent governments, insurers, and consumers, to reduce flood risk by rewarding behaviour for doing so.

- → Alice thinks we should all get a 🍩 for making sure our properties have good drainage. :-)

Let's identify the 3 options then examine how they work and evaluate them with respect to the 6 goals of financial management of floods.

(I will bet you a dozen donuts that you'll be asked to list these options on the exam.)

Question: identify the 3 options for the financial management of floods

- option 1: pure market solution - risk borne by homeowners

- option 2: evolved status quo - risk borne by blend of homeowners, governments through DFA

- option 3: high-risk flood insurance pool - risk borne by blend of homeowners, governments through capitalization (not DFA)

Now let's look at the details of each option:

Option 1: describe the pure market solution (to financial management of flood risk of residential properties)

- homeowner choices are: self-insure, purchase private insurance, relocate out of flood-prone area

- government DFA programs provide no coverage (Disaster Financial Assistance)

- private insurance premiums are risk-based:

- → premiums would initially be unaffordable for many

- → government infrastructure development and targeted buyouts of high-risk properties over time would lower costs and improve affordability

- → government could also introduce means-tested subsidies to increase participation rates

- international experience shows these disadvantages:

- → Australia - participation rates are low among high-risk properties due to high costs

- → Germany - government was pressured into providing disaster assistance after major floods despite stated policy

Option 2: describe the evolved status quo solution (to financial management of flood risk of residential properties)

- private insurance premiums are risk-based (private insurers accept flood risks according to their risk appetite)

- government DFA programs provide some coverage, specifically to uninsured high-risk properties where coverage was unaffordable

- → but provincial DFA programs vary greatly among provinces so DFA compensation is not predictable

- → DFA programs also do not provide incentive to homeowners for risk-mitigation

- DFA involvement does provide incentive to government to engage in risk-mitigation which broadly lowers risk so that private insurance can accept most/all risks

- international experience:

- → U.S. & Mexico - government reduces exposure by transferring some of the risk to global (re)insurance markets

Option 3: describe the high-risk flood insurance pool solution (to financial management of flood risk of residential properties)

- build a high-risk flood pool of properties that would not otherwise be offered affordable insurance

- shared public-private partnership (administered by insurance industry but governed & guaranteed by government/global reinsurance market)

- → high-risk property-owners could be offered overland flood coverage through their existing insurer

- → insurer decides whether to keep the risk or forward it to the pool

- → insurer collects premiums and remits to the pool (provides a source of capital to the pool)

- → other sources of pool capital: governments, homeowner levies, municipal property tax levies

- premiums should be risk-based but could also be capped & subsidized to ensure participation

We're going to come back to option 3 a little further down but let's step back for a moment and evaluate these options against the 6 principles: SEA-FOI.

Evaluating the 3 Options

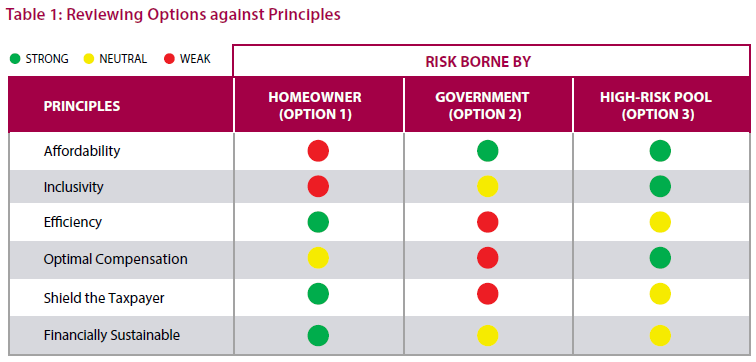

Here is a very nice table from the source text summarizing the strengths and weaknesses of each option with respect to the 6 principles: SEA-FOI. Note that the mnemonic hint shows the principles in a different order from the table. Sorry if that's slightly confusing. Recall however that the letters are reordered to spell a sort-of word to aid your memory. You should memorize this table but there is a web-based problem in the quiz to help you with that. You're welcome. :-)

Just a quick glance shows that the high-risk pool (option 3) performs the best overall. That's the reason we're going to look at it in a little more detail. It has:

- 3 green dots - Affordability, Inclusivity, Optimal compensation

- 3 yellow dots - Efficiency, Shield the taxpayer, Financial sustainable

- no red dots

Note that based solely on the green/yellow/red indicators in the table: (shout-out to SR!)

