IFRS Reinsurance Recovery Risk

in CIA.IFRS17

Hi Graham, I am a bit confused on how reinsurance recovery risk can be applied in calculating contract liabilities. Should it be applied in expected cashflows or can be part of the RA? Please see highlights in green. Would you please be able to help me clarify. Thanks

Comments

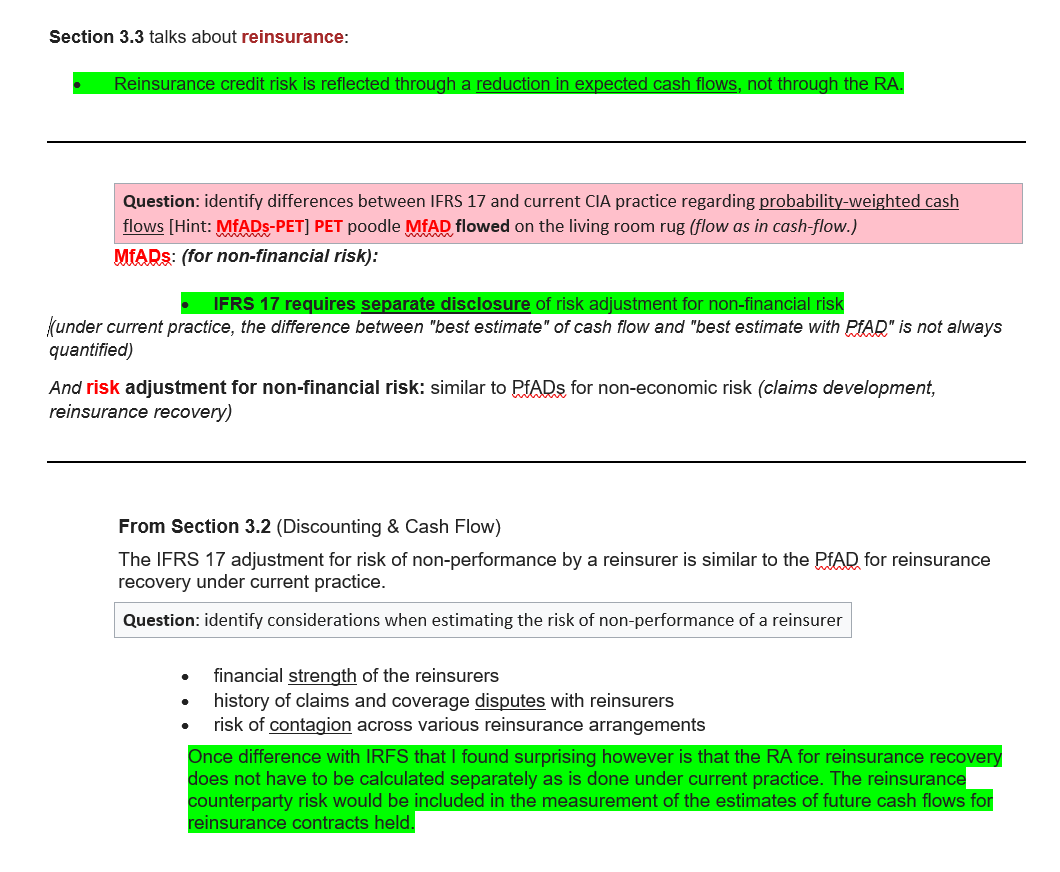

This is all a little confusing because these methods are new and none of the readings has a complete example of the whole process. It seems that one reading says that reinsurance risk is part of RA (Risk Adjustment) for non-financial risk, and is calculated separately. But elsewhere it says reinsurance credit risk is not reflected in the RA, rather it is reflected in a reduction in expected cash flows. So which is it? These statements seem contradictory. I did some further research using non-syllabus documents and this is what I found:

So the reinsurance contract creates 2 separate calculations:

This would resolve at least part of the issue you raised in your post. Regarding exactly how the cash flows are reduced to account for reinsurance credit risk is not discussed in the syllabus readings.

For the RA part, there are different methods for calculating the RA for non-financial risk which are discussed here:

To the best of my knowledge, based on the available information, that's generally how it works.

thank you!