Deduction from capital available (F)

Why premium payable is not included in (F) in the MCT excel worksheet Problem #3 (see upload picture from 2024 MCT Guidelines)?

Thus, "premiums payable to the assuming insurer" of 145$ labeled as "A2" should be added back in F. Is that correct ?

Thanks,

Comments

It was split out to make it clearer as A goes into the deduction and LOC limit. However, this does not change anything

Thanks for your response.

I noticed something else. D (amount of receivable) should only be consider for Foreign branch (see the attached picture) in the deduction for both capital available and margin required.

Why, D was not forced to 0$ in the Problem #3 of the MCT workbook given that the question did not specifically state that the reinsurance receivables was coming from a Foreign branch ?

Thank you !

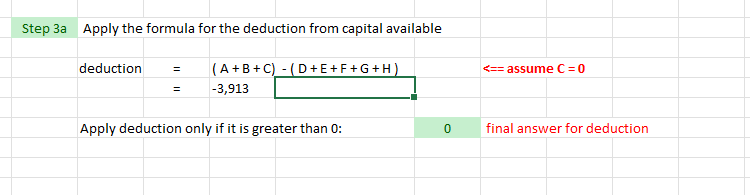

Hi, so I understand we deduct from capital avialable only when (A+B+C)-(D+E+F+G+H) is greater than 0. But My understanding is we only deduct it from the capital available amounts and its one of the "adjustments" that we make to capital available. In your excel problem for OSFI.MCT Capital Required, we are deductible the that amount from the capital required as well?

Hi Micky,

These are actually two different concepts.

It’s two different parts of the MCT. One is for capital available one is for margin

It is still unclear to me why Reinsurance Payable below is not included in F?

I would expect it to be summed with Other acceptable non-owned deposits as F is 'the amount of premiums payable and other acceptable non-owned deposits'. Could you elaborate?

No, I think you are right. F is supposed to include the words reinsurance premiums payable and other acceptable non-owned deposit, consistent with what's in the MCT. I'll fix that

Im still very confused because in the example in (4.3.3.2) , step 3a was calculating deduction from capital required (not capital available) for unregistered reins using the formula un-ded. Is this a typo? Then in the example in section (4.3.3.3), step3a was calculaing deduction from capital required using the negative of the formula un-ded.. I understand these 2 deductions are 2 different concept, but what is the logic behind the relationship of these 2 deductions?

Yes, it is a typo on 4.3.3.2 -> Basically the deduction to capital available can be thought of as a penalty because you don't have "as much" capital truly available since you are owed more from the reinsurer, than what is owed to him. Because of this, in the event of a reinsurer default you will be the one losing more money. The capital required is just something to penalize you for having unregistered insurance that is not fully backed by collateral

The number here in the solution is not the same as the question (highlighted in blue) in the excel practice problem:

**

Can you make it clear that one is for capital required and one is for cap required for this piece:**

I don't understand the signage.. in this file you have (A + B + C) - (D + ... ) > 0 then apply

OSFI.MCT_(043)_capital_available_deduction_unreg_re_v11

BUT,

in the other file OSFI.MCT_(044)_capital_required_unreg_re_v17 you have it the other way (D + ... ) - (A + B...) > 0 then apply deduction.

What is the sign suppose to be!

Not sure how that happened, but yes it should be 12900 for both the question and the answer.

The signs are supposed to be the opposite of each other in both files. You are looking at two different calculation files and two different concepts:

If collateral > receivables, then you don't need a deduction to capital available.

The idea is that the more capital available the better, and if your receivables are > collateral, this means that the quality of your capital is lower which means you need a deduction to that capital.

If receivables > collateral, then you deduct the capital required as you now owe the reinsurer more than he owes you, which means your risk is reduced leading to a lower capital requirement for unregistered reinsurance held.

I think you got the last paragraph switched up...

"If receivables > collateral, then you deduct the capital required as you now owe the reinsurer more than he owes you, which means your risk is reduced leading to a lower capital requirement for unregistered reinsurance held."

the bolded part is switched up

Yes you are right that I got it switched up. It should be if collateral > receivables. I also think I did not phrase my last sentence correctly - The collateral is not something that the reinsurer owes to you, but more of something that is used to back up their obligation.