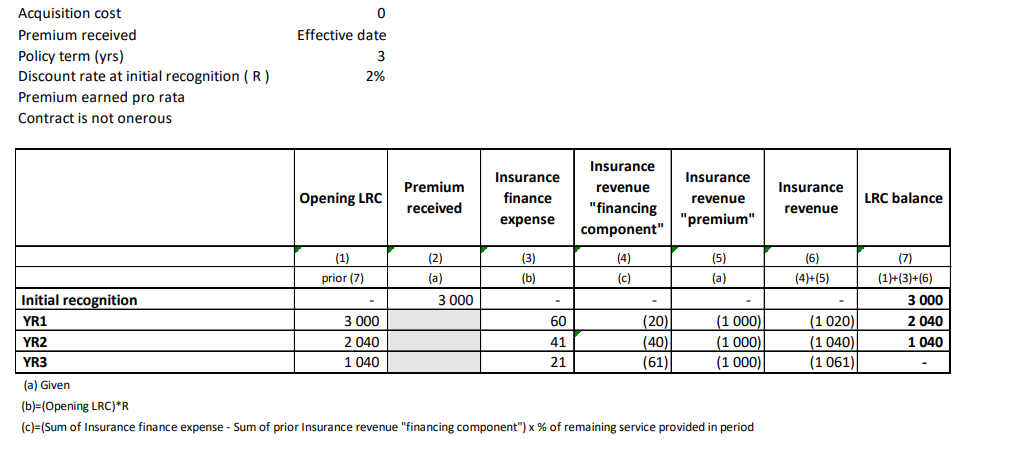

Financing Component - Page 34 to 35 and Sample 7 in CAS IFRS 17 Questions

Hello,

I am having a bit of a hard time understanding what the calculations are doing with regards to the Insurance Revenue Financing Component Column:

For Yr 1 it makes sense. You collected premiums early from the policyholder and you used it to finance your activities. Thus at the first year you recognize the finance revenue portion based on how much service you provided

Yr 2 onwards it starts getting confusing, why are we including prior insurance revenue from financing component? What does this calculation imply? Also why do we multiply by the cumulative service provided instead of the marginal service provided from year to year?

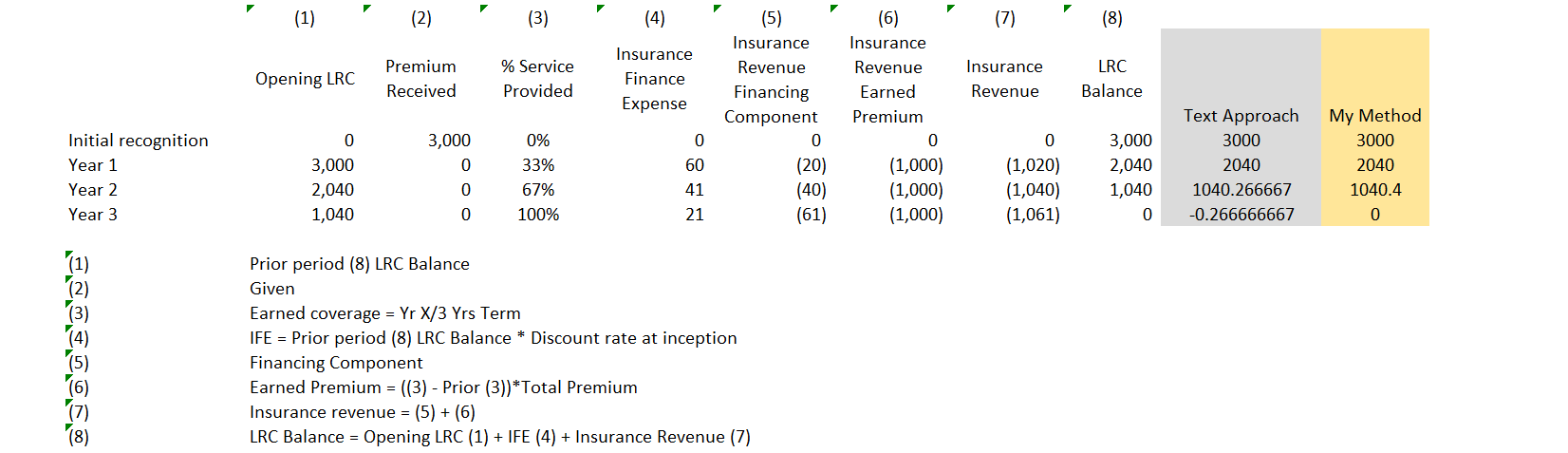

A more intuitive approach to me would have been:

