PACICC Limits

in PACICC.Comp

The limit for auto is 250k, the limit for personal property is 300k. But the link below states that the limit for auto is 400k and for home is 500k. For unearned premium, the maximum is 250070% in accordance with the link below, but the prior exams say it is 100070%. With which limits would you recommend to go?

http://www.pacicc.ca/industry-information/coverage/

Thank you in advance!

Comments

I have clarified this, thx!

Can you please confirm if the 500k limit for home claims and 400k for auto is the per claim limit? or it's per policy?

Neither, the limit is per occurrence. Here's the relevant section from the source (with old limits):

So if you have multiple claims arising from a single occurrence, the limit applies to the total, but for multiple occurrences on the same policy you get the limit on each.

Just to confirm, the current reading for PACICC still contains the old limits?

We won't be penalized if we use the new limits correct? 400K Auto and 500K Homeowners and 2500 Unearned Premium.

From syllabus:

I don't think you will ever be penalized for quoting up-to-date material that is more recent. It would just not make sense

I believe there was a comment in an examiner's report (can't remember which year or question) that stated something to that effect: If a candidate answers based on current information, they will receive credit even if it contradicts the official syllabus reading.

Does the new limit still applies if the dates are prior to 2021?

For example the date of incident is in 2019, claim is still being paid out but the insurer becomes insolvent in 2024.

Since the date of incident is before 2021 but insolvency happened in 2024. Should we use new limit or old limit?

Alternatively if the insolvency also happened in 2019, but we didn't know about the claim until we got sued in 2024 for an auto accident. How would that play out?

You'd always use the actual latest limit in real life. But for exams Im guessing either would be fine

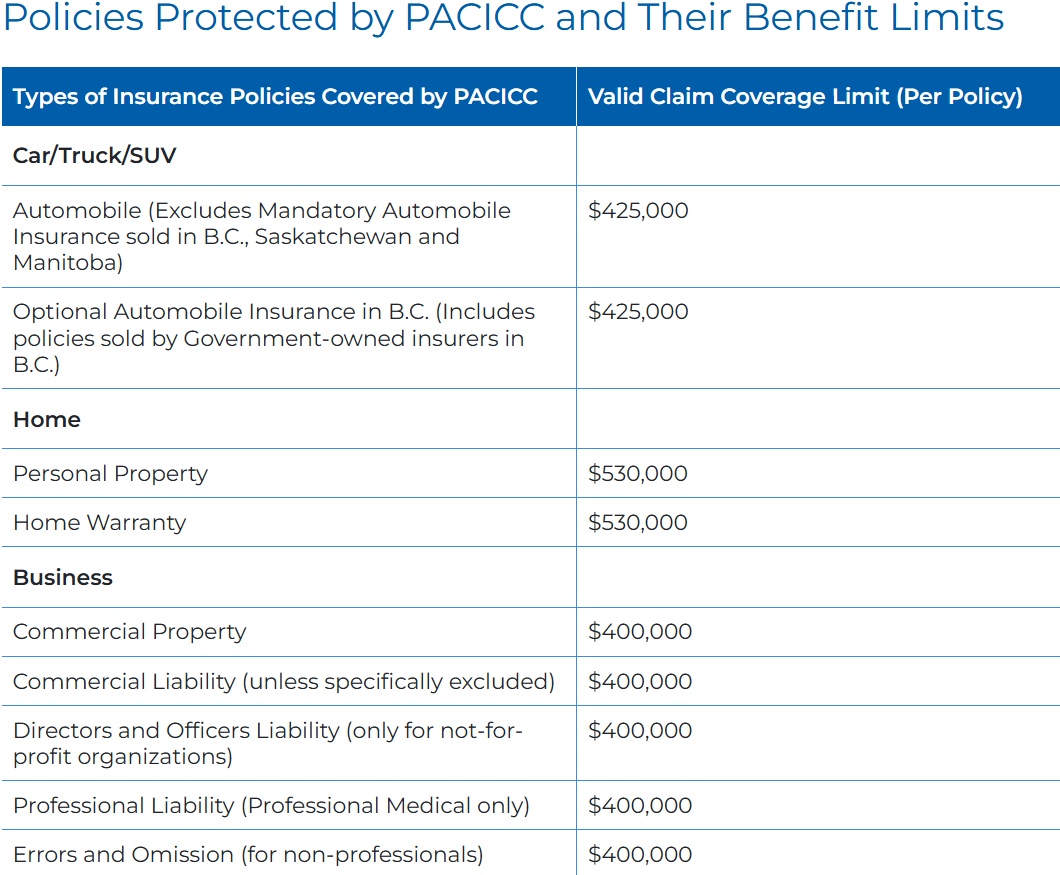

Hey @graham it looks like PACICC has once again updated their limits.

In the original paper, as AnLaPe noted, the limit was per occurance. In the above screenshot it looks like the limit now applies per policy? Does this mean we would aggregate claims in applying the limit now? Or am I interpreting this wrong and we should stick to the old approach

Thanks for pointing that out. We missed that because the content outline did not list this reference as "NEW".

But yes, it does appear that PACICC coverage now applies on a "per-policy" basis, which indicates a shift from the original "per-occurrence" limit. So you're correct in that now the limit should be applied to the entire policy rather than each occurrence. Therefore, claims might now need to be aggregated under the policy's total coverage limit.

It isn't clear when this change was made however because the web page itself doesn't list a specific date other than the year "2024". And to reiterate, the content outline did not list this reading as "NEW" so it isn't clear whether this update applies to the 2024-Fall sitting.

If a question of this type appears on your exam for 2024-Fall, I would mention this in your answer and then do the calculation on a "per-policy" basis, just in case the graders expect you to use the new method.

Unfortunately, you probably also have to memorize the new per-policy coverage limits but luckily there are only 3 to memorize:

And then everything else has a limit of $400,000.

Seams like the limits were updated once again.

Thanks! I have updated the wiki - I think they probably change this every year cause of inflation