- option 3 is the best (high-risk pool)

- option 2 is the worst (evolved status-quo)

- option 1 is in the middle ( private market )

In any case, you should be able to explain why each option is given it's particular score. Explanations are provided below the table but they are mostly self-evident. If you understand how each option works, you'll be able to explain their strengths and weaknesses.

For option 1: pure market solution

- Since premiums are risk-based, premiums for high-risk residential property owners are likely unaffordable for many so this option is not inclusive.

- But risk-based premiums are what make this option efficient and financially sustainable.

- And since DFA provides no coverage, taxpayers are shielded.

- Compensation may not be sufficient however so this option would likely have sub-optimal compensation

For option 2: evolved status quo

- private insurance premiums are risk-based:

- → affordable for low & moderate risk property owners

- → not affordable for high-risk property owners but they would then be covered by DFA

- → overall, this option is considered affordable

- mixture of risk-based premiums and variability in provincial DFA coverage has these negative effects:

- → inefficient

- → sub-optimal compensation due to provincial DFA variability

- → taxpayer is not shielded because of DFA is funded by taxpayers

- mixture of risk-based premiums and variability in provincial DFA coverage has these neutral effects:

- → not fully inclusive because insurers accept some but not all risks

- → not fully financially sustainable because DFA coverage is not supported by risk-based premiums

For option 3:

- private insurer offers overland flood coverage through existing HO policy to all risks but insurer can choose to forward high-risk policies to the pool

- → so affordable coverage is provided for all high-risk homeowners in Canada

- → all homeowners are covered, either by their insurer or by the pool, so this option is inclusive

- → compensation relies on insurance, not DFA, so compensation should be predictable & sufficient and therefore optimal

- premiums may vary by limits, deductibles, or subsidies so efficiency can vary and receives a neutral rating

- → recall that efficiency relates to incentives for risk reduction

- → for example, higher limits may reduce incentive to mitigate risk

- capitalization beyond premiums may be required

- → taxpayer is not fully shielded if government contributes to capitalization (so shielding taxpayers receives a neutral rating)

- → not fully sustainable by premiums (so sustainability receives a neutral rating)

Stages of Capitalization for the High-Risk Pool

This is a short discussion of something I think is a likely exam question. I left it until now because there were already so many details to memorize and I didn't want this to get lost in all that detail. The issue that when a high-risk pool is first established, it won't have any capital. We touched on the capitalization issue earlier but here we make it explicit.

Question: briefly describe the 2 stages of capitalization necessary with the creation of high-risk pools

- Stage 1: Initial Capitalization

- → the pool initially requires outside capital over a transition period before becoming self-sufficient from premiums

- → capital can come from: government contributions, levies on homeowners & municipal ratepayers

- → contributions are temporary until the pool becomes fully capitalized

- → during this temporary period, governments could pay all incoming claims (to limit drawdowns on pool capital)

- Stage 2: Low-Maintenance Capitalization

- → the pool requires ongoing low-maintenance capitalization to offset subsidies from capping premiums

- → capital can come from: government contributions, levies on homeowners & municipal ratepayers

I think you just have to memorize that. And pay special attention to the last point in stage 2. I think another good exam question would be as follows:

Question: how can we reduce the burden on governments & taxpayers in maintaining capitalization of high-risk flood pools

- reduce subsidies for high-risk insureds by offering lower-priced policies with lower limits and/or higher deductibles

- (premiums would still be risk-based)

Options for Managing Flood Costs of Canada's Highest Risk Residential Properties

Mandate

There is no testable information in this short section.

Issue

Climate change is making floods more frequent and severe. The government is concerned with lowering public safety risk as well as personal financial risk of Canadians living in high risk areas.

Flood Disaster Risk Reduction and a Desired End State

This section repeats the 3 prongs in Canada's flood risk disaster risk reduction approach from the Introduction. The authors note that we are decades away from the desired end state regarding flood risk reduction. We better start immediately, if not sooner! 🤪

Canadian Considerations

Some background:

- Most homeowners are at risk for damage arising from sewer backup, rain damage, burst pipes, and these are often offered as endorsements on homeowners policies. The type of flooding that has been generally uninsurable however is overland flooding and HO policies have historically excluded coverage for this. That means taxpayers, through DFA (Disaster Financial Assistance program) have typically borne the costs of overland flooding. About 90% of this cost is for rebuilding infrastructure, with the remaining 10% for compensation of residential losses.

- Note that the source text sometimes refers to DFA and sometimes to DFAA. It's the same thing. The full name is Disaster Financial Assistance Arrangements.

