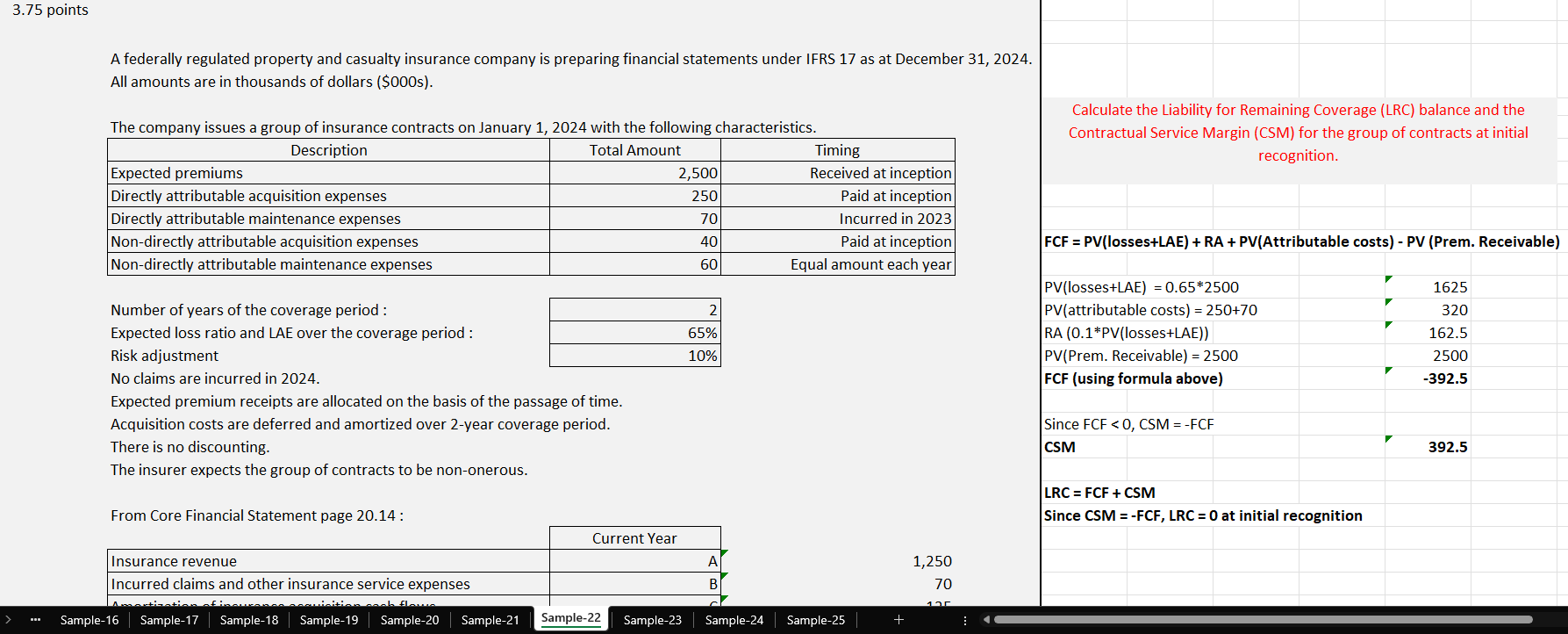

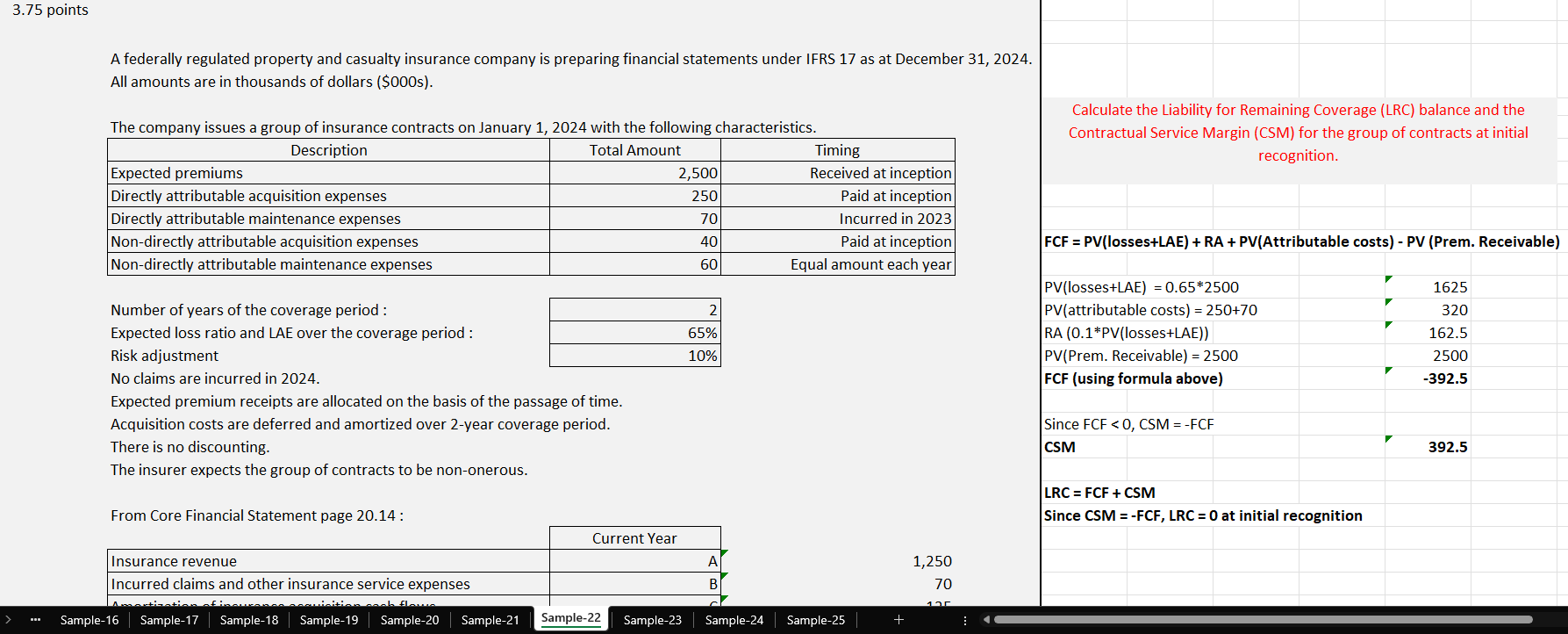

CAS Sample Questions IFRS 17 - #22

I'm trying to calculate the LRC and CSM at initial recognition but I obtain LRC = 0 instead of 2500 which is the correct answer. Could you please help me understand the issue with my calculation?

It looks like you're new here. If you want to get involved, click one of these buttons!

I'm trying to calculate the LRC and CSM at initial recognition but I obtain LRC = 0 instead of 2500 which is the correct answer. Could you please help me understand the issue with my calculation?

Comments

I also had a similar question:

FCF = Losses + Expenses + RA - Discounting - Premium = -392.5

CSM = 392.5

GMA LRC = FCF + CSM

I am wondering if it is because the question says premiums paid at inception which for non-onerous contracts inception = initial recognition?

Therefore to calculate CSM we consider ALL cash flows including premium (CSM = -FCF = 392.5), but then to value LRC at initial recognition we EXCLUDE premium as it has already been received at inception (FCF = Losses + Expense + RA - Discounting = 2017.5). This way at initial recognition LRC = 2017.5 + 392.5

In the wiki I recall reading that LRC under GMA = 0 at initial recognition but is it possible that this statement needs a qualification - UNLESS premiums are paid at inception/initial recognition?

This is the only way I can make sense of the the answer to 22a.

But then if we do this for premiums, why do acquisition expenses also paid at inception not get the same treatment? A key benefit of deferral of acquisition expense is that it will reduce our LRC. If directly attributable acquisition costs of 250 are paid at inception then I would argue we could only have 2 potential values of LRC:

1) Before anything is paid LRC = 0

2) Once premium and acquisition is paid LRC = FCF + CSM where FCF = 1625 + 70 + 162.5 = 1857.5 and CSM = 392.5 so LRC = 2250 (same result as PAA estimate)

I saw it the same way as you two.

For non-onerous contracts, inception = initial recognition.

In general, all cash flows are always considered to establish the initial CSM.

The correct answer should be that LRC = 0 here and this is always true for any non-onerous group of contracts measured under GMM at initial recognition.

What they are doing here is calculating LRC immediately after premium has been received which I don't think is correct.

For your second question, acquisition costs are clearly stated in the question that they are to be deferred and amortized over two years.