risk factor

What should we understand by risk factor in the FCT reading?

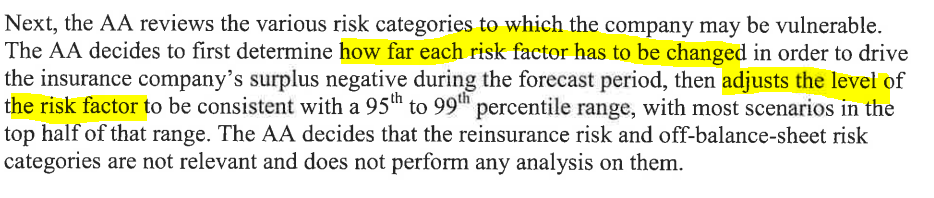

At first I thought it was something more qualitative like P&C risk category but by reading the paragraph below I'm wondering how AA adjusts the level of a risk factor, is it a number? Like the use of the term "risk factor in the MCT reading?

Or here for example it doesn't sound like something quantitative

Comments

Risk factors here refer to your projections related to ELR, GWP growth, inflation. For example, projecting that inflation will be 5% in 2024, 5% in 2025 and 3% in 2026 and looking at what impact that has on your balance sheet and MCT ratios

does that mean risk factor is the same concept in both FCT and MCT readings?

No, risk factors in the MCT are applied to unpaid claims , premium liab etc to get a capital required amount while risk factors in the FCT are more akin to sets of assumptions

P.S. I doubt the exam would ever ask you to perform a calculation related to reverse stress testing, although they have asked you to describe it in words. With no specific examples provided, there's not much more you can do.

The most likely calculation question on the FCT reading by far is to ask whether the company is in satisfactory financial condition. There are then usually a few short-essay questions on FCT and one of them could be to describe stress-testing in words.