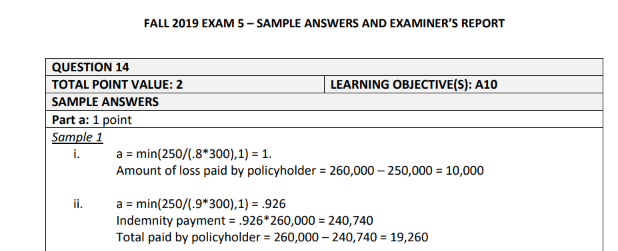

Fall 2019 Q14a)

Hi, this is very possibly splitting hairs, but (for my own understanding) the policyholder doesn't need to pay at the amounts above at the time of loss, correct? They would simply receive the amounts above less than the amount of loss, and it would be up to them whether or not to pay for the loss and when?

Comments

Well, yes. In this case, it looks like the house was a total loss so what would probably happen is that the homeowner would take the reimbursement from the insurer and then buy another house for some unspecified amount. Whether the new house costs more or less than the house that was destroyed and how much the homeowner would pay out of pocket is up to the homeowner.

But you didn't have to think through all that in this problem. They really just wanted you to do the standard calculation for the difference between the loss of $260,000 and the reimbursement under the insurance contract.

Ok thank you!