Investment Return (40.74 vs. 20.22)

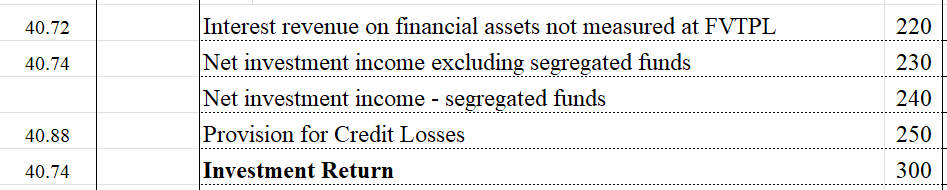

On 40.74, IR = NII - Provision for Credit Losses

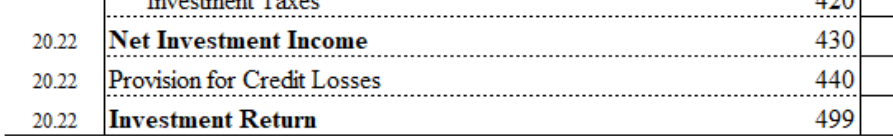

On 20.22, the Investment Return is surrounded by additional items:

I wanted to understand how the following incorporated into the calculation:

- Interest revenue on financial assets not measured at FVTPL

- Net investment income excluding segregated funds

- Net investment income - segregated funds

Furthermore, how do the formulas reconcile between 40.74 and 20.22?

Thanks ![]()

Comments

Interest revenue on financial assets comes from 40.72

Both the net investment income items comes from page 40.74. I think the allocation of the sub items between segregated funds and non-segregated funds is an accounting thing and is not needed for this exam

Thanks for your reply. I'm still unsure on this. It seems to me that:

40.74.499 "Investment return" is fully done on 40.74 as sum of line items:

On 20.22, Investment Return isn't actually calculated - it's just equal to 40.74.499 (Investment Return).

An implication of above: Suppose we are given all the values on 40.74, but we are also given "Interest revenue on financial assets not measured at FVTPL", "NII excl SF", "NII - SF". To calculate Investment Return, we would ignore these additional three values.

Please let me know if this all correct. Thanks again.