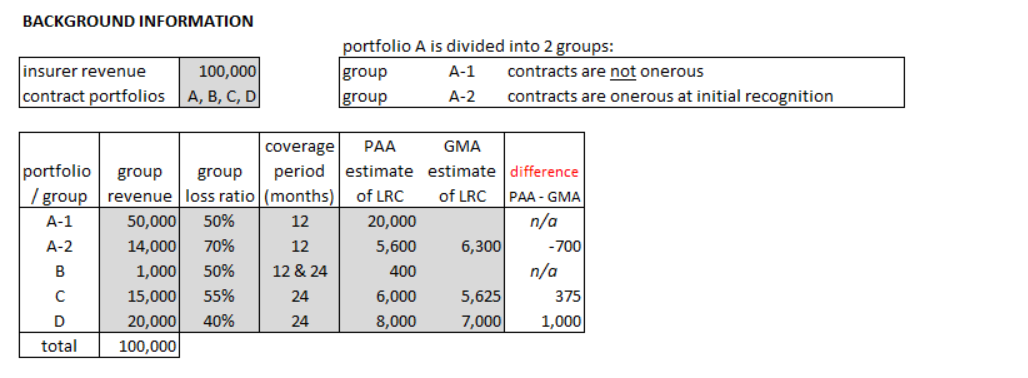

LC = LRC using GMA - LRC using PAA

Hi,

I don't get the logic behind this formula, why is it GMA - PAA, but not the other way around (ie. PAA - GMA)?

Thanks!

It looks like you're new here. If you want to get involved, click one of these buttons!

Hi,

I don't get the logic behind this formula, why is it GMA - PAA, but not the other way around (ie. PAA - GMA)?

Thanks!

Comments

If your GMA estimate is < PAA, you wouldn't have a loss component. Only when your GMA estimate is > PAA would you need to "top-up" a LC to make the PAA estimate = GMA. The PAA is meant to be a simplification of the GMA and we are okay to use it if the PAA estimate > GMA estimate since we are being more conservative. It is only when the PAA estimate is < GMA estimate when we need to book a LC.

And this is true even if both are in an asset position ?

I have not actually seen the mechanics of a PAA eligibility test for the ARC in practice, nor do the papers go into any detail on it. For the purpose of the exam, it is probably safe to assume you won't be asked about this

For this example:

If we are not given the LRC (GMA), how do we know if there is going to LC.

Because by definition the LC is LRC (GMA) - LRC (PAA)?

If we don't know LRC (GMA), than we don't know if there is a LC. Should we just assume that there is no LC? If we state this assumption in the exam, will it be correct?

And in the case of portfolio C why would we even choose LRC(PAA), we already know LRC (GMA) its more accurate and it gives a lower liability. Why would we choose the LRC (PAA), is there any rationale that we would want to choose LRC (PAA)?

You are given the GMA LRC in the second last column? the LC is given to you in the final column.

The whole point of PAA is to simplify financial reporting, it's not about being more accurate. The GMA is incredibly cumbersome to calculate and report in the financials in practice, so no you would always report under PAA if you can. the PAA estimate is meant to be a more conservative estimate of the GMA and should in theory be higher most of the time. If not, you will end up with a LC

I mean for porfolio/group A-1. How do we know there is no LC?

Or did we already split the contacts into two groups:

A-1 is non - onerous

A-2 is onerous?

Thanks for the clarification on why we should always use PAA since its less costly. If we already have both PAA and GMA, can we either one provided we are always consistent with out selection methodology?

If you are not onerous then you would not have a LC. If you are not onerous, and a group of contracts are PAA eligible, then you always go with the PAA estimate

Hi,

How is this related to another BC please:

Briefly describe the steps in calculating the Loss Component under PAA within IFRS 17

• Add FCF (Calculated as follows)

1) Determine the UPR (Unearned Premium Reserve).

2) Estimate future claims and loss adjustment expenses as follows:

• apply a selected ELR and an unallocated loss adjustment expense (ULAE) factor to the UPR by contract group (this is the largest component of the FCFs)

3) Discount the result of step 2 to the evaluation date.

4) Apply the RA (Risk Adjustment), acquisition costs, other attributable expenses to the result of step 3

• Subtract (LRC ex. LC)

can you please help confirm the below is correct?

so LC = FCF(GMA) - LRC excl.LC (PMA)

where FCF (GMA) = UPR x (ULR + ULAE) - discounting + RA + other costs;

LRC excl.LC =premiums received (at initial recognition) - acquisition cash flows at that date (unless already expensed) + any assets for acquisition cash flows derecognized – liabilities previously recognized

the FCF formula only exists for GMA since for PAA it's simplified and we don't need to estimate the cashflows, the above formula is only valid for initial recognition? for subsequent adjustment, we would calculating the LRC excl. LC using a more sophisticated approach?

"so LC = FCF(GMA) - LRC excl.LC (PMA)

where FCF (GMA) = UPR x (ULR + ULAE) - discounting + RA + other costs;

LRC excl.LC =premiums received (at initial recognition) - acquisition cash flows at that date (unless already expensed) + any assets for acquisition cash flows derecognized – liabilities previously recognized" This is correct.

You do not have to estimate any FCF under PAA.

The formulas above work for initial recognition and subsequent measurement. Its easier to just remember the LRC excl LC as UEP - DAC