Unregistered Reinsurance: Cap Av and Cap Req deduction

Looking on some clarity in the following:

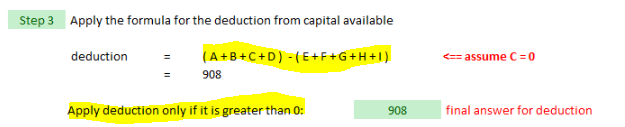

CapAv: A+B+C+D - (E+F+G+H+I)

CapReq: max(-1 * (CapAv deduction), 0)

Can the CapAv deduction ever be negative?

In regards to the CapReq deduction:

If collateral and payables are greater than receivables, why would this reduce capital required? My original thought was this is because it is a net inflow to the reinsurance company, thus there is essentially no risk of them not being able to pay you. Is this though correct?

Comments

Just saw the answer in the excel file now, CapAv = max(A+B+C+D - (E+F+G+H+I), 0).

Please ignore the first question.

If collateral and payable are greater than reinsurance receivable, then it will be an net future outflow for the reinsurer and a net future inflow for the insurer. So it makes sense to subtract the excessive collateral from the capital required.

I have limited accounting knowledge, but it was my understanding that reinsurance payable is what we owe the reinsurer, and reinsurance receivable is what we are expecting to get back shortly.

So if payable > receivable, wouldn't it be a net inflow for the reinsurer?

Yes you are right tshute -> I think bulubala got the orders mixed around but the logic is right

Hi i am a little confused regarding the deduction,

So if (A+B+C+D)-(E+F+G+H+I) is positive we deduce it as per example 1 in the notes:

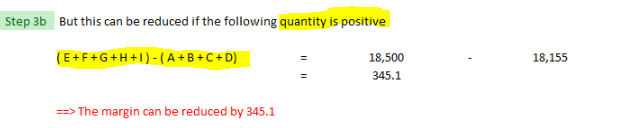

or if (E+F+G+H+I)-(A+B+C+D) is positive we deduce it as per exemple 2 in the notes?

You are confusing the 2 concepts.

The former is to calculate deduction to capital available

The latter is to calculate the margin for unregistered reinsurance

oh you are right i got confused because it is in the reinsurance section of cap required.

So these amount are the same but opposite sign right?

if receivables are higher than payables and collateral it is deduced from cap Available

if payables and collateral exceed receivables it is deduce from cap required in unregistered reinsurance

not sure it makes sens to me that more receiveble = lower capital available.. ??

Yeap they are.

If you have more receivables than payables, that means the reinsurer owes you more than what you owe them. This is riskier and you are penalized for it through a deduction to capital available