Spring 2016 Q22 - Part a & c

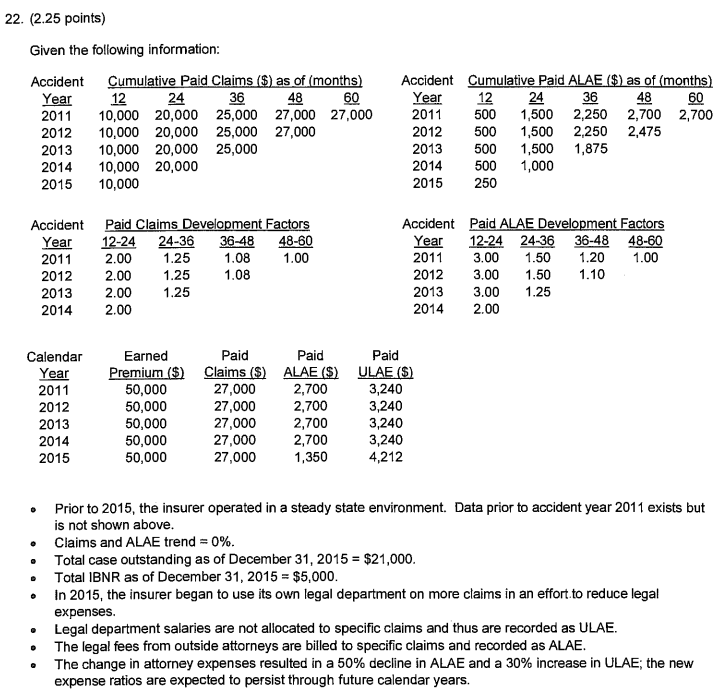

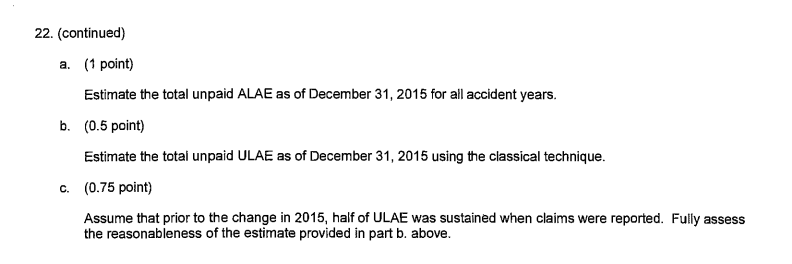

Hi Graham - This is a question that asks about Unpaid ALAE and Unpaid ULAE. I found the Unpaid ULAE calculation part to be okay, but could use your help in understanding the ULAE short answer question which is part c. More importantly, I found the Unpaid ALAE question (part a) to be difficult. So much information is given that can entice you to use other techniques like the ratio method, etc. And they tell you the Claims and ALAE trend = 0%, which could be extraneous given how they solved it in the examiner's report. But maybe it's important in another way that I'm not yet seeing.

Could you walk me through how you would approach & solve this problem for part's a and c? I can somewhat follow the sample approaches taken in the examiner's report but not fully confident that I understand the ends and outs of this question. Thanks.

Comments

Here are a few general comments before I get to the actual solution:

Anyway, In part (a) this problem, the key is somehow incorporating the fact that the legal fees in the ALAE triangle are 50% lower starting Jan 1, 2015. I think the second answer is the most clever because it gets right at the heart of the issue. I probably would have explained it more fully as follows: Without the 50% reduction, the ALAE triangle would have looked like this:

You can see pretty easily that the ultimate ALAE for each AY would have been 2,700. The question also gives you the paid ALAE for each AY, so you can calculate what the unpaid ALAE would have been as (2,700 - latest diagonal) and you get:

Now you can easily incorporate the 50% reduction by dividing all of these unpaid ALAE amounts by 2. Or even simpler, just divide the total by 2 to get 3,850/2 = 1,925. The reason this works is the problem tells you that going forward, all these (original) unpaid ALAE amounts will be 50% lower. It might take several minutes to realize all this, but I think that's the best solution. I suspect the examiners did not think of that solution because it seems too short for 1.0 points. I suspect they had in mind sample answer 3.

I will do another post for part (c).

(See above for part (b). For part (c) where you have to comment on the reasonableness of the ULAE estimate, here's how I thought through it:

So you have to figure out which is those is correct:

Hope that helps.

Thanks Graham, that was super helpful! I feel much better. I think I got so accustomed going to the ratio approach for ALAE reserve questions that I didn't even consider the possibility of just using the Paid ALAE triangle. So I fell into the exam committee's trap :-)

"Even if you try to adjust the ULAE ratio to account for the 30% increase in overall ULAE costs as the sample solutions in part (b) did, the classical method still has the 50/50 assumption embedded in it and will likely produce an estimate that's too low."

Does this mean that the RATIO has increased by 30% but the overall ULAE has increased by more than 30% due to changes in the 50/50 assumption? Is it then accurate for the question to state that ULAE has increased by 30%?

The question doesn't provide any information on the ULAE ratio (which is the ratio of paid ULAE to paid claims). All they tell you is that the paid ULAE increased by 30% but you don't know anything about the paid claims. (If the paid claims didn't change then the ULAE ratio would indeed increase by 30% also.)

The point of the change in operations was to reduce ALAE by more than any subsequent increase to ULAE.