A from Un-ded

The formula from the wiki is A = A* + A1 + A2 + A3 + A4 + A5 + A6 - A7

This is combining both PAA and GMM methods.

But in the source text it states:

For P&C insurers using the PAA to measure a group of reinsurance contracts held, the premiums associated with unexpired coverage on reinsurance contracts held is determined as:

Asset for remaining coverage on reinsurance contracts held + unamortized reinsurance commissionFootnote43 + premiums to be paid to the assuming insurer

For P&C insurers using the GMM to measure a group of reinsurance contracts held, the premiums associated with the unexpired coverage on reinsurance contracts held is determined as:

If the contractual service margin (CSM) of a group of reinsurance contracts held represents a net cost of purchasing reinsuranceFootnote44:

Expected cash inflow from reinsurer + risk adjustment (RA) + CSM + unamortized reinsurance commission

If the CSM of a group of reinsurance contracts held represents a net gain of purchasing reinsurance:

Expected cash inflow from reinsurer + risk adjustment (RA) - CSM + unamortized reinsurance commission

So For PAA its A = A* + A1 + A2

And for GMM its A = A3 + A4 + A5 (positive or negative depending on CSM) + A6.

So I see why you combined the two together. But I don't see a deduction for A7 in the source text.

Could you please clarify?

Comments

Also a follow up question, if the calculation only indicated GMM, do we still need to add A*? Or would it just be A3 + A4 + A5 + A6 - A7 (still pending where the A7 came from).

A* in the example contains both the PAA and GMM ARC which means you need to remove the GMM ARC (A7) as that is not required to calculate the capital required. If the insurer only uses the GMM, just use A3 + A4 + A5 + A6

I see that make sense. Thanks for the clarification

I guess there are 3 cases here:

Case 1: insurer uses both PAA and GMM (wiki example)

wiki formula=A=A*+A1+A2+A3+A4+A5+A6-A7

Since using both, why remove the GMM ARC (aka the term -A7)?

Case 2: insurer uses only GMM (example above)

A=A3+A4+A5+A6

This makes sense.

Case 3: insurer uses only PAA

In this case, is A=A*+A1+A2-A7?

Case 1: You are not supposed to use the GMM ARC in any calculation, but rather the components that feed into the FCF calculation. A* contains the GMM ARC which is why you need to back it out.

Case 3: No need to subtract A7 here. There is no GMM estimate in A*

Case 3:

oh! so because if we assume the company uses only PAA for all its contracts (no GMM at all),

then A*=ARC for PAA only (and A7=0)

correct?

Case 1:

A* = PAA ARC + GMM ARC

PAA ARC is part of component A (as in PAA component A=PAA ARC+A1+A2)

but GMM ARC is not used anywhere here (as in GMM component A=A3+A4+A5+A6)

so PAA&GMM component A=(A*-A7+A1+A2)+A3+A4+A5+A6.

correct?

Yup you are right for both cases

thanks!

Hi, regarding your reply on feb 17, I have a question:

A by (GMM) = 𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑐𝑎𝑠ℎ 𝑖𝑛𝑓𝑙𝑜𝑤 𝑓𝑟𝑜𝑚 𝑟𝑒𝑖𝑛𝑠𝑢𝑟𝑒𝑟 + 𝑟𝑖𝑠𝑘 𝑎𝑑𝑗𝑢𝑠𝑡𝑚𝑒𝑛𝑡 (𝑅𝐴) + / - 𝐶𝑆𝑀 + 𝑢𝑛𝑎𝑚𝑜𝑟𝑡𝑖𝑧𝑒𝑑 𝑟𝑒𝑖𝑛𝑠𝑢𝑟𝑎𝑛𝑐𝑒 𝑐𝑜𝑚𝑚𝑖𝑠𝑠𝑖𝑜. But you said "A* in the example contains both the PAA and GMM ARC " I did not see an ARC component in GMM method?

