Fall 2012 Q21

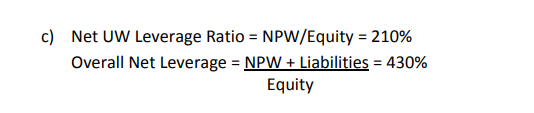

For part c) the solution gave this answer

But for Overall Net Leverage, the formula should be

(Net Liabilities + NWP)/EQ

and Net U/W Lev Ratio is NWP/EQ

So when we subtract Net U/W Lev Ratio from Overall Net Leverage (430% - 210%) = 220%

Should 220% be

Net Liabilities/EQ

This is different from Total Liabilities

Total Liabilities = Net Liabilities + Recoverable(s) from Reinsurer.

Luckily we have the ratio of Reinsurance Recoverables to Equity at 6.5%

Now we can equate

Total Liabilities/EQ

=(Net Liabilities + Recoverables)/EQ

= Net Liabilities/EQ + Recoverables/EQ

= 220% + 6.5%

Now we take the ratio of Net Loss Reserve / EQ over this new expression

[Net Loss/EQ]/[Total Liabilities/EQ]

=185%/226.5%

=81.68% (Rounded to 4 decimal place)

Comments

Yeah you are right. I think the sample answer is incorrect

There is also a footnote under the Battle Table for the MSA.Ratios reading about part (c):

Sorry I missed the footnote.

No problem! Looks like you are well engaged in slaying the beast.

For part b of this question we want Ins RO NEP which is

(UW income + investment income from UW income - capgains)/NEP

ROR on the other hand is

(UW income + investment income - capgains + income from subsidiaries)/GWP

There are no subsidiaries so this is simplified to be

(UW income + investment income - capgains)/GWP

Assuming al investment income is from UW income then

Ins RO NEP / ROR = GWP/NEP =1.1 so that Ins RO NEP = 1.1*ROR = 1.1%

Is my interpretation here correct and is this a valid assumption?

The CAS reading on MSA ratios is supposed to be updated and will likely change significantly but the official syllabus is not yet available for the 2024-Fall exam. Also, the MSA Ratios reading is part of the print-only study kit (not available online) and the CAS has not yet made the study kit available to order.

For that reason, it's probably better to skip the MSA Ratios reading and come back to it later once the CAS has clarified what you have to learn. We have left the wiki article for MSA Ratios "as is" for the time being because the CAS has provided conflicting guidance on the actual content for the 2024-Fall exam. In other words, we do not know for certain whether the MSA Ratios reading will remain the same or will be updated for IRRS-17, in which case it may be very different from the current reading.

I see, are there any other readings that we should leave for later in case the CAS updates them?

Yes, this information is provided on the Syllabus Changes wiki page here:

And there's a direct link under the Study Material section of the home page after you login (2nd link from the bottom):

Hi @graham , I am guessing we need to leave the BA MSA.Ratios reading for now until you receive the study kit ?

Also, the “MSA Report on Property & Casualty, Canada, 2019" in current content outline looks like an old report, has this changed from prior sitting ?

I have received my study kit for 2024-Fall and the date on the MSA reading is 2020, which is the same date as in the MSA reading from the previous study kit. So you can go ahead and study the BA MSA.Ratios reading.

I think at some point the MSA reading will change significantly but not for 2024-Fall.

Thanks for confirming!

The exam notes that an alternative solution was accepted using ratio of ROE to ROA which is what I did. I was wondering if someone could confirm my math here:

Ratio of ROE/ROA = Assets/Equity = (E + L)/E = 1+L/E so L/E = 6.2/3.5-1 = 0.77....

E/L = 1/0.77... = 1.296296

Net Claim Liabilities/ E = 185%

Net Claim Liabilities / L = 1.296296 *185% = 239.8%

I think its right I am just wondering since it produces a very different result than the alternative approach

Yup you are right. The ratio questions don't usually reconcile when you approach it with different methods since this is not an actual FS but just a made up one