DPAE & PDR Treatment in P&L

Hi,

I see from the return that PDR will result in the Premium Deficiency Adjustment, but how about the DPAE.

If it dropped, does that mean the acquisition expense increase? If so, would it reflect an increase as Gross and Ceded Acquisition Expense? Just want to confirm.

Thanks and Warm Regards,

Wilson

Comments

The DPAE is an asset that recognizes prepaid expenses over the policy period as long as these costs are recoverable from the equity in the net UPR.

A lower DPAE to put it simply means there is less "profit" in the UEP.

If you have negative equity in the UEP, then DPAE is necessarily 0 and we would book a premium deficiency instead.

There's no gross or ceded version of the DPAE as far as I am aware

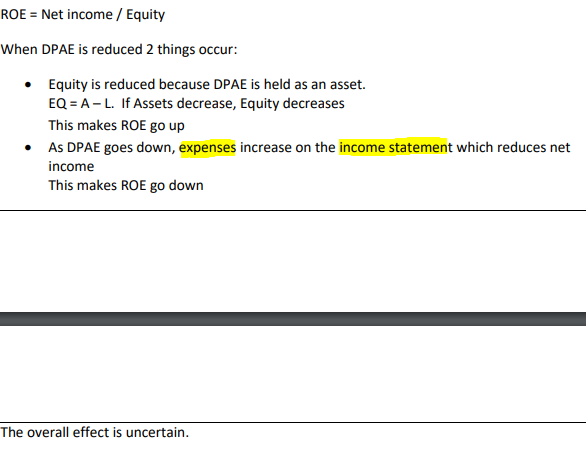

Yes, agree. I raised out this question is that when I look at 2019Spring Q14 c, they are asking the ROE impact, and they mentioned decreasing the DPAE will make Net Income less, and I am just thinking in which P&L Account it could be reflected:

I think this would go under the expense section. Less DPAE = more expenses (Generally although not always)