And another question regarding to excel practice v12:

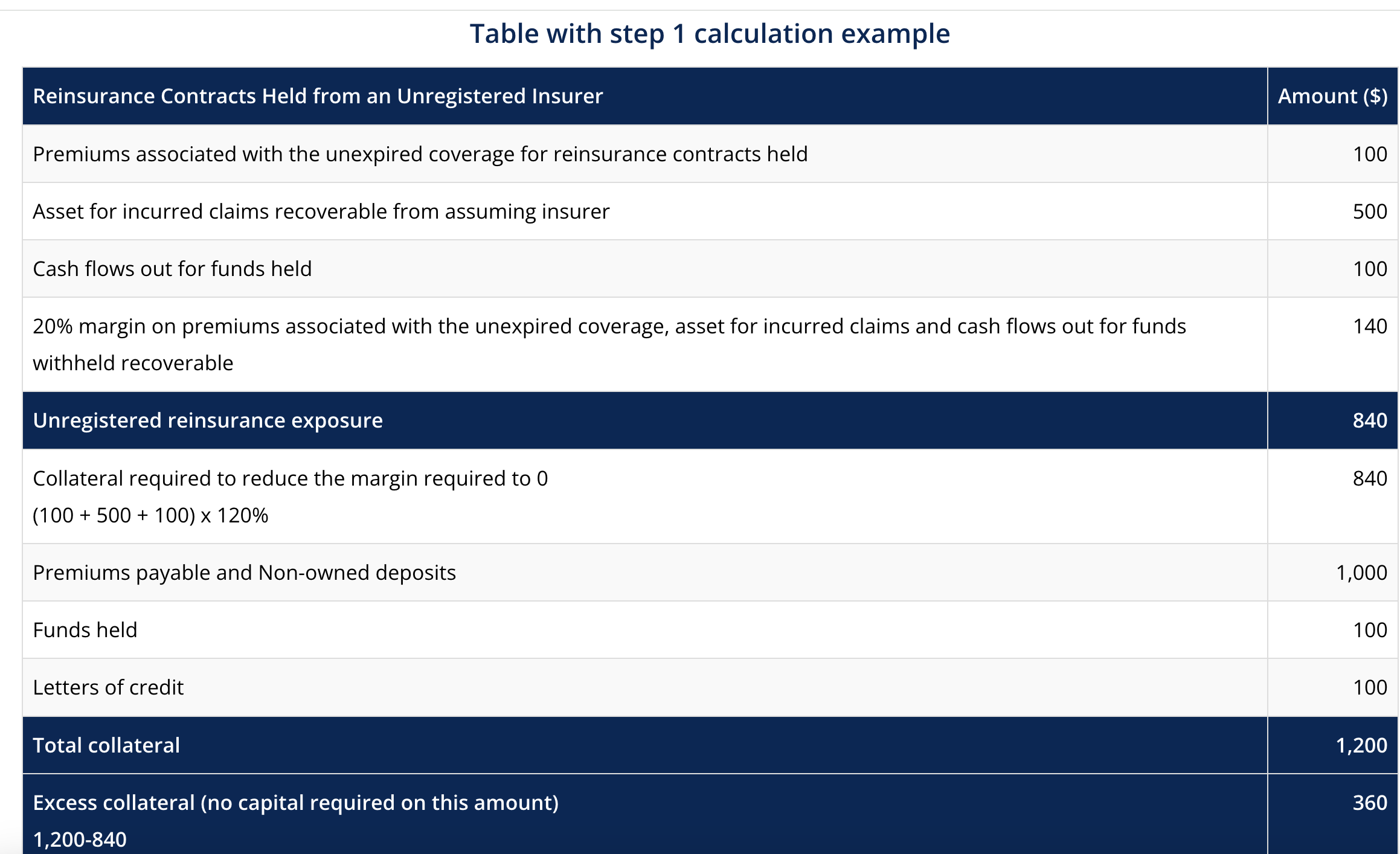

The text calculate "excess collateral", which I believe corresponds to (D+E+F+G+H) - 120% * (A+B+C) if this >0 then apply deductible to capital required.

What is meant here is that A* = GMM ARC + PAA ARC. A* includes both the PAA and GMM estimate of the LRC.

You are correct in that we do not need the GMM ARC, which is why we are removing it from A*. Look carefully at the components of A, the GMM ARC is not included in it.

What are you asking specifically here? If (D+E+F+G+H) > (A + B + C) then you subtract it from the capital required, which is 1.2*(A+B+C)

I can see that the information provided for examples in sections (4.3.3.2) and (4.3.3.3) is exactly the same. The only difference is that

The first line of solution in

Please can you confirm which statement is correct? I think it's both GMM and PAA because that's how the solution does the calculation. Plus, component B (AIC on reinsurance held) includes both (72) under PAA and (74) not under PAA with non-zero values, so it’s intuitive to me that not only PAA was used. Is my understanding correct?

Thank you @Staff-T1 for confirming. Please can you also modify the answers in following files to make them less confusing:

I will thanks for pointing it out