- In 2015, improved flood models became available for much of Canada and now 34% of Canadians have coverage for overland flooding. There are 3 types of overland flooding:

- → fluvial/floodplain flooding - when a river overflows its banks ← easiest to model (because it's correlated with topography)

- → pluvial/urban flooding - when heavy rainfall overwhelms urban drainage systems ← difficult to model

- → coastal flooding - when a storm surge floods coastal areas ← difficult to model

A likely exam question:

The following item from this section has appeared on multiple past exams:

Question: identify preconditions for a establishing a strong flood risk management. [Hint: AIM$]

- Awareness among policyholders - of risk, risk mitigation, financial management of flood risk

- Infrastructure - levies, sewers,...

- Maps of flood risks - for planning & management

- $ - government compensation should be limited to incentivize risk mitigation among policyholders

In my head, I hear the hint as AIMS because I read the '$' like an 'S'. Just like Alice's good friend Ke$ha.

Anyway, here are 3 old exam problems that asked this exact question:

Regarding the Infrastructure precondition, we should consider the cost-benefit relationship between the capital needed to fund rebuilding versus the capital needed for infrastructure investments needed to reduce risk. In other words, we shouldn't overspend on infrastructure when the cost of rebuilding might be lower. The best solution, however, is to encourage building in low flood risk areas.

Here's an old exam question that asks you to evaluate different infrastructure options for flood risk management. I don't think this is a well constructed question but it gives an idea of the type of practical question that might be asked. Nothing like this is covered in the source text so you have to apply your flood risk knowledge to a new situation.

- E (2017.Spring #10)

I created a somewhat easier version of of that problem to help you get a better grasp of how to approach it. You should keep in mind the goals of a flood risk management system, especially affordability and sustainability.

SimFlood - a simple Excel flood management simulator (click to download then open in Excel)

And here's a short and easy quiz!

Disaster Financial Assistance in Canada

Here's the big picture regarding Disaster Financial Assistance in Canada: (References to provinces apply to territories also.)

- Provincial governments have a responsibility for disaster management.

- The federal program, Disaster Financial Assistance Arrangements (DFAA), reimburses provinces for some of their disaster response costs.

The federal DFAA program helps provinces and territories support disaster recovery through financial assistance to property owners.

Question: identify the main eligibility requirement for a homeowner to receive financial assistance in a disaster

- damage was due to an event that could not be insured

In other words, if insurance is readily and reasonably available then disaster assistance programs do not cover the damage. Ontario however is an exception. Ontario may still cover what are considered essential losses even if appropriate insurance was available to the homeowner.

Principles

Nothing new here. This short section simply repeats the 6 principles of financial management of flood risks.

International Review

The University of Waterloo and the Geneva Association conducted an international review and found that approaches to handling flood risk varies from country to country. We touched on international experience earlier in the wiki article in the section Options for Managing Flood Costs of Canada - Highest Risk Residential Properties. There source text covers this topic very lightly but here are a few factoids:

- Australia has a risk-based private market and many high-risk homeowners do not purchase flood insurance because it's too expensive.

- The U.S. has their National Flood Insurance Program. It provides coverage to high-risk customers who would not be able to obtain affordable coverage in the private market. It is currently funded by the government but the long-term goal is to move to a risk-based funding model.

- The Netherlands focuses very heavily on mitigation because a large portion of the country is at significant risk of floods. The goal is to transition all communities to risk levels that are insurable.

- The U.K. has a program called Flood Re. It's long-range goal is to mitigate flood risk so that high-risk regions can transition into an affordable risk-based system by 2039.

Options

The 3 options for the financial management of floods were discussed earlier in this wiki article in the section Options for Managing Flood Costs of Canada - Highest Risk Residential Properties. There is no new information but the source text has a nice summary of each option which I've copied below:

| OPTION I – PURE MARKET SOLUTION - RISK BORNE BY HOMEOWNERS |

- Private residences would no longer be covered by DFA programs and homeowners either self-insure, move, or transfer their flood contingent liability to the private insurance market. There are no subsidies in place to create perverse incentives and premiums are risk-based, which may mean that a portion of high-risk homeowners will opt out of the insurance market. As the government invests in adaptive infrastructure and targeted buyouts of immitigable properties, insurance becomes more available and affordable. To increase take-up rates, the government could consider introducing means-tested subsidies through taxation-based voucher programs or other mechanisms to ensure that vulnerable populations are not ‘left behind’.

