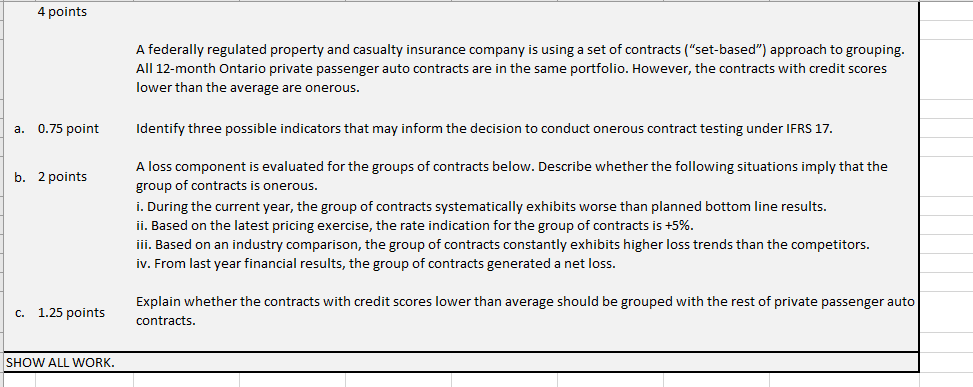

Sample Question 19

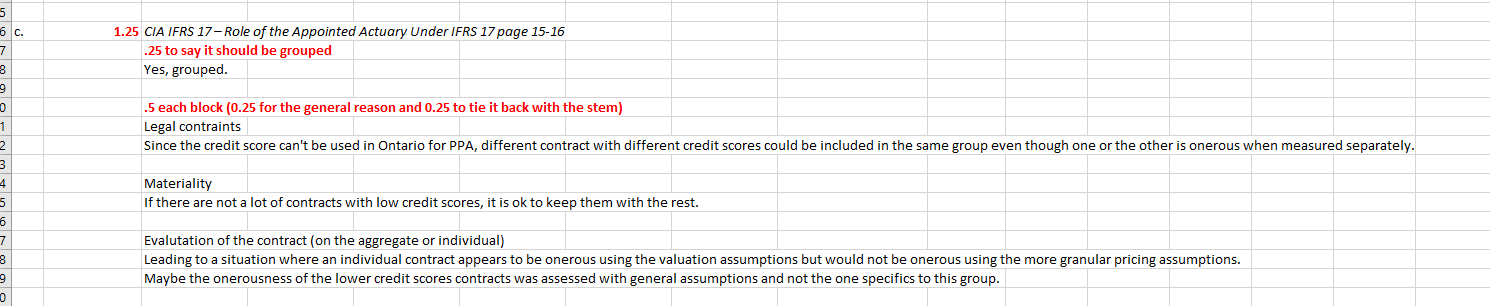

For this question part C

I don't understand why we can group them.

For Auto LOB, you can't legally use credit score for rating, so why are we allowed to group them together? Is grouping different from rating? When they say grouping, does it just have to do with how it is reported? Or does it have to do with classification and setting rates? If its for setting rates, how can we use credit score as criteria for grouping?

Comments

Grouping just refers to ensuring similar risks are placed together. If credit score isn't a factor for rating, then why shouldn't they be grouped together as they'd be seen as virtually identical? Grouping depends on classification, to the extent that it will identify cohorts that are onerous and is a main factor for reporting.

I suggest you reread the measurement considerations under ifrs17 which explains what groupings and level of aggregations are.

Thanks @Staff-T1, really appreciate you answering questions on the weekend! Last push for us haha.

Also for part B.

I just noticed that the first line says "A loss component is evaluated in for the group of contracts below"

Since a loss component was already evaluated, wouldn't that automatically mean they are all onerous since there is a loss component?

Also follow up question for Part C. It was stated in the wiki that:

In this case the group with lower credit score is onerous, shouldn't we not group it with the rest of the PPA contracts?

Since groups need to separate onerous and non onerous?

Do you see this as a fair argument. It doesn't relate to the IFRS 17 AA paper that the solution refers to:

In jurisdictions where credit score is permitted as a risk classification element that any increase in claim costs due to low credit score would be reflected in premiums and there would be no reason to believe that low credit score contracts are more likely to be onerous. In Ontario PPA where credit score is a prohibited risk classification element, increased claim costs may not be reflected in premium and this may indicate that below average credit scores are more likely to be onerous thus we would want to group them separately.

Where credit score is permitted, to the extent that difference in costs are fully reflected in differentials then yes, they are not more likely to be onerous.

Yes, your argument would work if credit score is prohibited. Honestly, if it is a prohibited rating element, you'll probably have difficulty getting consent to pull credit scores, which will mean you won't have much data anyways