sample-20

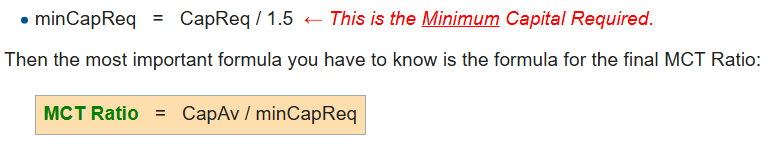

MCT Ratio = CapAv / minCapReq = CapAv / (CapReq / 1.5) = CapAv / CapReq * 1.5

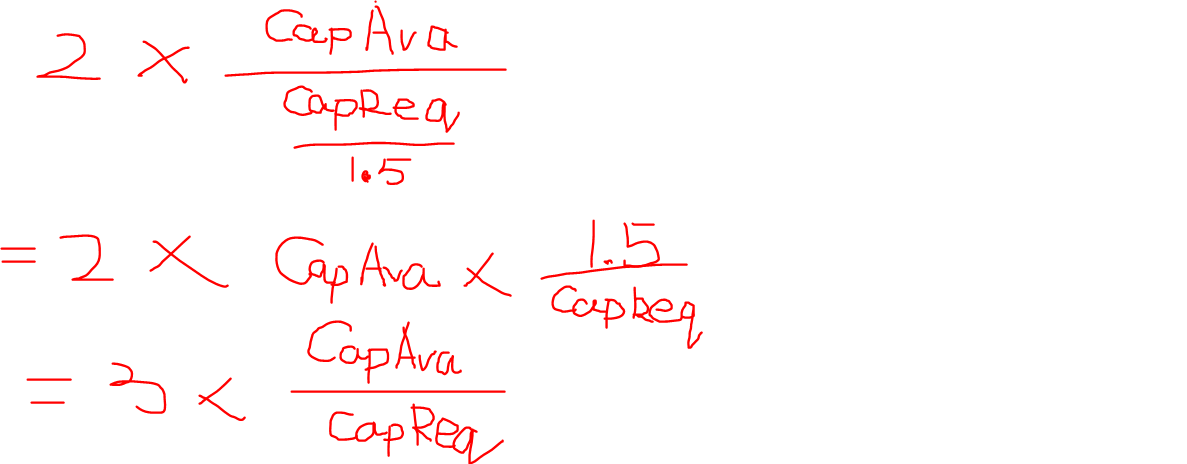

operating target corresponds to a 200% Minimum Capital Test (MCT) ratio = 2 * (CapAv / CapReq * 1.5)

Why we need to adjust by (2/1.5) instead of (/3)?

It looks like you're new here. If you want to get involved, click one of these buttons!

MCT Ratio = CapAv / minCapReq = CapAv / (CapReq / 1.5) = CapAv / CapReq * 1.5

operating target corresponds to a 200% Minimum Capital Test (MCT) ratio = 2 * (CapAv / CapReq * 1.5)

Why we need to adjust by (2/1.5) instead of (/3)?

Comments

CapAv / (CapReq / 1.5) = CapAv / CapReq * 1.5 this should be 1.5 * CapAv/ CapReq.

Your algebra is incorrect. 1/(1/1.5) = 1.5

are they not the same? CapAv / CapReq * 1.5 vs.1.5 * CapAv/ CapReq

maybe i should write (CapAv / CapReq) * 1.5like this, but then 2 * (CapAv / CapReq) * 1.5) is still 3 * (CapAv / CapReq), i still got divide by 3 instead

You are not using brackets which is why it is confusing. 200% MCT Ratio = 2 * (CapAV/(1.5 * MinCapReq)) = (2/1.5) * (CapAv/MinCapReq). Write it out on a piece of paper, it will be clearer

why 2 * (CapAV/(1.5 * CapReq))? should it be 2 * [CapAV/(CapReq/1.5)] which is 2 * (CapAV/CapReq1.5)? which is 3(CapAV/CapReq)

Its 1.5 * mincapreq not capreq/1.5 in your denominator

why 1.5 * Cap Req?

I realised what the issue is now. You are not supposed to include capital available as you are confusing the actual MCT ratio vs the target MCT ratio

The company's operating target corresponds to a 200% Minimum Capital Test (MCT) ratio, why we want 2MinCapReq instead of 2CapAv/MinCapReq?

a 200% MCT ratio does not depend on your own capital. It is a fixed number. So is your minimum capital required. You'll also notice that nowhere in the question is capital available provided and that is because you do not need it.

for b), how do we know that we have to calculate the RA for LRC, and not LIC?

The date provided is at Dec 31 2023 and there are 100% of claim payments remaining which means the policy has not started providing coverage yet

Part C:

CoC method using a req cap position selected at higher %'le capture the comp req for upper working layers

Q'le model: may not calc a significant RA, unless working layers of reins treaty.

1) What do these statements mean, what is a working layer exactly and how does that tie into these points above?

2) From online 'working layer' just means when RE kicks in. What if you have multiple layers within a treaty, how are you pricing/val this with RA? Can you just talk me through.

1) Working layer is a reinsurance term to identify the layers of reinsurance that are most likely to be pierced by claims. It's called a working layer because it gets worked the most, i.e. there is a large frequency of claims in the later. We usually express reinsurance as towers, for example your tower could be:

Your working layer would then be the 20M XS 20M layer

The capital required for working layers are usually less because they are at a lower return period with less severity. This could understate your cost of capital and RA if you base your quantiles on working layers.

2) You'd just select a higher percentile for your RA quantile or higher cost of capital assumption to capture the risk at higher layers

From CIA.IFRS17-2: the basic concept for the Simplified calculation of RA based on CoC method is the target profit margin is allocated between reserve risk, UW risk, and other risks are not relevant to the RA.

1. How do we know that this problem refers to a simplified CoC method?

2. If the problem uses other methods to calculate RA (for LRC), do we include Market & Operational risk?