| OPTION II – EVOLVED STATUS QUO - RISK BORNE BY BLEND OF HOMEOWNERS AND GOVERNMENTS |

- In this option the private sector takes on as much contingent liability for flood as its risk appetite allows, while leaving the highest risk properties, where premiums would be unaffordable, to be covered ex post by government DFA programs. To somewhat reduce the government’s exposure, this option could be augmented by transferring some of the government’s risk to the global re-insurance market, similar to what the United States and Mexico are doing with portions of their own DFA programs. To do so, the government would need to define its risk appetite and leave re-insurers to take on the excess loss up to a pre-defined maximum liability, with anything in excess being borne by taxpayers. Although the government would continue to bear some of the risk, the re-insurance option would provide a buffer, making DFA-type disbursements more predictable from budgeting/accounting perspective. Note that the greater the number of jurisdictions participating, the lower the relative premium due to risk diversification. Reinsurance premium reductions may also be used to reward desired government behavior, such as making public investment in infrastructure investments to de-risk priority areas. This option is the one that received the least amount of attention amongst Working Group members as it is the closest we have with the status quo.

| OPTION III – CREATE A HIGH RISK FLOOD INSURANCE POOL |

- This solution involves creating a high risk flood pool of properties that is managed separately from what is considered normally insurable risk. The pool is run in a shared public-private partnership – administered by the insurance industry but governed and guaranteed by the government/global reinsurance market. The pool would need sources of both pre-capitalization to get the pool up and running and ongoing capitalization to subsidize the difference between true risk pricing and premium caps needed to assure affordability. The pool could be precapitalized either through a fund contributed to by governments, similar to how the Caribbean Catastrophe Risk Insurance Facility (CCRIF) was set-up, and then be supported by premiums paid into the pool and levies assessed on all homeowners or, if feasible, municipal ratepayers. In the meantime, claims could be paid out through federal and provincial disaster assistance programs. Ongoing capitalization could be paid by levies and/or through government contributions. Ongoing capitalization must be structured to ensure that all actors are incented to reduce the size of the pool over time.

Options Assessment

This section is a much more detailed version of what was presented in the executive summary in the subsection Evaluating the 3 Options. Since this is a high-ranked reading, it might be worth taking 30 minutes to read this section in the source text. I think the most important points to pay attention to are the strengths and weaknesses of each of the 3 options. These were neatly summarized earlier the a table with green, yellow, and red dots but here is a verbal description:

| Assessment: OPTION 1 – PURE MARKET SOLUTION - RISK BORNE BY HOMEOWNERS |

- key strength

- → efficiency in leveraging market incentives to encourage de-risking behaviours

- key weakness

- → potential for property owner to avoid being subject to these incentives

- (Ex: In Australia, many high-risk property owners simply do not buy flood insurance because it's expensive)

- → potential for property owner to avoid being subject to these incentives

| Assessment: OPTION II – EVOLVED STATUS QUO - RISK BORNE BY BLEND OF HOMEOWNERS AND GOVERNMENTS |

- key strength

- → simplest to implement as it does not require any major change to the current system

- key weakness

- → expensive and not fiscally sustainable

| Assessment: OPTION III – CREATE A HIGH RISK FLOOD INSURANCE POOL |

- key strengths

- → allows for a transition to building more climate resilient communities

- → promotes risk-sharing among property owners, private insurers and all levels of government

- → delivers insurance payments rather than public assistance

- key weaknesses

- → setup & operation of the pool is expensive

- → setup & operation of the pool may take many years because of negotiations required among federal government, provinces, and territories

Conclusion

Alice asked Ian-the-Intern to write a summary paragraph but he got lazy and just copied the summary paragraphs from the source text! Actually, the source text summary it pretty good. You don't have to memorize anything from it. Just read it over. Here it is:

- This study explored a range of financial solutions for residual risk properties. Clearly, stakeholders should collaborate to reduce communities' financial vulnerability in the immediate term and to provide them with enough time to lower their risk profile over the longer run so that market solutions become accessible. Any of the financial management mechanisms presented needs to be paired with necessary spending in physical risk treatment measures (e.g. mitigation, maintenance, exposure reduction, and strategic retreat) to contain, if not decrease, the number of dwellings that falls in the high-risk category in order to achieve the desired end state.

- The desired end-state will reflect an overall reduction in flood risk and will foster a whole-of-society approach to building resilience. Targeted investment in climate action and disaster mitigation that includes flood risk reduction will result in fewer Canadians living in high-risk zones with better access to affordable insurance.

| Note the emphasis on transitioning to market-based solutions and the whole-of-society approach. Managing flood risks is a tough problem and we all need to work together! |