Initial Recognition: Leave it as is

Yr 1: Leave it as is

Yr 2: Insurance Revenue Financing Component = (60)/3 + (41)/2 -> Here we are amortizing another (20) from Yr 1 Finance Expense as we complete another 1/3 of service while also amortizing the "new Finance Expense" of 41 over the next 2 years of the remaining contract

Yr 3: Insurance Revenue Financing Component = (60)/3 + (41)/2 + (26) -> Similar to Yr 2, we amortize final portion from Yr 1 and Yr 2 Finance Expense and we also recognize the final Finance Expense from Yr 3

Surprisingly the text approach doesn't give exactly 0 for LRC balance at Yr 3 whereas my method does give exactly 0. Can I use my method?

Comments

Actually, I've posted my own Excel version of this problem with a step-by-step solution and 4 extra practice problems. Both the source text and the CAS sample solution have errors. You can download it from this wiki page:

(It's the orange highlighted link in the first table.)

Thanks for this Graham. I had a chance to review the LRC question you posted specifically and it seems mathematically my approach does match yours. Conceptually it just makes sense that you amortize the financing component over the remaining period which helps me remember the process better:

Hopefully that particular problem is all wrapped up then!

Quick question: Is it right to say that the Financing Component is like the "Recognized revenue on interest" (including from previous period) ?

Which is why in the end it is deduced from LRC@start.

Of course I'm probably oversimplyfing thing, but is completly wrong to think of it that way?

Also, does the Insurance Revenue have to be negative in the table? The formula in the text for the subsequent LRC subtract the amount of revenu recognized so I though of having the amount of Revenue positive, but at the end we subtract it instead of adding it. Or is it mandatory according to the IFRS17 to have the Revenue as a negative amount?

For groups where a significant financing component exists, the financing component would reflect the time value of money associated with the mismatch in the timing of premium receipts and the service provided for that portion of the policy at each measurement date. The financing component is the interest you are earning on the pre-payment of premium before service is provided. This interest needs to be earned, similar to premium. The deduction at the start is because you have "earned" 1/3 of the interest component, similar to how you would deduct EP from your PAA LRC.

I am not really familiar with what you mean by "recognized revenue on interest"

Well PAA is Prem Received - EP - DAC. Why wouldn't it be negative? It is just semantics whether it is subtracting a (+EP) or adding a (-EP)

" This interest needs to be earned, similar to premium. The deduction at the start is because you have "earned" 1/3 of the interest component, similar to how you would deduct EP from your PAA LRC."

This is exactly what I meant by recongnized revenue on interest!

Concerning the other question, I know indeed that it is just semantic, but I was wondering how much the semantic was important. Is it a rule that we need to add (-EP)? Or as long as it is consistent, the CAS would probably give full mark?

Great! We are on the same page then

It is just semantic, as long as the logic is consistent, you will definitely get full marks

I notice in the question #7 that "Insurance Revenue Financing Component" is added to the earned premium. I guess that means they are both considered part of the Insurance Revenue.

However, in the formula from the text for LRC at subsequent calculation, "Adjustement to a Financing Component" is not the same sign as the Insurance Revenue. I guess they are just not the same thing, but do you have an idea what exactly is this adjustment to the financing component? Or is it the kind of thing nobody knows a thing about and we just hope it is written as is in the question?

That is strange - I cannot think of any other 'adjustment to financing component' besides what you mentioned. I think just memorising the formula and doing the calculations as per the Excel will suffice, given the paper doesn't go into much detail on that component of the formula