2017 Spring Q21

Hello,

Does anyone know why the new risk margin for operational risk is calculated as below?

It looks like you're new here. If you want to get involved, click one of these buttons!

Hello,

Does anyone know why the new risk margin for operational risk is calculated as below?

Comments

Since change in common shares doesn't affect DWP, AWP, CWP, I was expecting it to only affect the cap, so I expected it to stay the same.

Thanks!

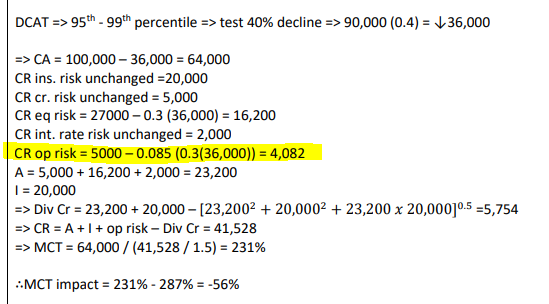

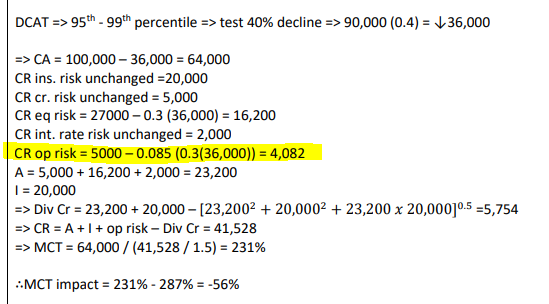

Note: My answer looks long and complicated but that's only because I wrote out everything in detail. It all boils down to recalculating the equity risk component of market risk (because of the decrease in stock value) and feeding that back into the formula for operational risk.

For reference, here is the quiz that has the web-based problem and formulas for operational risk. (It's BattleCard 6.)

The key observation in this problem is that the the value of stocks decreases by 40% which works out to 36,000. Now, the formula for the capital required for operational risk is:

You don't need to worry about the 30% x CR(0) cap because the problem specifically tells you the uncapped margin is less than 30% x CR(0) anyway. Now, the reason the capital required for operational risk changes is that this term changes:

These are the "A" components:

They all stay the same except for the first one, (Risk factor) x CR(0), so that one has to be recalculated. Recall the formula for CR(0):

And CapReq(MktRsk) will change because remember Mr. IFER! Market risk consists of the components: Interest Rate Risk, Foreign Exchange Risk, Equity Risk, Real Estate Risk. In this scenario, equity risk changes. Here's the formula for equity risk:

Recall C/S stands for Common Shares, so if commons shares decreases by 36,000, then the capital required decreases by:

But you then also have to multiply this by its risk factor in the operational risk formula, which is 8.5%. So the total decrease in operational risk is:

Since we started with 5,000, the final value in the adverse scenario is:

Thank you Graham! This is super helpful!

You're welcome!

Hi, come across this question from the top question quizlet, however I never recalled learning about this in battleacts or MCT reading. Wondering if this is an outdated material? Specifically, do we need to memorize different risk factors for AWP/DWP/CWP? Thank you!

No it is not outdated. It is in the MCT operational risk section. No need to memorise the factors, I have seen them provided in every single MCT question in the past